Question: Wizard Inc. has to choose between two mutually exclusive projects. If it chooses project A, Wirard Inc. will have the opportunity to make a similar

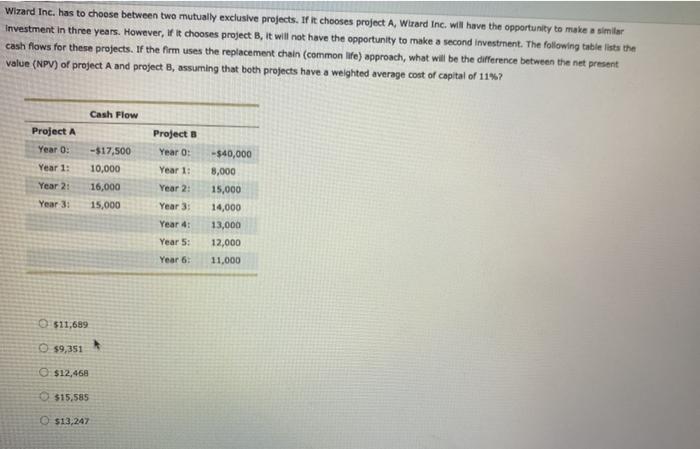

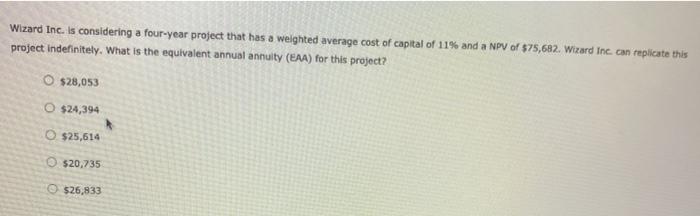

Wizard Inc. has to choose between two mutually exclusive projects. If it chooses project A, Wirard Inc. will have the opportunity to make a similar Investment in three years. However, if it chooses project B, it will not have the opportunity to make a second Investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 11%? Cash Flow Project A Year : Project Year : Year 1: -$40,000 8,000 Year 1: -$17.500 10,000 16,000 15,000 Year 2: Year 2: Year 3: Year 3 Year 4: Year 5: 15,000 14,000 13,000 12,000 11,000 Year 6 O $11,689 O $9,351 $12,468 O $15.585 $13,247 Wizard Inc. is considering a four-year project that has a weighted average cost of capital of 11% and a NPV of $75,682. Wizard Inc can replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project? O $28,053 O $24,394 O $25,614 $20,735 $26,833

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts