Question: word count 500 and minimum 2 references please For Question 1, students are required to identify the efficient portfolio through the impact of changes in

word count 500 and minimum 2 references please

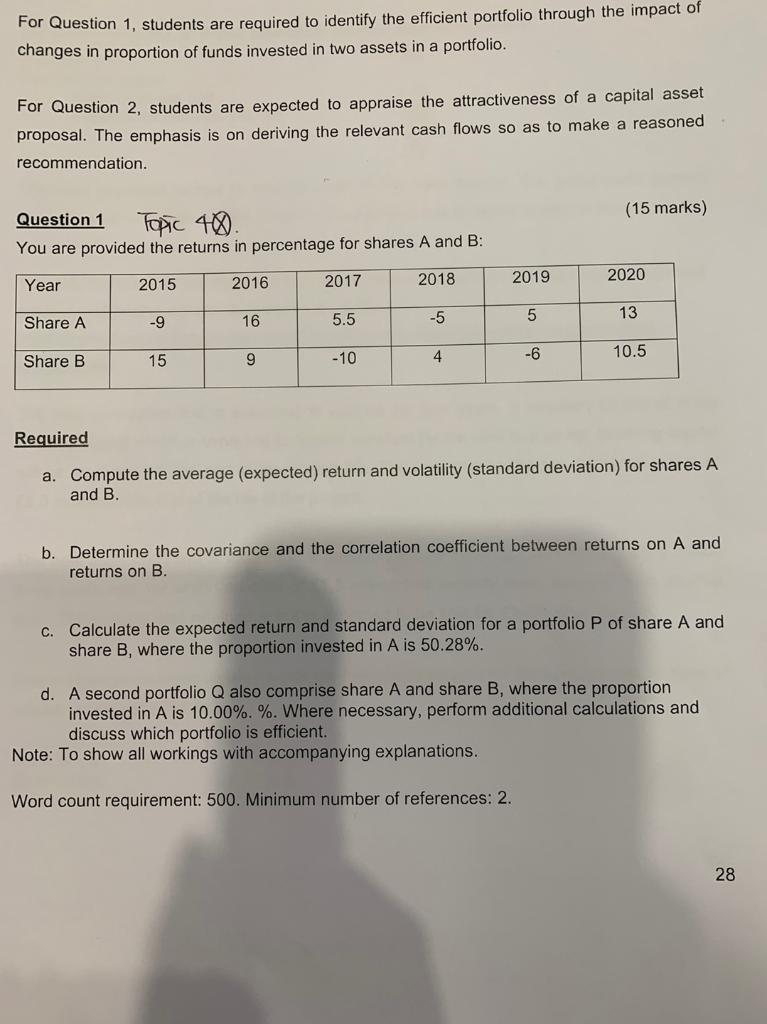

For Question 1, students are required to identify the efficient portfolio through the impact of changes in proportion of funds invested in two assets in a portfolio For Question 2, students are expected to appraise the attractiveness of a capital asset proposal. The emphasis is on deriving the relevant cash flows so as to make a reasoned recommendation. (15 marks) Question 1 Topic 40. You are provided the returns in percentage for shares A and B: Year 2015 2016 2017 2020 2018 2019 Share A -9 16 5.5 5 13 -5 Share B 15 9 -10 10.5 4 -6 Required a. Compute the average (expected) return and volatility (standard deviation) for shares A and B. b. Determine the covariance and the correlation coefficient between returns on A and returns on B. c. Calculate the expected return and standard deviation for a portfolio P of share A and share B, where the proportion invested in A is 50.28%. d. A second portfolio Q also comprise share A and share B, where the proportion invested in A is 10.00%. %. Where necessary, perform additional calculations and discuss which portfolio is efficient. Note: To show all workings with accompanying explanations. Word count requirement: 500. Minimum number of references: 2. 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts