Question: For Question 1, students are required to identify the efficient portfolio through the impact of changes in proportion of funds invested in two assets in

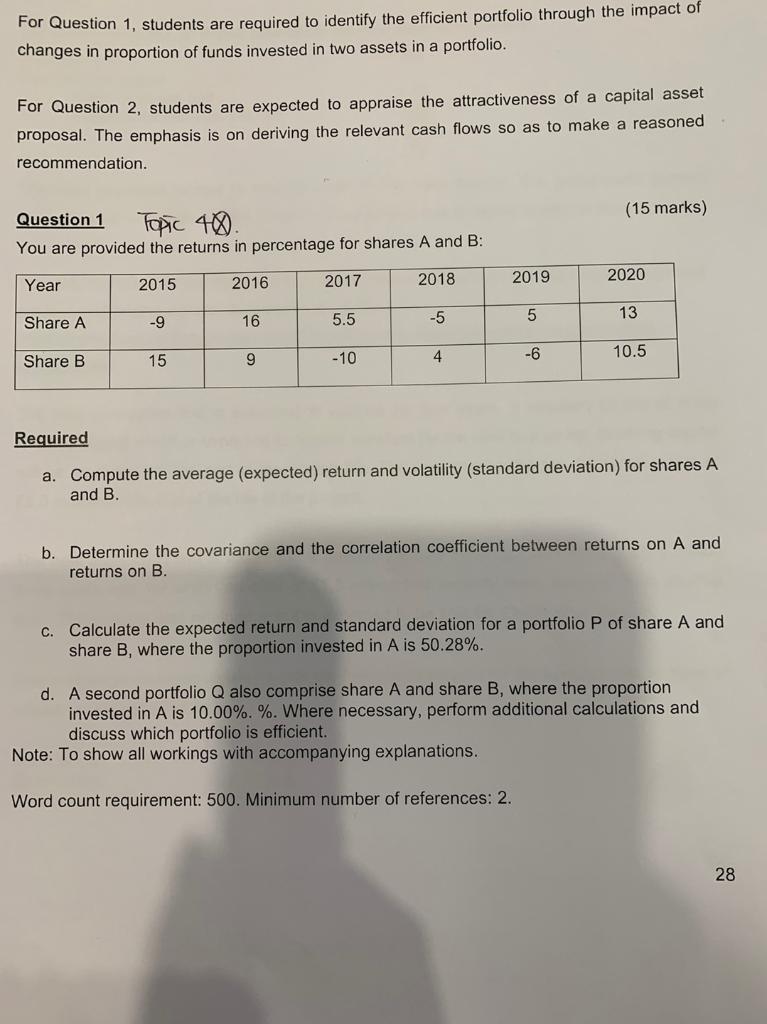

For Question 1, students are required to identify the efficient portfolio through the impact of changes in proportion of funds invested in two assets in a portfolio For Question 2, students are expected to appraise the attractiveness of a capital asset proposal. The emphasis is on deriving the relevant cash flows so as to make a reasoned recommendation. (15 marks) Question 1 Topic 40. You are provided the returns in percentage for shares A and B: Year 2015 2016 2017 2020 2018 2019 Share A -9 16 5.5 5 13 -5 Share B 15 9 -10 10.5 4 -6 Required a. Compute the average (expected) return and volatility (standard deviation) for shares A and B. b. Determine the covariance and the correlation coefficient between returns on A and returns on B. c. Calculate the expected return and standard deviation for a portfolio P of share A and share B, where the proportion invested in A is 50.28%. d. A second portfolio Q also comprise share A and share B, where the proportion invested in A is 10.00%. %. Where necessary, perform additional calculations and discuss which portfolio is efficient. Note: To show all workings with accompanying explanations. Word count requirement: 500. Minimum number of references: 2. 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts