Question: Word File Edit View Insert Format Tools Table Window Help S Sun Jan 26 9:09 PM Q W MT S20 (1) Q Search in Document

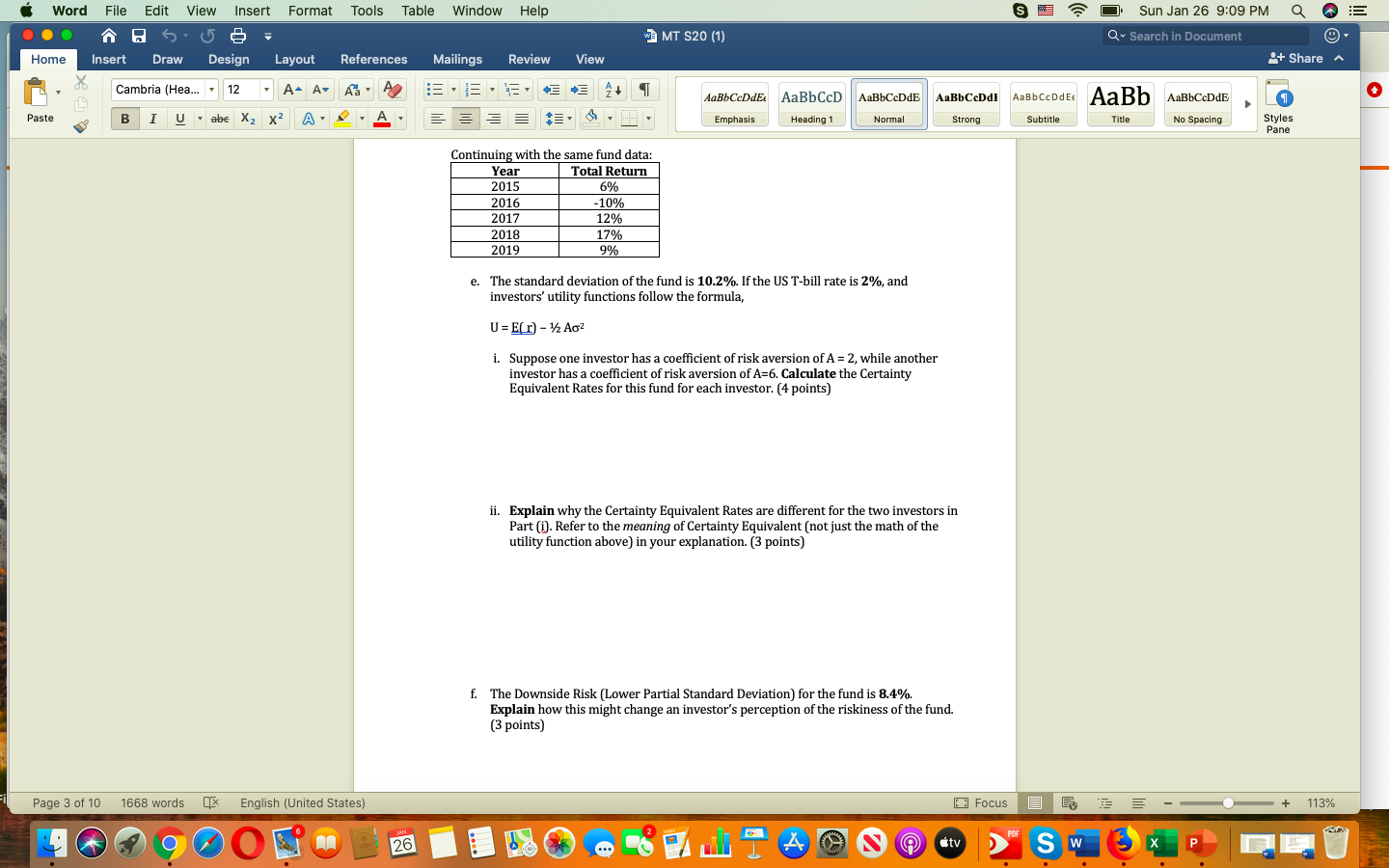

Word File Edit View Insert Format Tools Table Window Help S Sun Jan 26 9:09 PM Q W MT S20 (1) Q Search in Document Home Insert Draw Design Layout References Mailings Review View + Share A X Cambria (Hea... 12 - A A A- A+ Aa A- AT A AaBb Ceddi AaBbceDdEt AaBb AaBbCcDdE AaBbCcDdEt AaBbCcD AaBbCcDdE Emphasis Heading 1 Normal Paste BI U Uabe Xx2 A. Strong Subtitle Title No Spacing Styles Pane Continuing with the same fund data: Year Total Return 2015 6% 2016 -10% 2017 12% 2018 17% 2019 9% e. The standard deviation of the fund is 10.2%. If the US T-bill rate is 2%, and investors'utility functions follow the formula, UNEC) - Ao2 Er i. Suppose one investor has a coefficient of risk aversion of A = 2, while another investor has a coefficient of risk aversion of A=6. Calculate the Certainty Equivalent Rates for this fund for each investor. (4 points) ii. Explain why the Certainty Equivalent Rates are different for the two investors in Part(1). Refer to the meaning of Certainty Equivalent (not just the math of the utility function above) in your explanation. (3 points) f. The Downside Risk (Lower Partial Standard Deviation) for the fund is 8.4%. Explain how this might change an investor's perception of the riskiness of the fund. (3 points) Page 3 of 10 1668 words English (United States) O Focus + 113% AN POF O 26 9 tv Sw Word File Edit View Insert Format Tools Table Window Help S Sun Jan 26 9:09 PM Q W MT S20 (1) Q Search in Document Home Insert Draw Design Layout References Mailings Review View + Share A X Cambria (Hea... 12 - A A A- A+ Aa A- AT A AaBb Ceddi AaBbceDdEt AaBb AaBbCcDdE AaBbCcDdEt AaBbCcD AaBbCcDdE Emphasis Heading 1 Normal Paste BI U Uabe Xx2 A. Strong Subtitle Title No Spacing Styles Pane Continuing with the same fund data: Year Total Return 2015 6% 2016 -10% 2017 12% 2018 17% 2019 9% e. The standard deviation of the fund is 10.2%. If the US T-bill rate is 2%, and investors'utility functions follow the formula, UNEC) - Ao2 Er i. Suppose one investor has a coefficient of risk aversion of A = 2, while another investor has a coefficient of risk aversion of A=6. Calculate the Certainty Equivalent Rates for this fund for each investor. (4 points) ii. Explain why the Certainty Equivalent Rates are different for the two investors in Part(1). Refer to the meaning of Certainty Equivalent (not just the math of the utility function above) in your explanation. (3 points) f. The Downside Risk (Lower Partial Standard Deviation) for the fund is 8.4%. Explain how this might change an investor's perception of the riskiness of the fund. (3 points) Page 3 of 10 1668 words English (United States) O Focus + 113% AN POF O 26 9 tv Sw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts