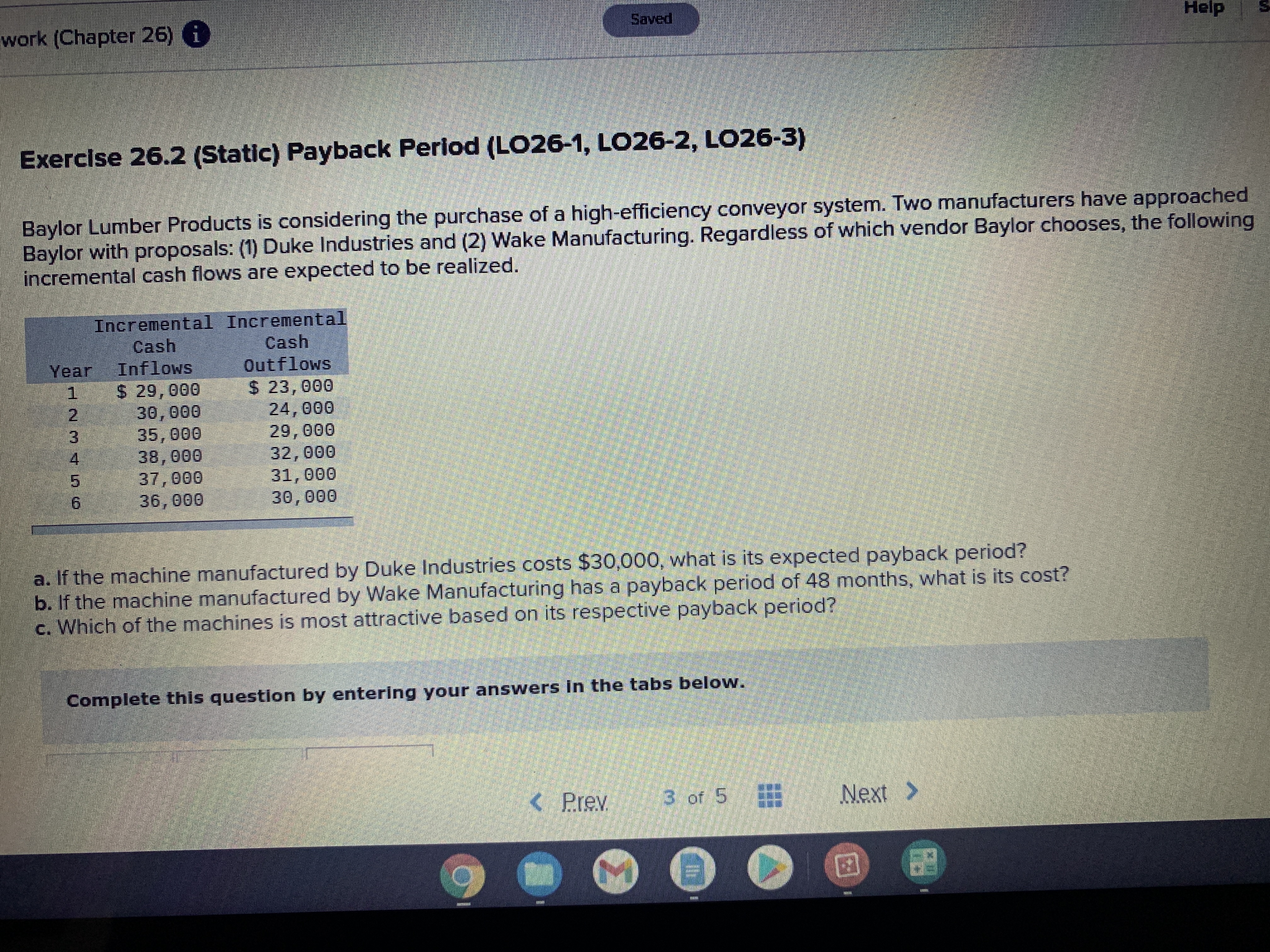

Question: work (Chapter 26) i Saved Exercise 26.2 (Static) Payback Period (LO26-1, LO26-2, LO26-3) Baylor Lumber Products is considering the purchase of a high-efficiency conveyor system.

work (Chapter 26) i Saved Exercise 26.2 (Static) Payback Period (LO26-1, LO26-2, LO26-3) Baylor Lumber Products is considering the purchase of a high-efficiency conveyor system. Two manufacturers have approached Baylor with proposals: (1) Duke Industries and (2) Wake Manufacturing. Regardless of which vendor Baylor chooses, the following incremental cash flows are expected to be realized. Incremental Incremental cash Cash Year Inflows Outflows $ 29, 000 $ 23, 090 30, 000 24, 000 35, 000 29, 090 38, 000 32, 000 37, 000 31, 000 36, 000 30,000 a. If the machine manufactured by Duke Industries costs $30,000, what is its expected payback period? b. If the machine manufactured by Wake Manufacturing has a payback period of 48 months, what is its cost? c. Which of the machines is most attractive based on its respective payback period? Complete this question by entering your answers in the tabs below. Prev. 3 of 5 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts