Question: work done in excel plz :) the image is extremely clear, what more information do you need ? A. [20 points total] Consider two agency

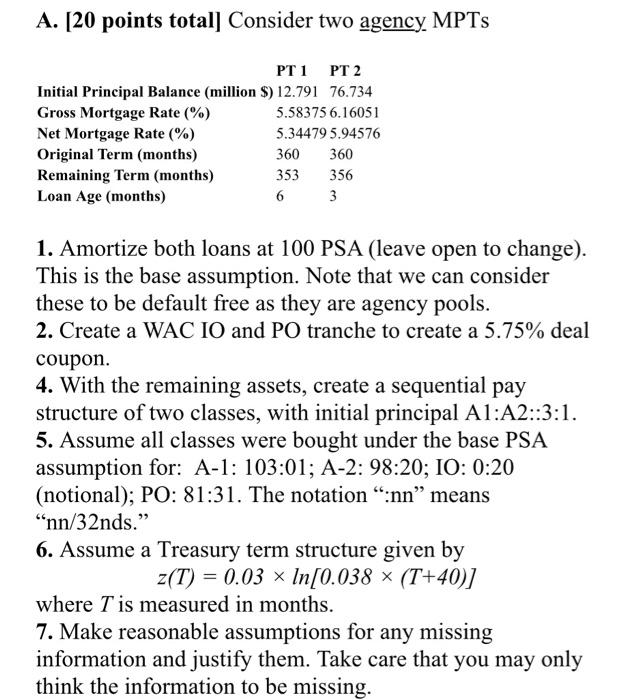

A. [20 points total] Consider two agency MPTs 1. Amortize both loans at 100 PSA (leave open to change). This is the base assumption. Note that we can consider these to be default free as they are agency pools. 2. Create a WAC IO and PO tranche to create a 5.75% deal coupon. 4. With the remaining assets, create a sequential pay structure of two classes, with initial principal A1:A2::3:1. 5. Assume all classes were bought under the base PSA assumption for: A-1: 103:01; A-2: 98:20; IO: 0:20 (notional); PO: 81:31. The notation ":nn" means "nn/32nds." 6. Assume a Treasury term structure given by z(T)=0.03ln[0.038(T+40)] where T is measured in months. 7. Make reasonable assumptions for any missing information and justify them. Take care that you may only think the information to be missing. A. [20 points total] Consider two agency MPTs 1. Amortize both loans at 100 PSA (leave open to change). This is the base assumption. Note that we can consider these to be default free as they are agency pools. 2. Create a WAC IO and PO tranche to create a 5.75% deal coupon. 4. With the remaining assets, create a sequential pay structure of two classes, with initial principal A1:A2::3:1. 5. Assume all classes were bought under the base PSA assumption for: A-1: 103:01; A-2: 98:20; IO: 0:20 (notional); PO: 81:31. The notation ":nn" means "nn/32nds." 6. Assume a Treasury term structure given by z(T)=0.03ln[0.038(T+40)] where T is measured in months. 7. Make reasonable assumptions for any missing information and justify them. Take care that you may only think the information to be missing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts