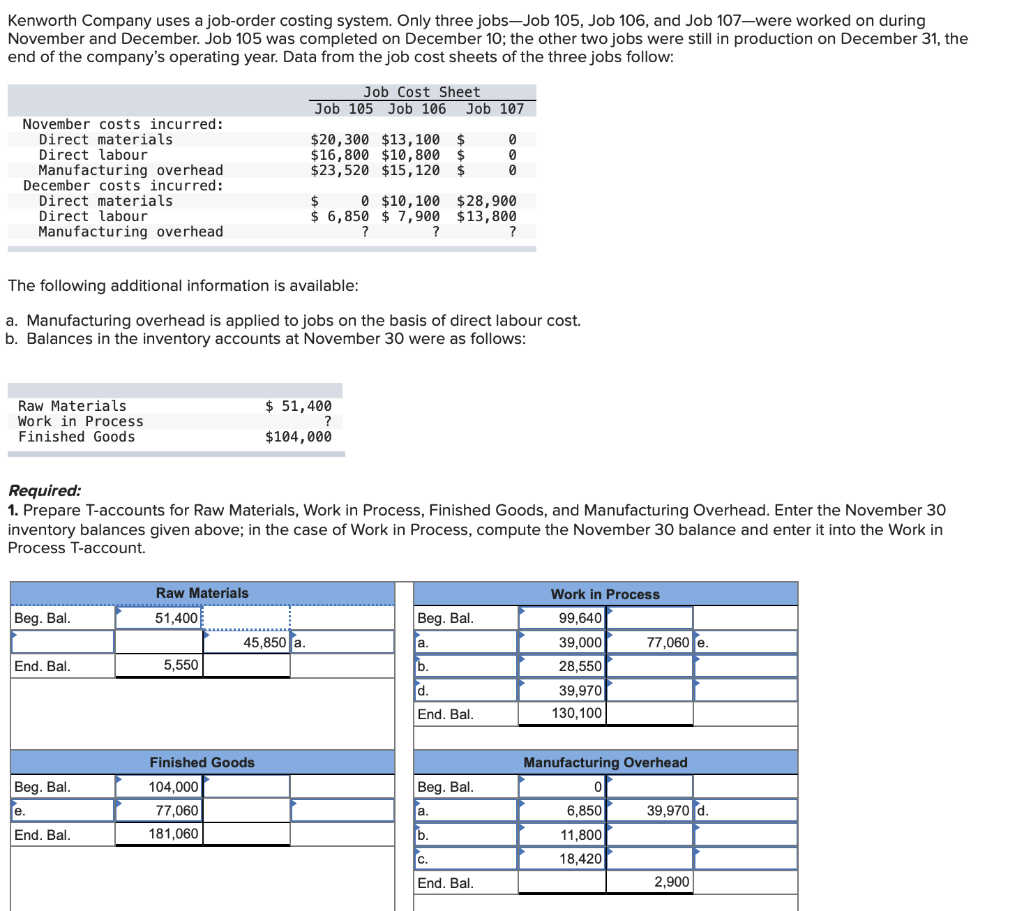

Question: Work in process Beg Bal = $20,300 + $13,100 + $16,800 + $10,800 + $23,520 + $15,120 = $99,640 Question 1 is done, need 2

Work in process Beg Bal = $20,300 + $13,100 + $16,800 + $10,800 + $23,520 + $15,120 = $99,640

Question 1 is done, need 2 a - 3

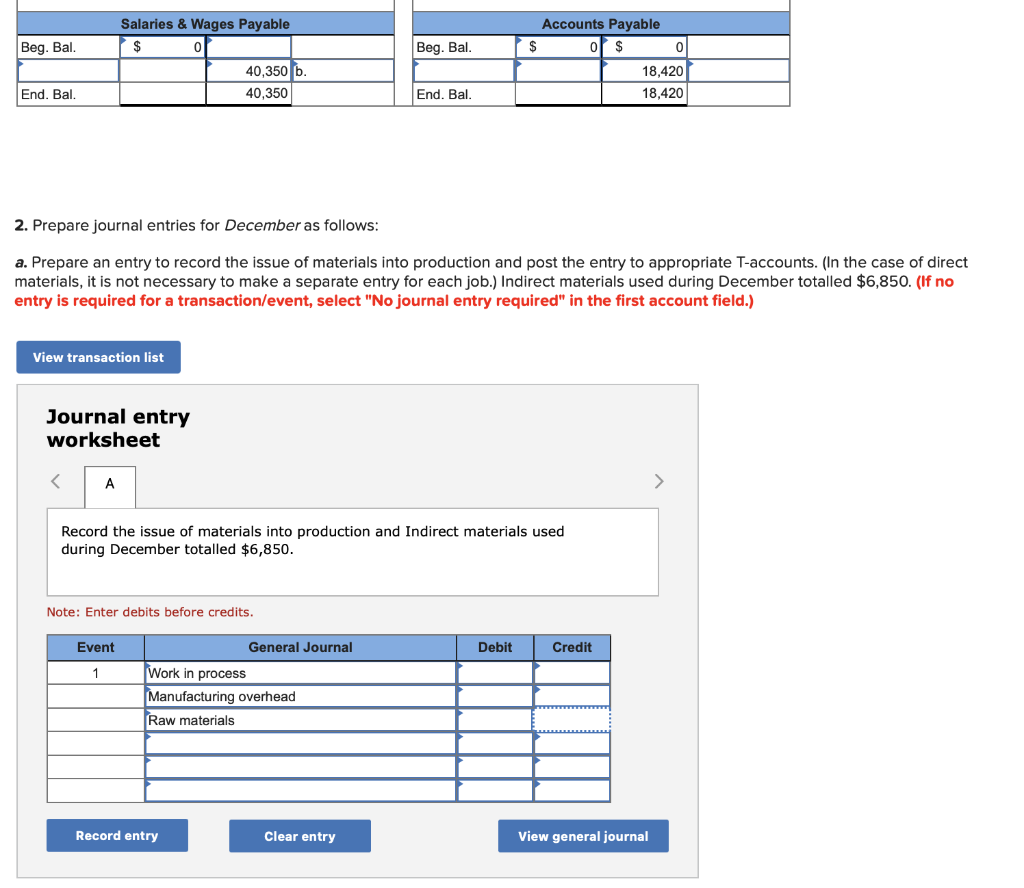

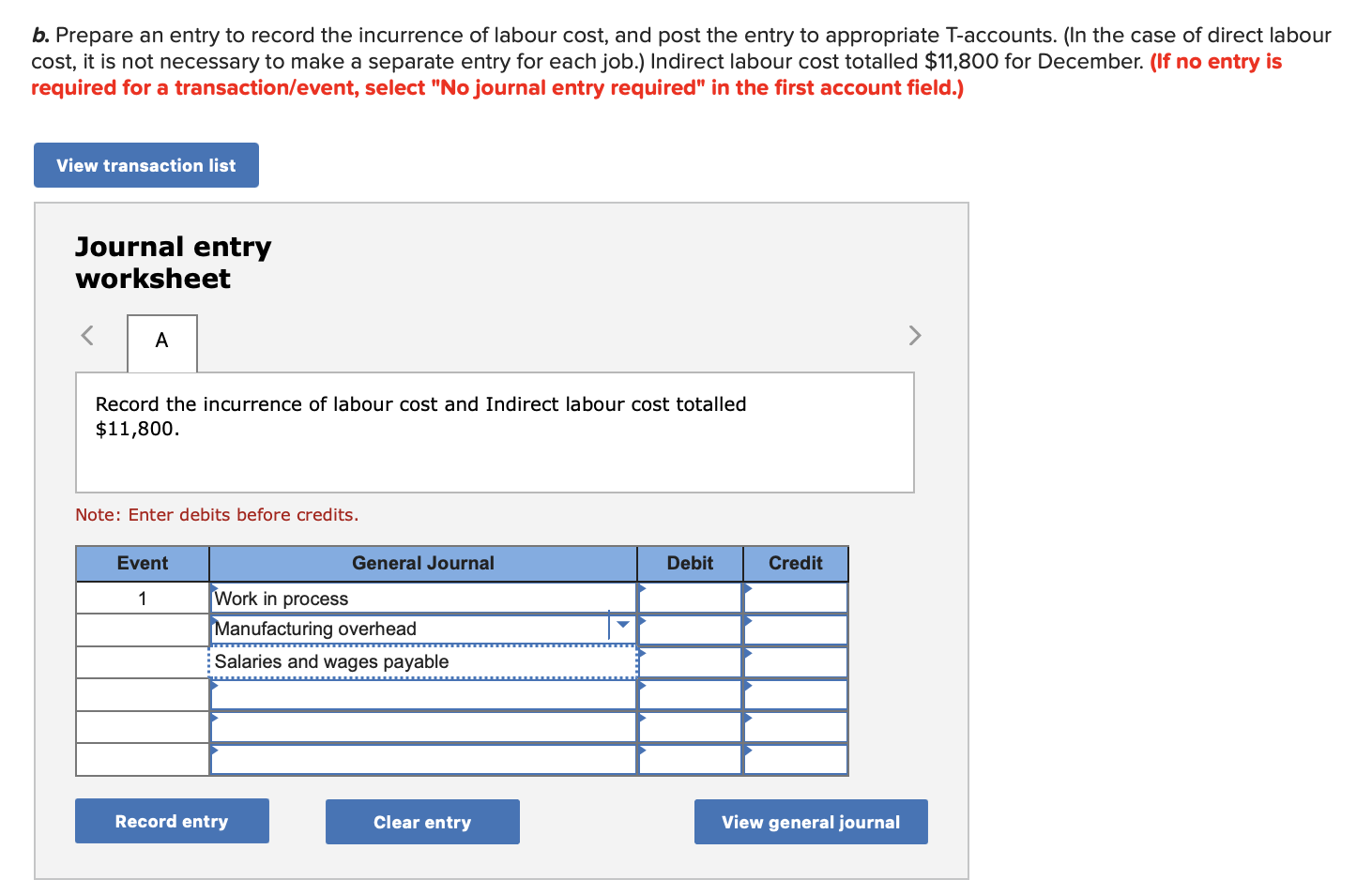

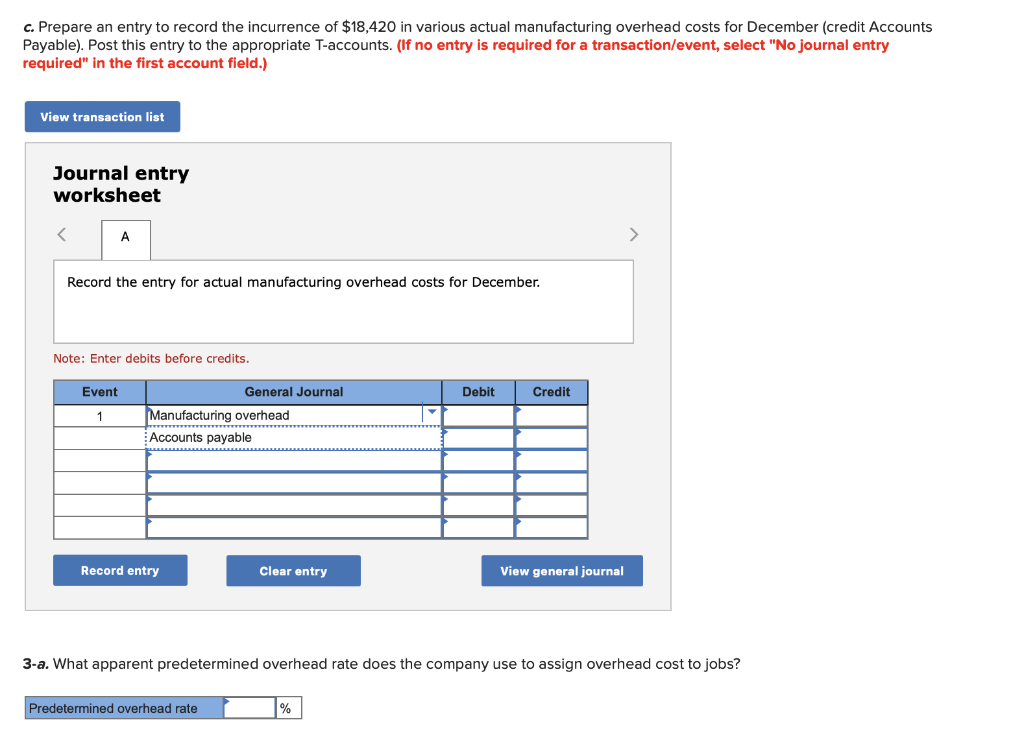

Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107 -were worked on during end of the company's operating year. Data from the job cost sheets of the three jobs follow: The following additional information is available: a. Manufacturing overhead is applied to jobs on the basis of direct labour cost. b. Balances in the inventory accounts at November 30 were as follows: Required: 1. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Overhead. Enter the November 30 Process T-account. 2. Prepare journal entries for December as follows: a. Prepare an entry to record the issue of materials into production and post the entry to appropriate T-accounts. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during December totalled $6,850. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the issue of materials into production and Indirect materials used during December totalled $6,850. Note: Enter debits before credits. b. Prepare an entry to record the incurrence of labour cost, and post the entry to appropriate T-accounts. (In the case of direct labour cost, it is not necessary to make a separate entry for each job.) Indirect labour cost totalled $11,800 for December. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the incurrence of labour cost and Indirect labour cost totalled $11,800. Note: Enter debits before credits. c. Prepare an entry to record the incurrence of $18,420 in various actual manufacturing overhead costs for December (credit Accounts Payable). Post this entry to the appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for actual manufacturing overhead costs for December. Note: Enter debits before credits. 3-a. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts