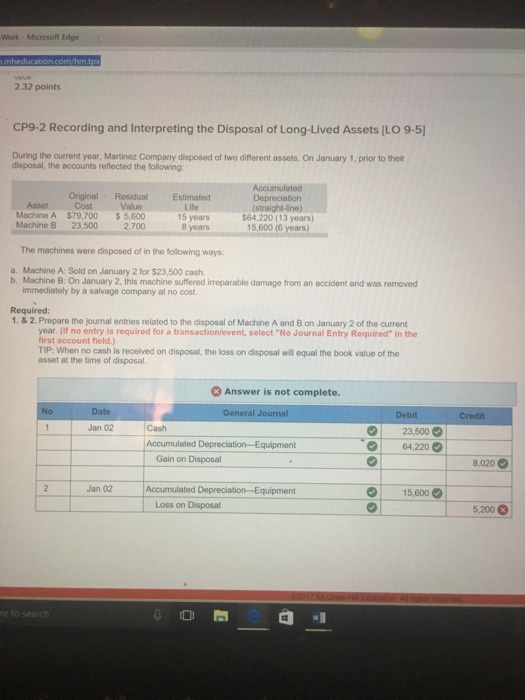

Question: Work Microsoft Edge 2.32 points CP9-2 Recording and Interpreting the Disposal of Long-Lived Assets ILO 9-5 During the current year, Martinez Company disposed of two

Work Microsoft Edge 2.32 points CP9-2 Recording and Interpreting the Disposal of Long-Lived Assets ILO 9-5 During the current year, Martinez Company disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: Original Rosidual Estimated Asset Value Machine A $79,700 $ 5,600 2,700 Life 15 years 8 years (straight-line) S64,220 (13 years) 15,600 (6 years) Machine B 23,500 The machines were disposed of in the following ways: a. Machine A: Sold on January 2 for $23,500 cash. b. Machine B: On January 2, this machine sulfered irreparable damage from an accident and was removed immediately by a salvage company at no cost. Required 1. &2.Prepare the journal entries related to the disposal of Machine A and B on January 2 of the current year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) TIP: When no cash is recelived on disposal, the loss on disposal will equal the book value of the asset at the time of disposal. & Answer is not complete. Date General Journal Credit Debit 23,500 64,220 Jan 02 O 64,220 Gain on Disposal 8,020 15,600 Jan 02 ipment Loss on Disposal 5,200 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts