Question: WORKSHOP 7 ADDITIONAL QUESTION 6.33 PREPARING AN ACCRUAL BASED STATEMENT Racey has prepared an income statement for the 12-month reporting period ended 30 June on

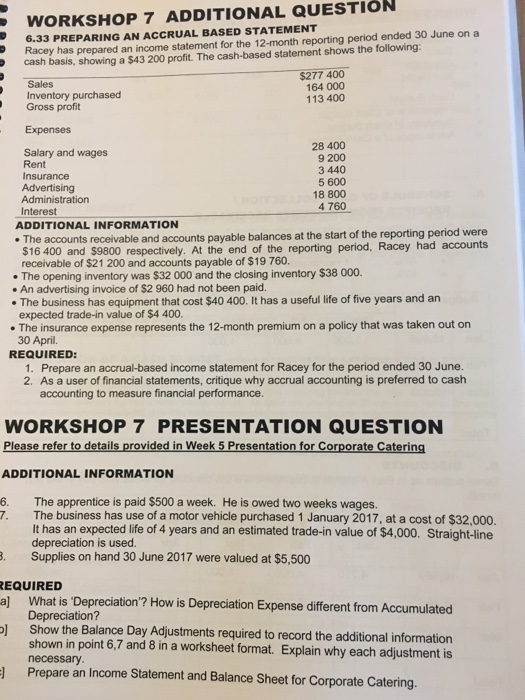

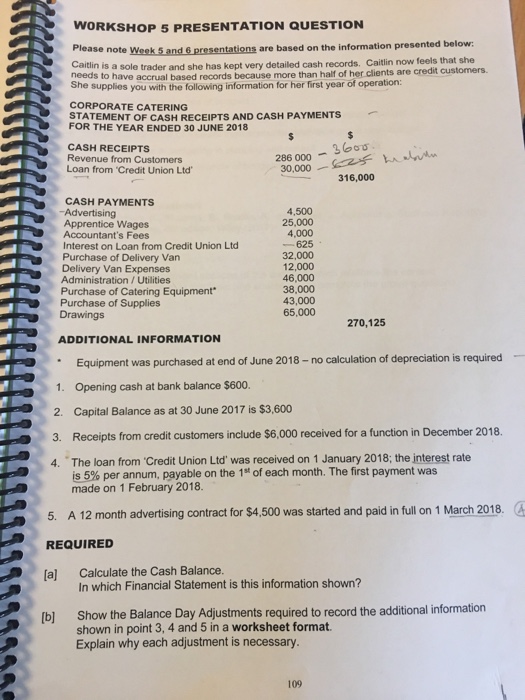

WORKSHOP 7 ADDITIONAL QUESTION 6.33 PREPARING AN ACCRUAL BASED STATEMENT Racey has prepared an income statement for the 12-month reporting period ended 30 June on a cash basis, showing a $43 200 profit. The cash-based statement shows the following: Sales Inventory purchased Gross profit $277 400 164 000 113 400 28 400 9 200 3 440 5 600 18 800 4 760 Salary and wages Rent Administration Interest The accounts receivable and accounts payable balances at the start of the reporting period were receivable of $21 200 and accounts payable of $19 760. ADDITIONAL INFORMATION $16 400 and $9800 respectively. At the end of the reporting period, Racey had accounts .The opening inventory was $32 000 and the closing inventory $38 000. . An advertising invoice of $2 960 had not been paid. .The business has equipment that cost $40 400. It has a useful life of five years and an expected trade-in value of $4 400. The insurance expense represents the 12-month premium on a policy that was taken out on 30 April. REQUIRED: 1. Prepare an accrual-based income statement for Racey for the period ended 30 June. 2. As a user of financial statements, critique why accrual accounting is preferred to cash accounting to measure financial performance. WORKSHOP 7 PRESENTATION QUESTION atio ADDITIONAL INFORMATION The apprentice is paid $500 a week. He is owed two weeks wages. The business has use of a motor vehicle purchased 1 January 2017, at a cost of $32,000. It has an expected life of 4 years and an estimated trade-in value of $4,000. Straight-line depreciation is used. 6. 7. . Supplies on hand 30 June 2017 were valued at $5,500 EQUIRED What is 'Depreciation'? How is Depreciation Expense different from Accumulated Depreciation? Show the Balance Day Adjustments required to record the additional information shown in point 6,7 and 8 in a worksheet format. Explain why each adjustment is necessary Prepare an Income Statement and Balance Sheet for Corporate Catering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts