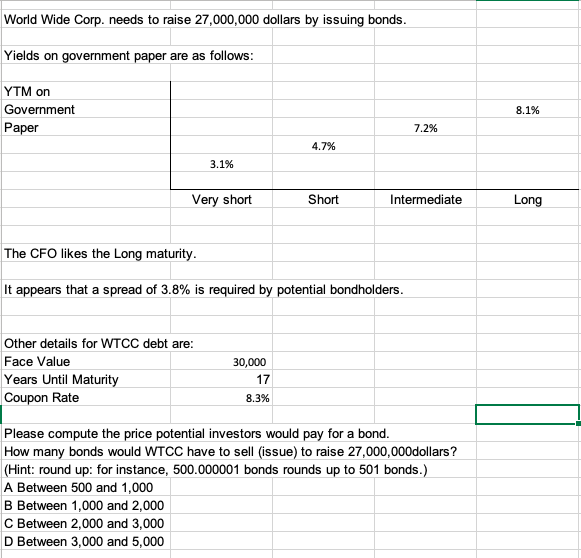

Question: World Wide Corp. needs to raise 27,000,000 dollars by issuing bonds. Yields on government paper are as follows: YTM on Government Paper 8.1% 7.2%

World Wide Corp. needs to raise 27,000,000 dollars by issuing bonds. Yields on government paper are as follows: YTM on Government Paper 8.1% 7.2% 4.7% 3.1% Very short Short Intermediate Long The CFO likes the Long maturity. It appears that a spread of 3.8% is required by potential bondholders. Other details for WTCC debt are: Face Value Years Until Maturity Coupon Rate 30,000 17 8.3% Please compute the price potential investors would pay for a bond. How many bonds would WTCC have to sell (issue) to raise 27,000,000dollars? (Hint: round up: for instance, 500.000001 bonds rounds up to 501 bonds.) A Between 500 and 1,000 B Between 1,000 and 2,000 C Between 2,000 and 3,000 D Between 3,000 and 5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts