Question: Would anyone know how to do questions 4-6? Please help I dont understand how to figure these out on a federal tax return or what

Would anyone know how to do questions 4-6? Please help I dont understand how to figure these out on a federal tax return or what additional tax schedules I would need.

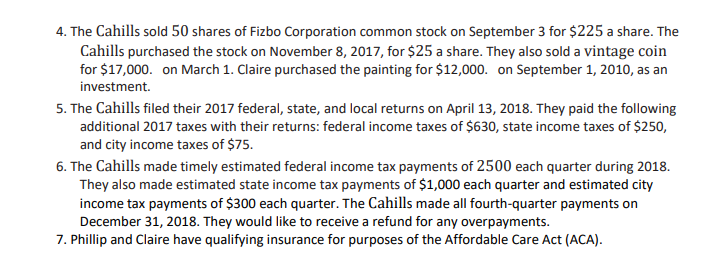

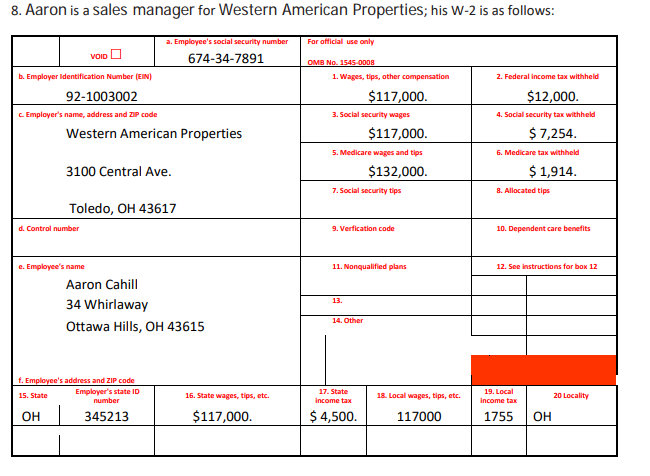

4. The Cahills sold 50 shares of Fizbo Corporation common stock on September 3 for $225 a share. The Cahills purchased the stock on November 8, 2017, for $25 a share. They also sold a vintage coin for $17,000. on March 1. Claire purchased the painting for $12,000. on September 1, 2010, as an investment 5. The Cahills filed their 2017 federal, state, and local returns on April 13, 2018. They paid the following additional 2017 taxes with their returns: federal income taxes of $630, state income taxes of $250, and city income taxes of $75. 6. The Cahills made timely estimated federal income tax payments of 2500 each quarter during 2018. They also made estimated state income tax payments of $1,000 each quarter and estimated city income tax payments of $300 each quarter. The Cahills made all fourth-quarter payments on December 31, 2018. They would like to receive a refund for any overpayments. 7. Phillip and Claire have qualifying insurance for purposes of the Affordable Care Act (ACA). 8. Aaron is a sales manager for Western American Properties; his W-2 is as follows: Employee's social security number For official use only VOID 674-34-7891 OMB No. 1545-0008 1. Wages, tips, other compensation $117,000. b. Employer identification Number (EN) 92-1003002 2. Federal income tax withheld $12,000. c. Employer's name, address and ZIP code 3. Social security wages 4. Social security tax withheld Western American Properties $117,000 5. Medicare wages and tips $132,000. 7. Social security tips $ 7,254. 6. Medicare tax withheld $ 1,914. 8. Allocated tips 3100 Central Ave. Toledo, OH 43617 d. Control number 9. Vertication code 10. Dependent care benefits 11. Nonqualified plans 12. See Instructions for box 12 13. Aaron Cahill 34 Whirlaway Ottawa Hills, OH 43615 14. Other f. Employee's address and ZIP code 15. State Employer's state ID number 19. Local 16. State wages, tips, etc. 17. State Income tax 18. Local wages, tips, etc. 117000 OH 345213 $117,000. Income tax 20 Locality 1755 OH $ 4,500. 4. The Cahills sold 50 shares of Fizbo Corporation common stock on September 3 for $225 a share. The Cahills purchased the stock on November 8, 2017, for $25 a share. They also sold a vintage coin for $17,000. on March 1. Claire purchased the painting for $12,000. on September 1, 2010, as an investment 5. The Cahills filed their 2017 federal, state, and local returns on April 13, 2018. They paid the following additional 2017 taxes with their returns: federal income taxes of $630, state income taxes of $250, and city income taxes of $75. 6. The Cahills made timely estimated federal income tax payments of 2500 each quarter during 2018. They also made estimated state income tax payments of $1,000 each quarter and estimated city income tax payments of $300 each quarter. The Cahills made all fourth-quarter payments on December 31, 2018. They would like to receive a refund for any overpayments. 7. Phillip and Claire have qualifying insurance for purposes of the Affordable Care Act (ACA). 8. Aaron is a sales manager for Western American Properties; his W-2 is as follows: Employee's social security number For official use only VOID 674-34-7891 OMB No. 1545-0008 1. Wages, tips, other compensation $117,000. b. Employer identification Number (EN) 92-1003002 2. Federal income tax withheld $12,000. c. Employer's name, address and ZIP code 3. Social security wages 4. Social security tax withheld Western American Properties $117,000 5. Medicare wages and tips $132,000. 7. Social security tips $ 7,254. 6. Medicare tax withheld $ 1,914. 8. Allocated tips 3100 Central Ave. Toledo, OH 43617 d. Control number 9. Vertication code 10. Dependent care benefits 11. Nonqualified plans 12. See Instructions for box 12 13. Aaron Cahill 34 Whirlaway Ottawa Hills, OH 43615 14. Other f. Employee's address and ZIP code 15. State Employer's state ID number 19. Local 16. State wages, tips, etc. 17. State Income tax 18. Local wages, tips, etc. 117000 OH 345213 $117,000. Income tax 20 Locality 1755 OH $ 4,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts