Question: Would like an answer to this question for part a, b & c 3. Yangtze Engineering Limited commenced in business on 1 January 2019. On

Would like an answer to this question for part a, b & c

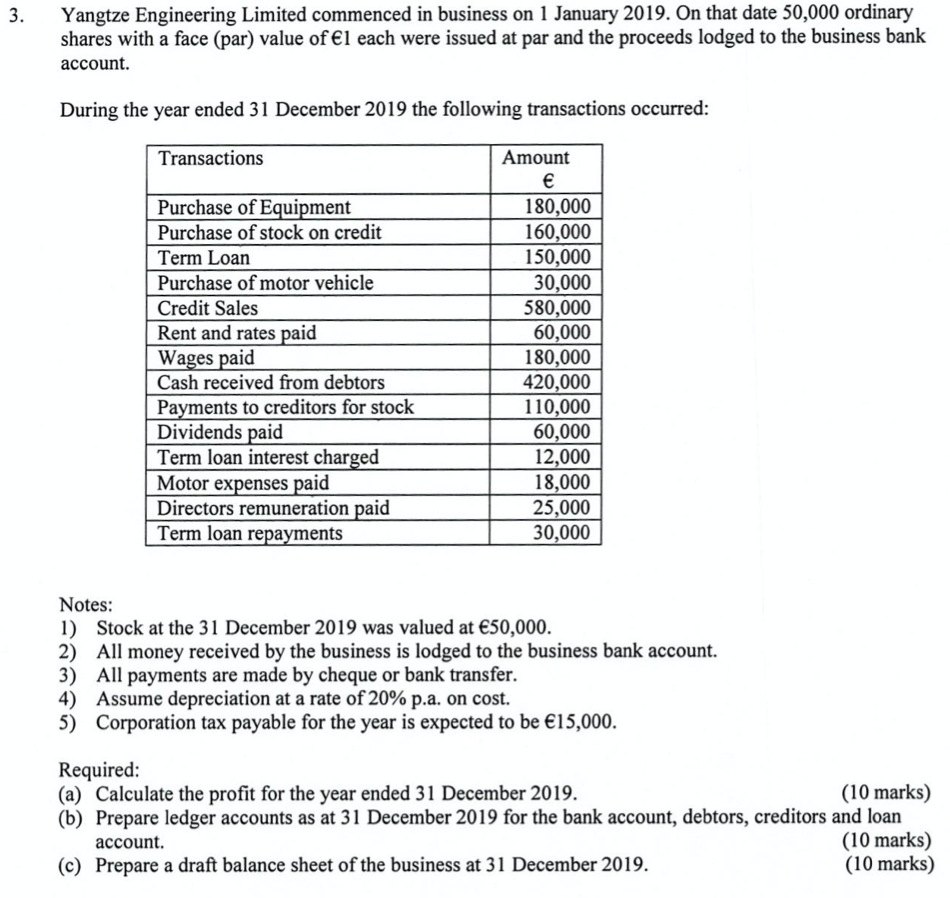

3. Yangtze Engineering Limited commenced in business on 1 January 2019. On that date 50,000 ordinary shares with a face (par) value of El each were issued at par and the proceeds lodged to the business bank account. During the year ended 31 December 2019 the following transactions occurred: Transactions Purchase of Equipment Purchase of stock on credit Term Loan Purchase of motor vehicle Credit Sales Rent and rates paid Wages paid Cash received from debtors Payments to creditors for stock Dividends paid Term loan interest charged Motor expenses paid Directors remuneration paid Term loan repayments Amount 180,000 160,000 150,000 30,000 580,000 60,000 180,000 420,000 110,000 60,000 12,000 18,000 25,000 30,000 Notes: 1) Stock at the 31 December 2019 was valued at 50,000. 2) All money received by the business is lodged to the business bank account. 3) All payments are made by cheque or bank transfer. 4) Assume depreciation at a rate of 20% p.a. on cost. 5) Corporation tax payable for the year is expected to be 15,000. Required: (a) Calculate the profit for the year ended 31 December 2019. (10 marks) (b) Prepare ledger accounts as at 31 December 2019 for the bank account, debtors, creditors and loan account. (10 marks) (C) Prepare a draft balance sheet of the business at 31 December 2019. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts