Question: Would really appreicate the help and an explanation too please. Thank you. 8. Teletech Co. wants to use a decision tree in evaluating a venture

Would really appreicate the help and an explanation too please. Thank you.

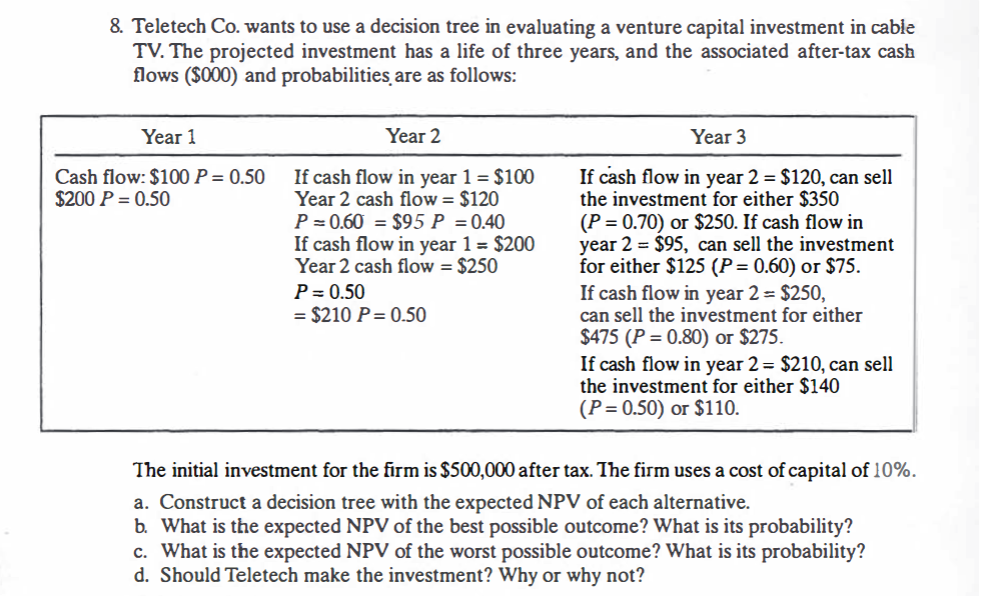

8. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment has a life of three years, and the associated after-tax cash flows ($000) and probabilities are as follows: Year 1 Year 2 Year 3 Cash flow: $100 P = 0.50 $200 P=0.50 If cash flow in year 1 = $100 Year 2 cash flow = $120 P=0.60 = $95 P = 0.40 If cash flow in year 1 = $200 Year 2 cash flow = $250 P=0.50 = $210 P=0.50 If cash flow in year 2 = $120, can sell the investment for either $350 (P = 0.70) or $250. If cash flow in year 2 = $95, can sell the investment for either $125 (P = 0.60) or $75. If cash flow in year 2 = $250, can sell the investment for either $475 (P = 0.80) or $275. If cash flow in year 2 = $210, can sell the investment for either $140 (P=0.50) or $110. The initial investment for the firm is $500,000 after tax. The firm uses a cost of capital of 10%. a. Construct a decision tree with the expected NPV of each alternative. b. What is the expected NPV of the best possible outcome? What is its probability? c. What is the expected NPV of the worst possible outcome? What is its probability? d. Should Teletech make the investment? Why or why not? 8. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment has a life of three years, and the associated after-tax cash flows ($000) and probabilities are as follows: Year 1 Year 2 Year 3 Cash flow: $100 P = 0.50 $200 P=0.50 If cash flow in year 1 = $100 Year 2 cash flow = $120 P=0.60 = $95 P = 0.40 If cash flow in year 1 = $200 Year 2 cash flow = $250 P=0.50 = $210 P=0.50 If cash flow in year 2 = $120, can sell the investment for either $350 (P = 0.70) or $250. If cash flow in year 2 = $95, can sell the investment for either $125 (P = 0.60) or $75. If cash flow in year 2 = $250, can sell the investment for either $475 (P = 0.80) or $275. If cash flow in year 2 = $210, can sell the investment for either $140 (P=0.50) or $110. The initial investment for the firm is $500,000 after tax. The firm uses a cost of capital of 10%. a. Construct a decision tree with the expected NPV of each alternative. b. What is the expected NPV of the best possible outcome? What is its probability? c. What is the expected NPV of the worst possible outcome? What is its probability? d. Should Teletech make the investment? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts