Question: please explain with the equations for parts b, c, and d. thank you Decision tree 1. Teletech Co. wants to use a decision tree in

please explain with the equations for parts b, c, and d. thank you

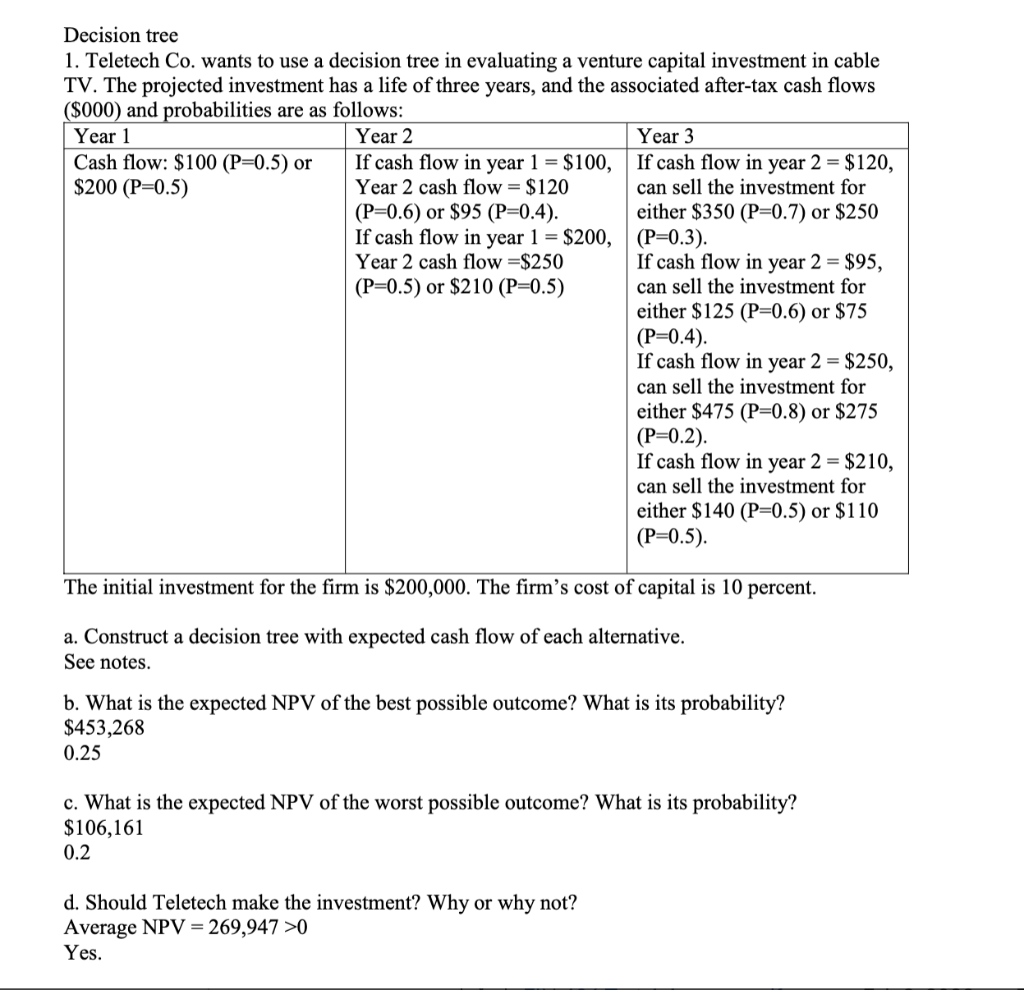

Decision tree 1. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment has a life of three years, and the associated after-tax cash flows ($000) and probabilities are as follows: Year 1 Year 2 Year 3 Cash flow: $100 (P=0.5) or If cash flow in year 1 = $100, If cash flow in year 2 = $120, $200 (P=0.5) Year 2 cash flow = $120 can sell the investment for (P=0.6) or $95 (P=0.4). either $350 (P=0.7) or $250 If cash flow in year 1 = $200, (P=0.3). Year 2 cash flow =$250 If cash flow in year 2 = $95, (P=0.5) or $210 (P=0.5) can sell the investment for either $125 (P=0.6) or $75 (P=0.4). If cash flow in year 2 = $250, can sell the investment for either $475 (P=0.8) or $275 (P=0.2). If cash flow in year 2 = $210, can sell the investment for either $140 (P=0.5) or $110 (P=0.5). The initial investment for the firm is $200,000. The firm's cost of capital is 10 percent. a. Construct a decision tree with expected cash flow of each alternative. See notes. b. What is the expected NPV of the best possible outcome? What is its probability? $453,268 0.25 c. What is the expected NPV of the worst possible outcome? What is its probability? $106,161 0.2 d. Should Teletech make the investment? Why or why not? Average NPV = 269,947 >0 Yes. Decision tree 1. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment has a life of three years, and the associated after-tax cash flows ($000) and probabilities are as follows: Year 1 Year 2 Year 3 Cash flow: $100 (P=0.5) or If cash flow in year 1 = $100, If cash flow in year 2 = $120, $200 (P=0.5) Year 2 cash flow = $120 can sell the investment for (P=0.6) or $95 (P=0.4). either $350 (P=0.7) or $250 If cash flow in year 1 = $200, (P=0.3). Year 2 cash flow =$250 If cash flow in year 2 = $95, (P=0.5) or $210 (P=0.5) can sell the investment for either $125 (P=0.6) or $75 (P=0.4). If cash flow in year 2 = $250, can sell the investment for either $475 (P=0.8) or $275 (P=0.2). If cash flow in year 2 = $210, can sell the investment for either $140 (P=0.5) or $110 (P=0.5). The initial investment for the firm is $200,000. The firm's cost of capital is 10 percent. a. Construct a decision tree with expected cash flow of each alternative. See notes. b. What is the expected NPV of the best possible outcome? What is its probability? $453,268 0.25 c. What is the expected NPV of the worst possible outcome? What is its probability? $106,161 0.2 d. Should Teletech make the investment? Why or why not? Average NPV = 269,947 >0 Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts