Question: Would someone be able to explain how they got the numbers for the answers in this question? The question is in the link sent below

Would someone be able to explain how they got the numbers for the answers in this question?

The question is in the link sent below

http://www.chegg.com/homework-help/questions-and-answers/chapter-3-problem-14-using-information-provided-construct-monthly-cash-budget-october-dece-q4395584

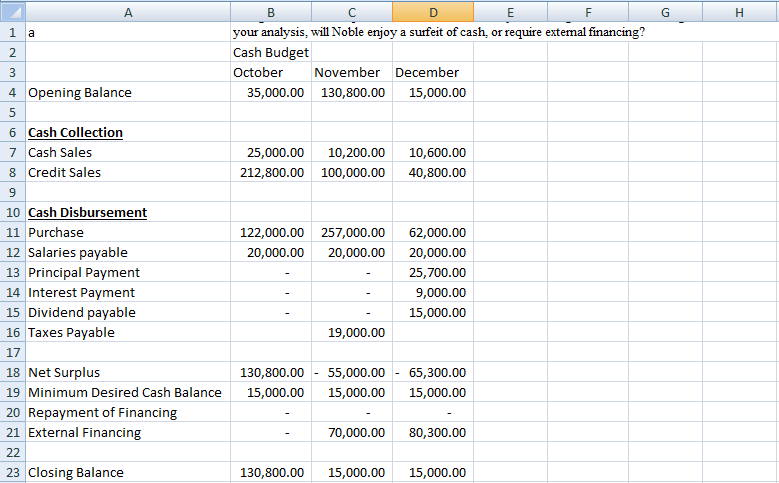

| Using the information provided, construct a monthly cash budget for October through December 2011. Based on your analysis, will Noble enjoy a surfeit of cash, or require external financing? | |||||||

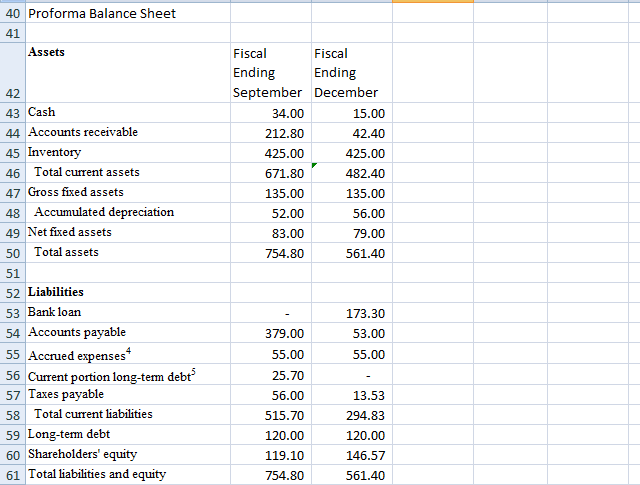

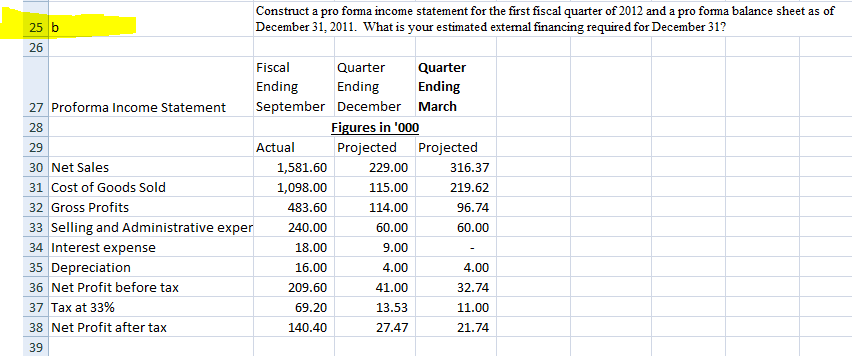

| Construct a pro forma income statement for the first fiscal quarter of 2012 and a pro forma balance sheet as of December 31, 2011. What is your estimated external financing required for December 31? | |||||||

| Does the December 31, 2011, estimated external financing equal your cash surplus (deficit) for this date from your cash budget? | |||||||

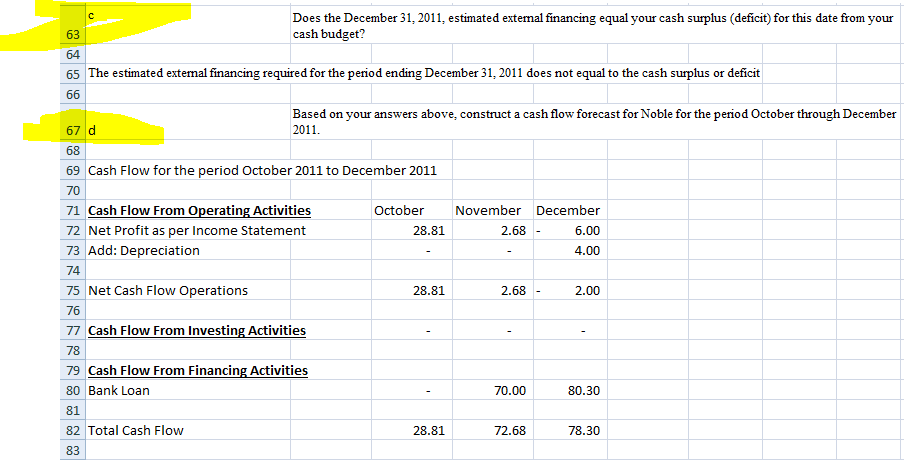

| Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2011. | |||||||

| Sales (20 percent for cash, the rest on 30-day credit terms): | |||||||

| 2011 Actual | 2011Projected | ||||||

| July | August | September | October | November | December | ||

| 76,000 | 88,000 | 266,000 | 125,000 | 51,000 | 53,000 | ||

| Purchases (all on 60-day terms): | |||||||

| 2011 Actual | 2011 Projected | ||||||

| July | August | September | October | November | December | ||

| 116,000 | 122,000 | 257,000 | 62,000 | 27,000 | 26,000 | ||

| 20,000 | |||||||

| 25,700 | |||||||

| 9,000 | |||||||

| 15,000 | |||||||

| 19,000 | |||||||

| 4,000 | |||||||

| 35,000 | |||||||

| 15,000 | |||||||

| Noble | |||||||

| Annual Income Statement | |||||||

| Fiscal Year ended September 30, 2011 ($ 000) | |||||||

| 1,581.6 | |||||||

| 1,098.0 | |||||||

| 483.6 | |||||||

| 240.0 | |||||||

| 18.0 | |||||||

| 16.0 | |||||||

| 209.6 | |||||||

| 69.2 | |||||||

| 140.4 | |||||||

| Noble | |||||||

| Balance Sheet | |||||||

| September 30, 2011 ($ 000) | |||||||

| 34.0 | |||||||

| 212.8 | |||||||

| 425.0 | |||||||

| 671.8 | |||||||

| 135.0 | |||||||

| 52.0 | |||||||

| 83.0 | |||||||

| 754.8 | |||||||

| 0.0 | |||||||

| 379.0 | |||||||

| 55.0 | |||||||

| 25.7 | |||||||

| 56.0 | |||||||

| 515.7 | |||||||

| 120.0 | |||||||

| 119.1 | |||||||

| 754.8 | |||||||

| |||||||

a your analysis, will Noble enjoy a surfeit of cash, or require external financing? Cash Budget October November December 4 opening Balance 35,000.00 130,800.00 15,000.00 6 Cash Collection Cash sales 25,000.00 10, 200.00 10,600.00 7 Credit Sales 212,800.00 100,000.00 40,800.00 8 10 Cash Disbursement 122,000.00 257,000.00 62,000.00 11 Purchase 12 Salaries payable 20,000.00 20,000.00 20,000.00 13 Principal Payment 25,700.00 14 Interest Payment 9,000.00 15 Dividend payable 15,000.00 16 Taxes Payable 19,000.00 17 18 Net surplus 130,800.00 55,000.00 65,300.000 19 Minimum Desired Cash Balance 15,000.00 15,000.00 15,000.00 20 Repayment of Financing 21 External Financing 70,000.00 80,300.00 22 23 Closing Balance 130,800.00 15,000.00 15,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts