Question: Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off ? Estimate NPV, IRR

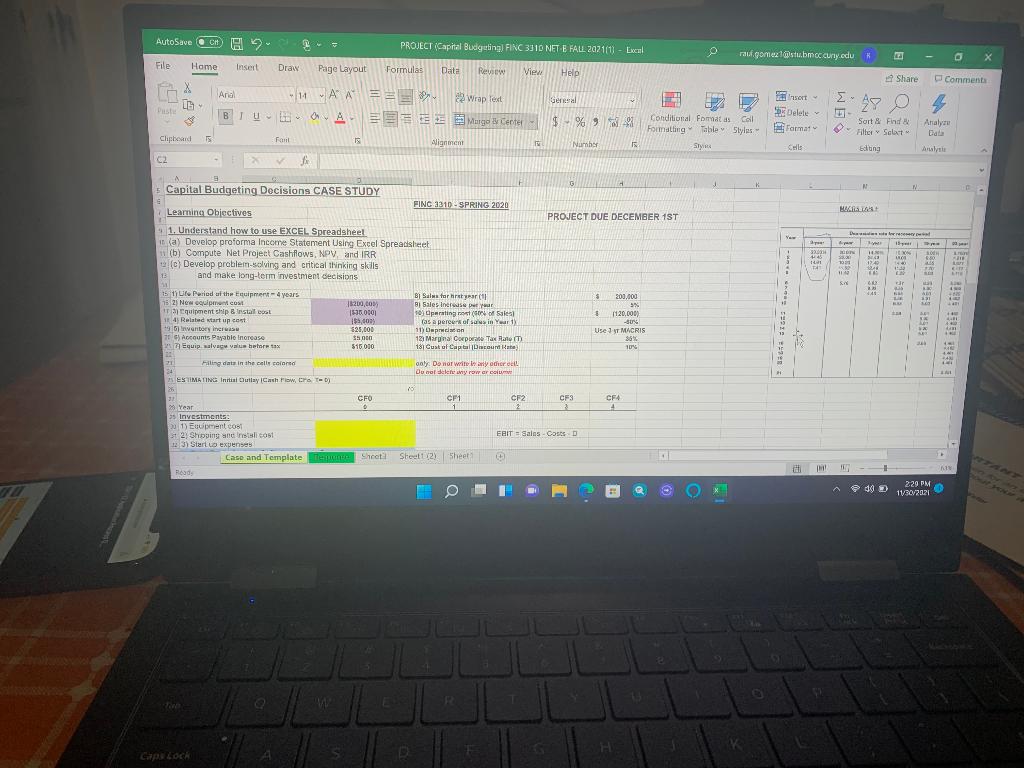

Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off ? Estimate NPV, IRR and Payback Period of the project if tax rate equals to 21%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenarios (1) or (2) would you choose? Why? How would you explain to your CEO what NPV means? What are advantages and disadvantages of using only Payback method? Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why?

Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off ? Estimate NPV, IRR and Payback Period of the project if tax rate equals to 21%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenarios (1) or (2) would you choose? Why? How would you explain to your CEO what NPV means? What are advantages and disadvantages of using only Payback method? Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why?

AutoSave C PROJECT (Capital Budgeting) FIN 3310 NET E FALL 2021111 - Excel raugomestu.bmoc.cuny.edu File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments X LG And -4 AA== 82 Wrap Text Buba A. Murgol canter General sort Delete 297 O4 Dit $ -% -% Conditional Formatas Call Coil Formatting Table Styles Style Format Sort & Find Filter Salat Chipboard Famil Analyze Data Anale Alignment Numbo CHis Editing C2 18 N M HISTA PROJECT DUE DECEMBER 1ST Capital Budgeting Decisions CASE STUDY FING 33410 - SPRING 2020 Learning Objectives 1. Understand how to use EXCEL Spreadsheel (a) Develop proforma Income Statement Using Excel Spreadsheet 11 (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills 13 and make long-term investment decisions Ya il 32 45 DS w 15 ON EN sod 9.30 103 1909 40 35 11 58 . 4.40 131 10 B Sala for haar B Sales ind put your to Operating of sales as a percek of win Yuri 11) Depron 121 Marina Corporate Tax Rate() 18 Custol Cipta Dund Kate $ 200.000 3% $ 1120,000) -0% Use IT MWCRIS SO 10 $200,00 1930.0001 $5,000 525,000 $500 516 000 * 2 41 goly: Do nor witowany odio Do not delete y rower MI 15 11 Ure Period of the Equipment 4 years 15 2 New game IT Cruipment ship & Install boat 14 Related start up cost +916 ventory 7) Accounts Payable Increase Equip. salveg value before tax 11 21 Paling data in the cells colored 34 25 ESTIMATING Ini Outlay Cash, Crow 25 31 Year 35 Investments: 201) Ecument cost St 2 Shoping and cost 123) Start expenses Case and Template Te.co Read 10 CFO CF2 CF3 CF1 1 CF4 EDIT Salas Cost Shoot Sheet (2) Sheet 49 229 PM 11/30/2021 ED H Caps Lock AutoSave C PROJECT (Capital Budgeting) FIN 3310 NET E FALL 2021111 - Excel raugomestu.bmoc.cuny.edu File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments X LG And -4 AA== 82 Wrap Text Buba A. Murgol canter General sort Delete 297 O4 Dit $ -% -% Conditional Formatas Call Coil Formatting Table Styles Style Format Sort & Find Filter Salat Chipboard Famil Analyze Data Anale Alignment Numbo CHis Editing C2 18 N M HISTA PROJECT DUE DECEMBER 1ST Capital Budgeting Decisions CASE STUDY FING 33410 - SPRING 2020 Learning Objectives 1. Understand how to use EXCEL Spreadsheel (a) Develop proforma Income Statement Using Excel Spreadsheet 11 (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills 13 and make long-term investment decisions Ya il 32 45 DS w 15 ON EN sod 9.30 103 1909 40 35 11 58 . 4.40 131 10 B Sala for haar B Sales ind put your to Operating of sales as a percek of win Yuri 11) Depron 121 Marina Corporate Tax Rate() 18 Custol Cipta Dund Kate $ 200.000 3% $ 1120,000) -0% Use IT MWCRIS SO 10 $200,00 1930.0001 $5,000 525,000 $500 516 000 * 2 41 goly: Do nor witowany odio Do not delete y rower MI 15 11 Ure Period of the Equipment 4 years 15 2 New game IT Cruipment ship & Install boat 14 Related start up cost +916 ventory 7) Accounts Payable Increase Equip. salveg value before tax 11 21 Paling data in the cells colored 34 25 ESTIMATING Ini Outlay Cash, Crow 25 31 Year 35 Investments: 201) Ecument cost St 2 Shoping and cost 123) Start expenses Case and Template Te.co Read 10 CFO CF2 CF3 CF1 1 CF4 EDIT Salas Cost Shoot Sheet (2) Sheet 49 229 PM 11/30/2021 ED H Caps Lock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts