Question: Would you help me with this please. This is question 1: This is question 2: Thank you very much for your help! Consider the following

Would you help me with this please.

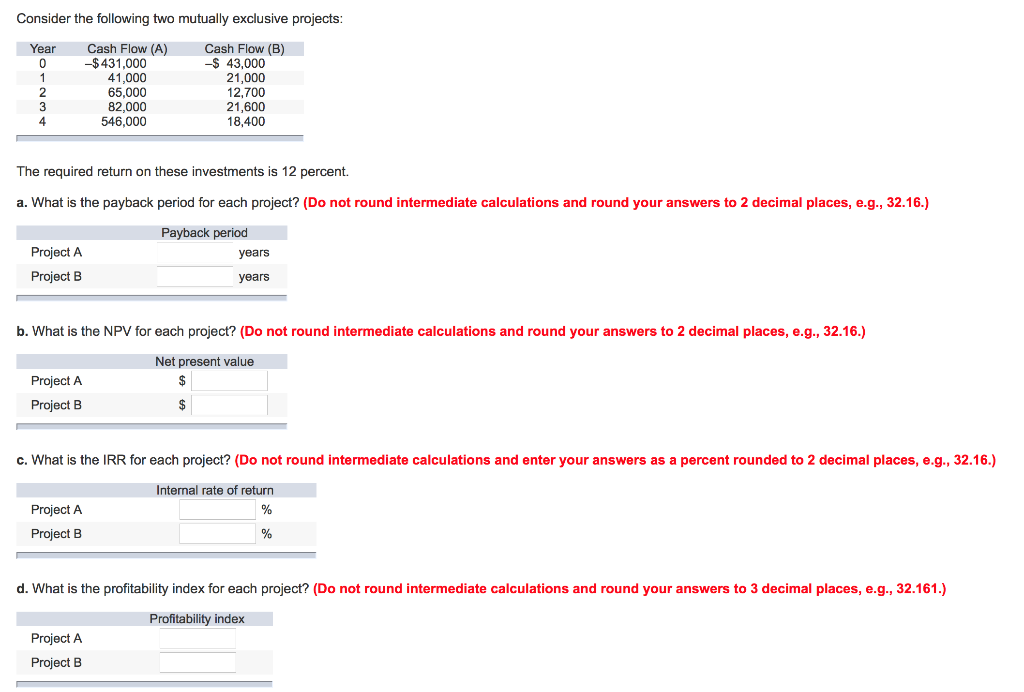

This is question 1:

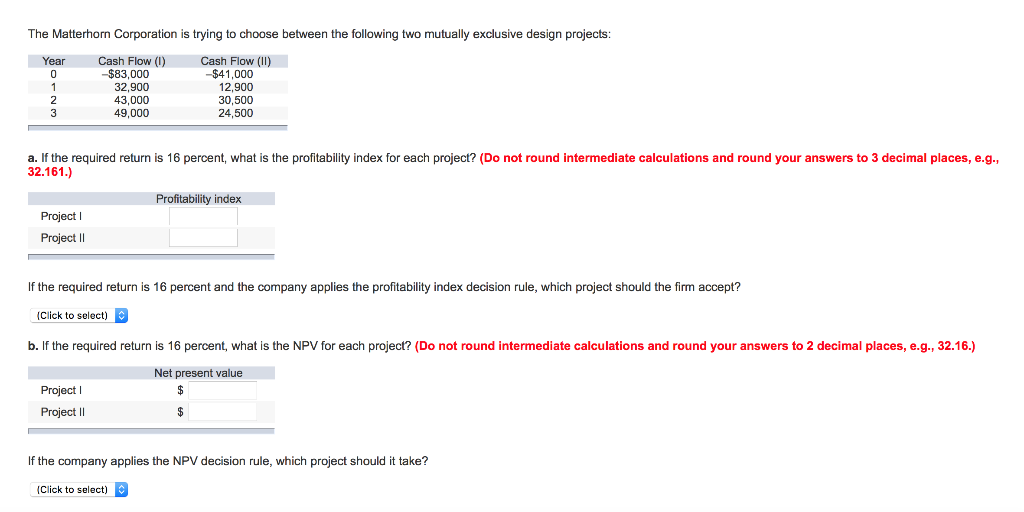

This is question 2:

Thank you very much for your help!

Consider the following two mutually exclusive projects Year Cash Flow (A)Cash Flow (B) -$431,000 41,000 65,000 82,000 546,000 -$ 43,000 21,000 12,700 21,600 18,400 2 4 The required return on these investments is 12 percent. a. What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Payback period Project A years Project B years b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Net present value Project A Project B c. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Internal rate of return Project A Project B d. What is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Profitability index Project A Project B The Matterhorn Corporation is trying to choose between the following two mutually exclusive design projects Year Cash Flow () Cash Flow (lI) -$83,000 32,900 43,000 49,000 -$41,000 12,900 30,500 24,500 a. If the required return is 16 percent, what is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g. 32.161.) Profitability index Project I Project ll If the required return is 16 percent and the company applies the profitability index decision rule, which project should the firm accept? Click to select) b. If the required return is 16 percent, what is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Net present value Project I Project II If the company applies the NPV decision rule, which project should it take? (Click to select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts