Question: WP Ch9 NPV & IRR X WP NWP Assessment Player UI Ap X Course Hero X + C a education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=b4333f46-b537-4b49-af08-e631c5da2630#/question/4 Ch9 NPV & IRR Question

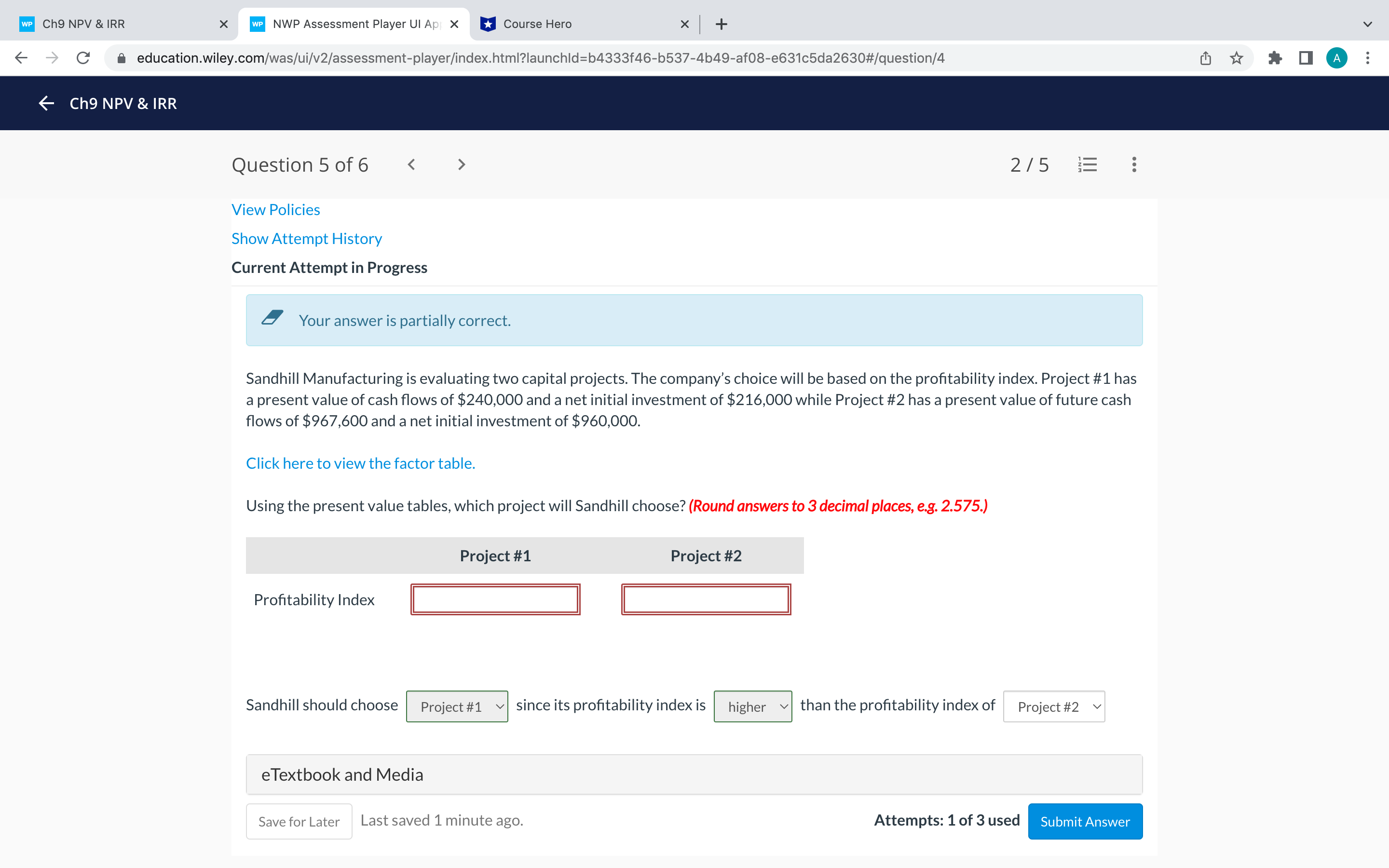

WP Ch9 NPV & IRR X WP NWP Assessment Player UI Ap X Course Hero X + C a education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=b4333f46-b537-4b49-af08-e631c5da2630#/question/4 Ch9 NPV & IRR Question 5 of 6 > 2/5 ... View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. Sandhill Manufacturing is evaluating two capital projects. The company's choice will be based on the profitability index. Project # 1 has a present value of cash flows of $240,000 and a net initial investment of $216,000 while Project #2 has a present value of future cash flows of $967,600 and a net initial investment of $960,000. Click here to view the factor table. Using the present value tables, which project will Sandhill choose? (Round answers to 3 decimal places, e.g. 2.575.) Project #1 Project #2 Profitability Index Sandhill should choose Project # 1 since its profitability index is higher than the profitability index of Project #2 e Textbook and Media Save for Later Last saved 1 minute ago. Attempts: 1 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts