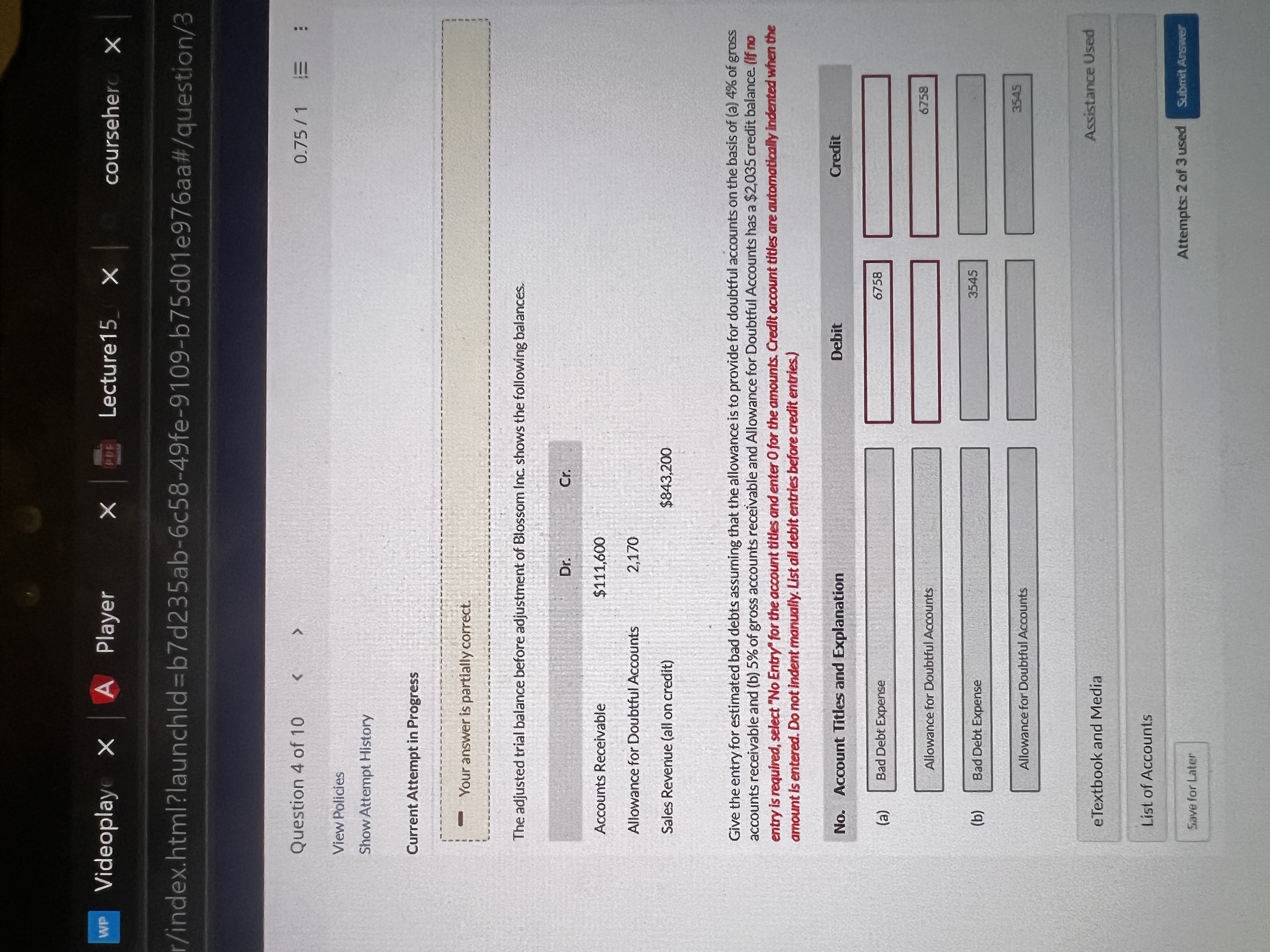

Question: WP Videoplaye X A Player X ODE Lecture 15_ X coursehero x /index.html?launchld=b7d235ab-6c58-49fe-9109-b75d01e976aa#/question/3 Question 4 of 10 0.75 /1 : View Policies Show Attempt History

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts