Question: WRITE 2 PARAGRAPHS FOR YOUR RESPONSE. EACH PARAGRAPH SHOULD HAVE AT LEAST 5 SENTENCES: Given Your Thoughts/Comments For Inform ation Below 20-6 Major Business Forms

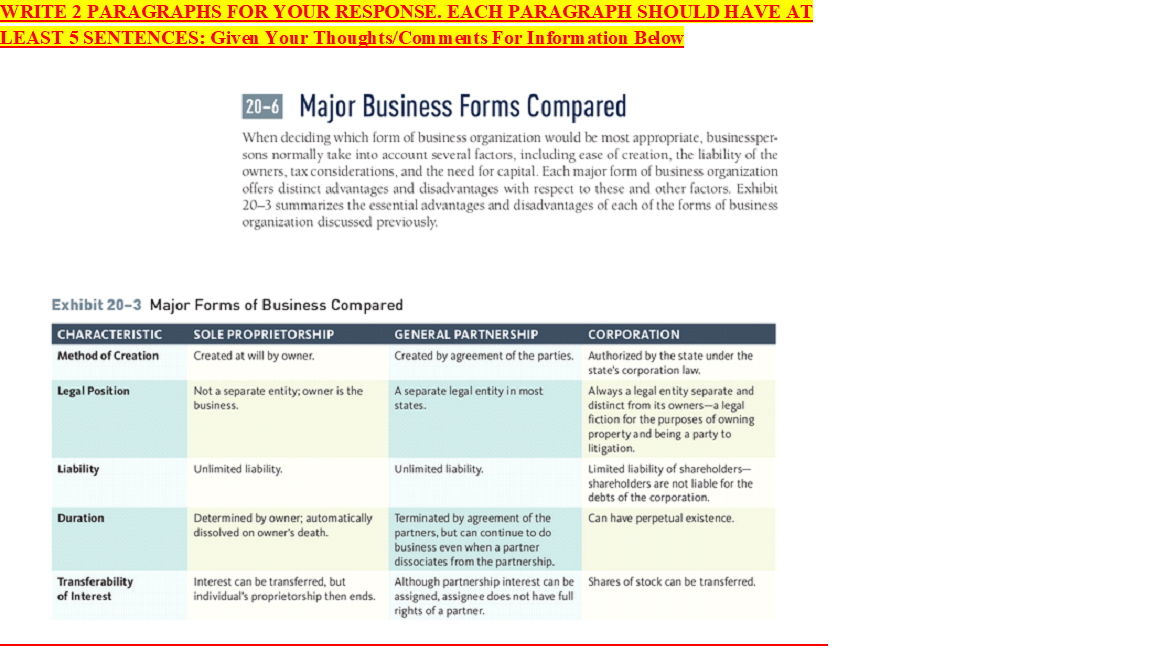

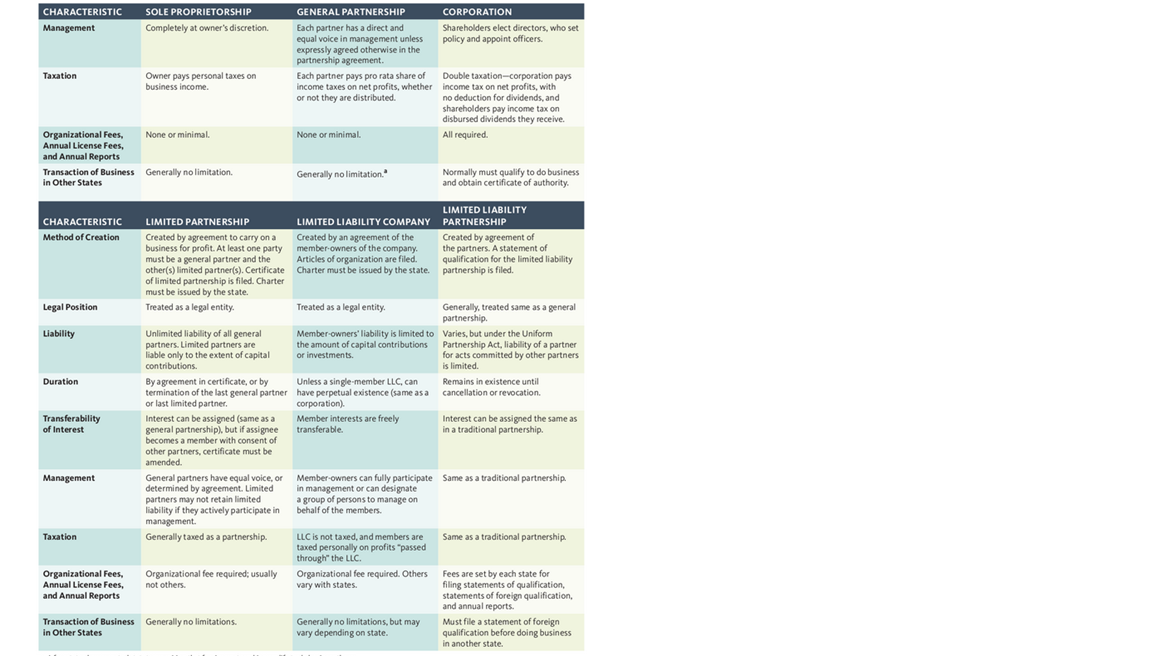

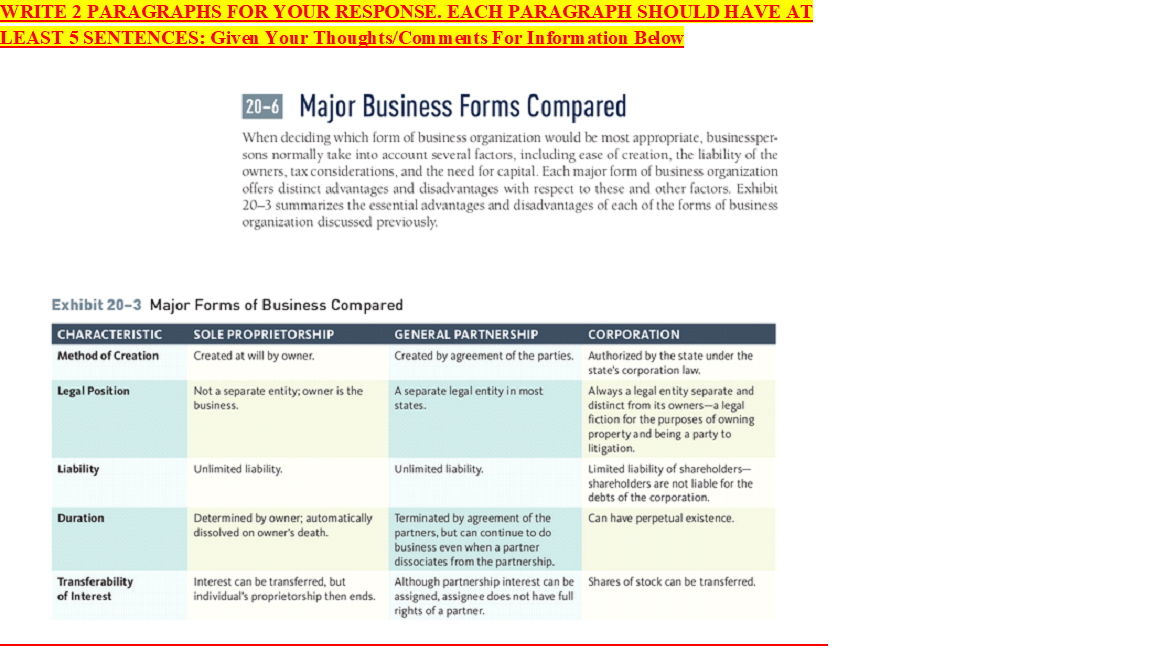

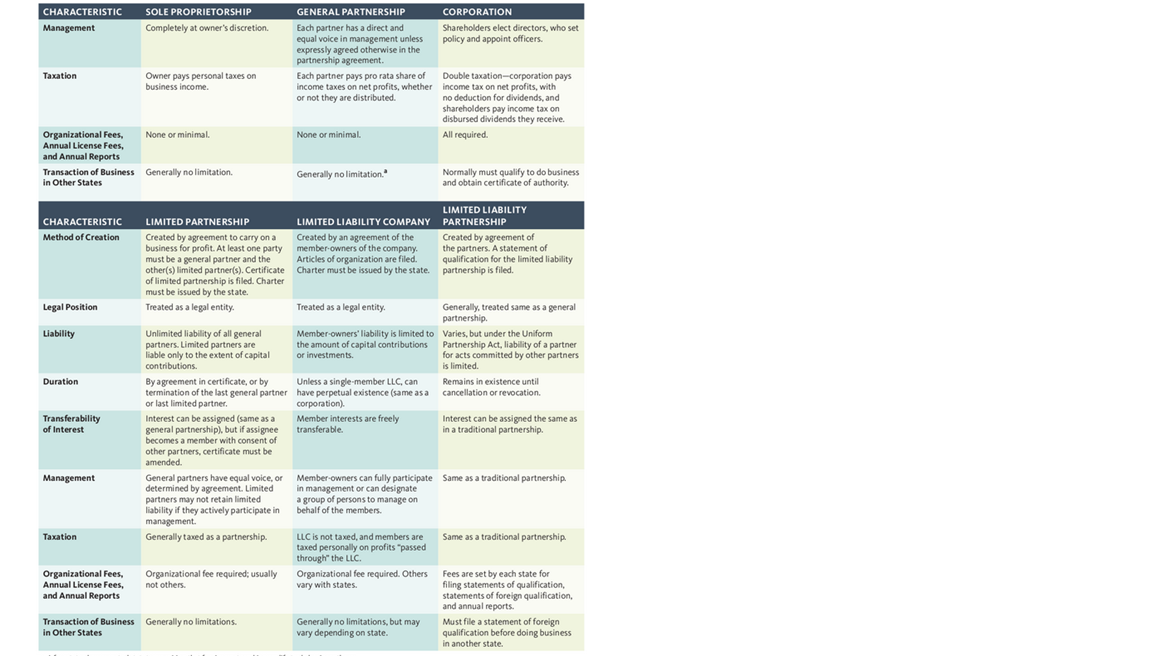

WRITE 2 PARAGRAPHS FOR YOUR RESPONSE. EACH PARAGRAPH SHOULD HAVE AT LEAST 5 SENTENCES: Given Your Thoughts/Comments For Inform ation Below 20-6 Major Business Forms Compared When deciding which form of business organization would be most appropriate, businessper- sons normally take into account several factors, including ease of creation, the liability of the owners, tax considerations, and the need for capital. Each major form of business organization offers distinct advantages and disadvantages with respect to these and other factors. Exhibit 20-3 summarizes the essential advantages and disadvantages of each of the forms of business organization discussed previously Exhibit 20-3 Major Forms of Business Compared CHARACTERISTIC SOLE PROPRIETORSHIP GENERAL PARTNERSHIP CORPORATION Method of Creation Created at will by owner. Created by agreement of the parties. Authorized by the state under the state's corporation law. Legal Position Not a separate entity, owner is the A separate legal entity in most Always a legal entity separate and business. states. distinct from its owners-a legal fiction for the purposes of owning property and being a party to litigation. Liability Unlimited liability Unlimited liability Limited liability of shareholders- shareholders are not liable for the debts of the corporation Duration Determined by owner, automatically Terminated by agreement of the Can have perpetual existence. dissolved on owner's death. partners, but can continue to do business even when a partner dissociates from the partnership. Transferability Interest can be transferred, but Although partnership interest can be shares of stock can be transferred. of Interest individual's proprietorship then ends. assigned, assignee does not have full rights of a partner. CHARACTERISTIC Management SOLE PROPRIETORSHIP Completely at owner's discretion. Taxation Owner pays personal taxes on business income. GENERAL PARTNERSHIP CORPORATION Each partner has a direct and Shareholders elect directors, who set equal voice in management unless policy and appoint officers. expressly agreed otherwise in the partnership agreement. Each partner pays pro rata share of Double taxation-corporation pays income taxes on net profits, whether income tax on net profits, with or not they are distributed. no deduction for dividends, and shareholders pay income tax on disbursed dividends they receive. None or minimal All required. None or minimal. Organizational Fees, Annual License Fees, and Annual Reports Transaction of Business in Other States Generally no limitation Generally no limitation. Normally must qualify to do business and obtain certificate of authority. CHARACTERISTIC Method of Creation LIMITED PARTNERSHIP Created by agreement to carry on a business for profit. At least one party must be a general partner and the other(s) limited partner(s). Certificate of limited partnership is filed. Charter must be issued by the state. Treated as a legal entity LIMITED LIABILITY COMPANY Created by an agreement of the member owners of the company. Articles of organization are filed. Charter must be issued by the state. LIMITED LIABILITY PARTNERSHIP Created by agreement of the partners. A statement of qualification for the limited liability partnership is filed. Legal Position Liability Treated as a legal entity. Generally treated same as a general partnership Member-owners' liability is limited to Varies, but under the Uniform the amount of capital contributions Partnership Act, liability of a partner or investments for acts committed by other partners is limited. Unless a single-member LLC, can Remains in existence until have perpetual existence (same as a cancellation or revocation corporation) Member interests are freely Interest can be assigned the same as transferable. in a traditional partnership. Duration Unlimited liability of all general partners. Limited partners are liable only to the extent of capital contributions By agreement in certificate, or by termination of the last general partner or last limited partner. Interest can be assigned (same as a general partnership). but if assignee becomes a member with consent of other partners, certificate must be amended. General partners have equal voice, or determined by agreement Limited partners may not retain limited liability if they actively participate in management. Generally taxed as a partnership Transferability of Interest Management Same as a traditional partnership Member-owners can fully participate in management or can designate a group of persons to manage on behalf of the members. Taxation Same as a traditional partnership LLC is not taxed and members are taxed personally on profits "passed through the LLC Organizational fee required. Others vary with states Organizational Fees, Annual License Fees, and Annual Reports Organizational fee required, usually not others Fees are set by each state for filing statements of qualification, statements of foreign qualification, and annual reports. Must file a statement of foreign qualification before doing business in another state. Transaction of Business in Other States Generally no limitations. Generally no limitations, but may vary depending on state