Question: write a code for code blocks for the following task: x EECS 1500 Pr 3.pdf e This ls For A C++ program. You X |

write a code for code blocks for the following task:

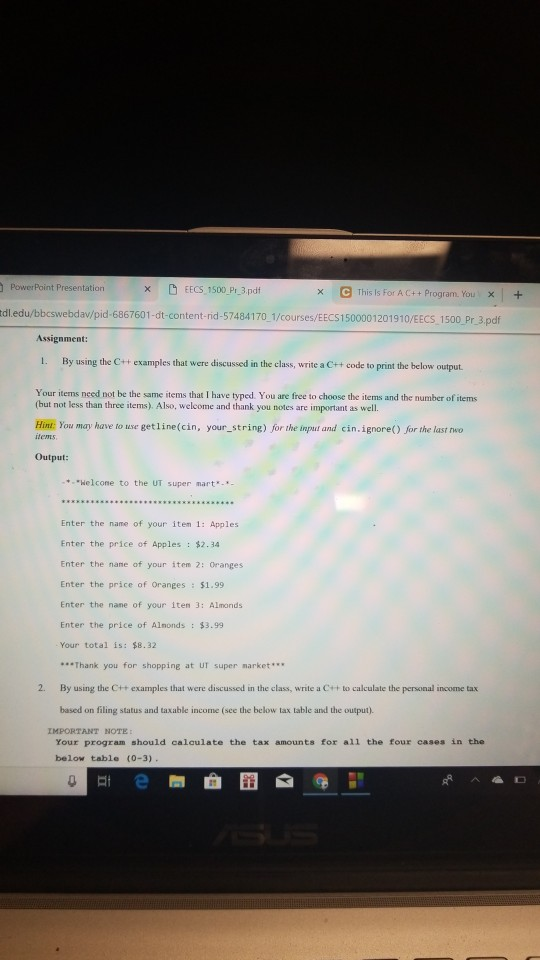

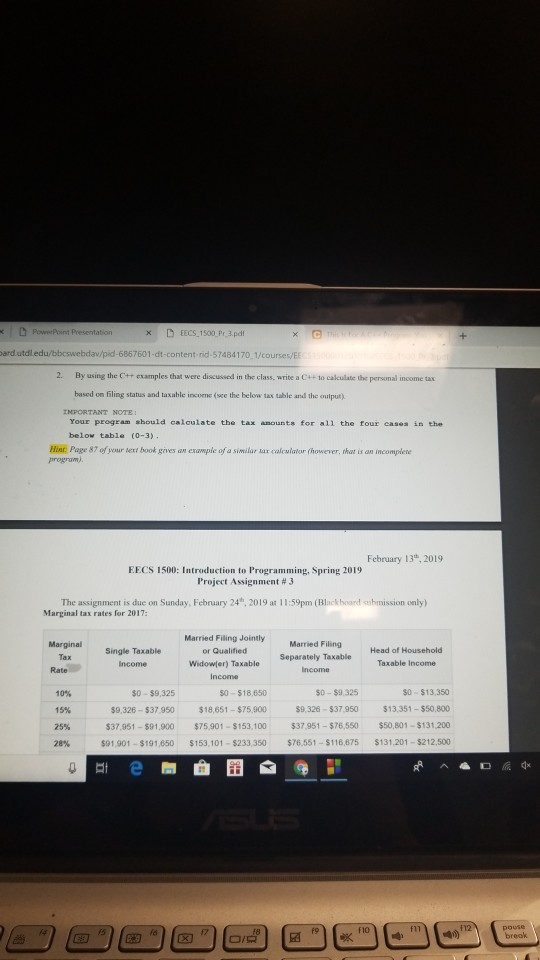

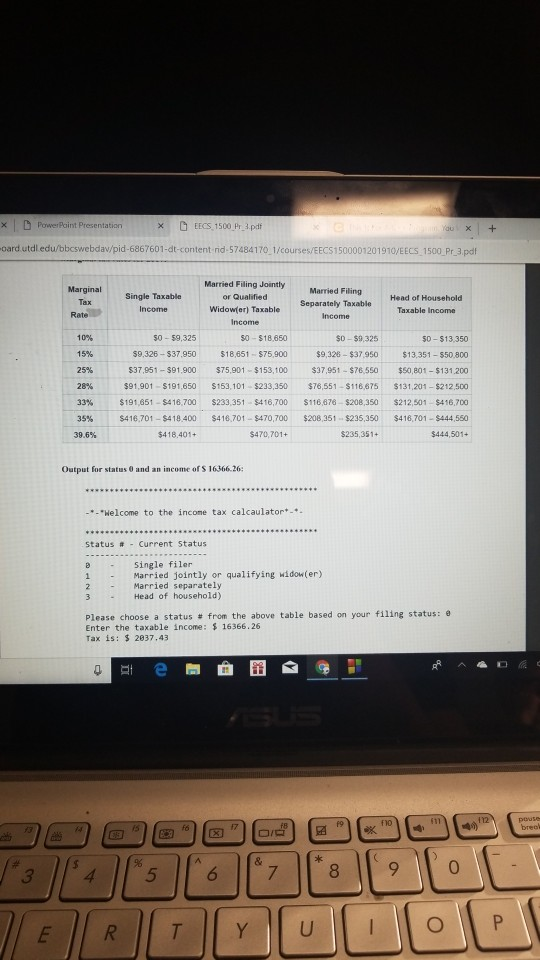

x EECS 1500 Pr 3.pdf e This ls For A C++ program. You X | + tdl edu/bbcswebdav/pid-6867601-dt-content-nid-57484170 1/courses/EECS15000 01201910/EECS 1500 Pr 3 pdf Assignment: 1. By using the Ct+ examples that were discussed in the class, write a C++ code to print the below output. Your items need not be the same items that I have typed. You are free to choose the items and the number of items (but not less than three items). Also, welcome and thank you notes are important as well. Hint: You may have to use getline(cin, your_string) for the imput and cin.ignore() for the last reo Output: ."Helcone to the UT super mart Enter the name of your item 1: Apples Enter the price of Apples $2.34 Enter the nane of your item 2: Oranges Enter the price of Oranges $1.99 Enter the nane of your iten 3: Almonds Enter the price of Alnonds: $3.99 Your total is: $8.32 Thank you for shopping at UT super narket 2. By using the Ct+ examples that were discussed in the class, write a C++ to calculate the personal income tax based on filing status and taxable income (see the below tax table and the output). IMPORTANT NOTE Your program should calculate the tax amounts for all the four cases in the below table (0-3) x D EECS 1500 Pr 3 pd pardutdledu/bbeswebdav/pid-6867601-dt-content nid-57484170 1/courses/E 2. By using the C+ examples that were discussed in the class, write a C++ to calculate the personal income tax based on filing status and taxable income (see the below tax table and the output) Your program sbould caloulate the tax anounts for all the four cases in the below table (0-3) Hiat Page 87 of your text book gives an exampie of a simiar ar calcalalor (howeer, th is an incomplene program) February 13, 2019 EECS 1500: Introduction to Programming, Spring 2019 Project Assignment # 3 The assignment is due on Sunday, February 24h, 2019 at 11:59pm (Black board sabmission only) Marginal tax rates for 2017: Marginal Married Filing Widowjer) Taxable Separately Taxable Head of Householtd income or Qualified Tax Income Taxable Income Rate Income S0-$13,350 9,326-$37950 $18,651-$75,900 $9,326-$37950 $13.351-$50.800 $37,951 $91,900 $75,901-$153,100 $37,951-$76,550 $50,801-$131,200 $91,901- $191,650 $153,101-$233,350 $76,551-$118,675 $131.201-$212,500 $o-$9,325 50-$9.325 10% 15% 25% 28% S0 $18,650 f10 xEECS, 1500 Pr 3pdf oard utdl edu/bbcswebdav/pid-6867601-dt-content rnid-57484170 1/courses/EECS1500001201910/EECS 1500 Pr 3 pdf Married Filing Jointly or Qualified Widowfer) Taxable Marginal Married Filing Head of Household Taxable Income Separately Taxable Rate $0- $9,325 S0-$18,650 $0-$9,325 15% 25% 28% 33% 35% 39.6% 50-$13,350 $9,326-537.950 $18,651 $75,900 $9,328-$37,950 $13,351-50,800 $37,951-$91,900 $75,901 $153,100 $37,951 $76,550 $50,801-$131.200 $91.901-$191.650 $153, 101-$233,350 $76551-$116,675 $131,20, $212,500 $191,651 .$416,700 $233 351 $416,700 $116676$208,350 $212501$416,700 $416701 _ $4 18,400 $416,701-S470,700 S208 351-$235,350 s416 701 .$444550 $444,501+ $418.401+ $470,701+ $235,351+ Output for status 0 and an income of S 1636626 .."Helcome to the income tax calcaulator Status -current status Single filer Married jointly or qualifying widow(er) Married separatel)y 3Head of household) Please choose a status # from the above table based on your filing status: e Enter the taxable income : 16366.26 Tax is: 2837,43 tis 203a-162

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts