Question: Write a summary for the case, and the managerial decisions faced by Peters. thank you! BUCKEYE POWER & LIGHT COMPANY Don Peters was manager of

Write a summary for the case, and the managerial decisions faced by Peters.

thank you!

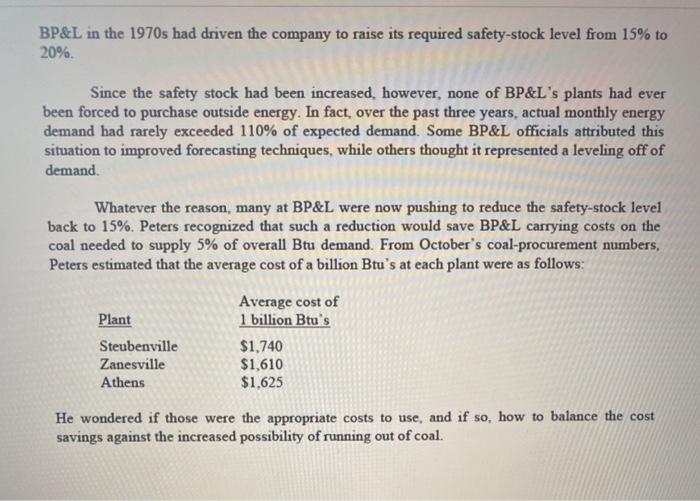

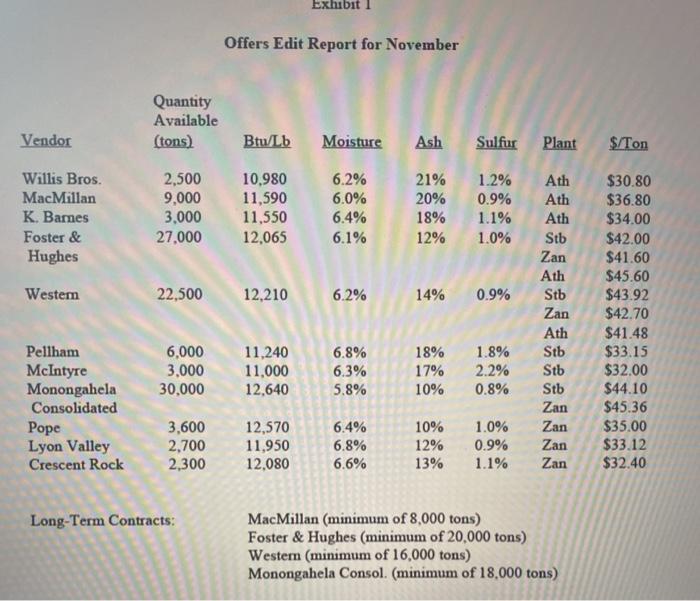

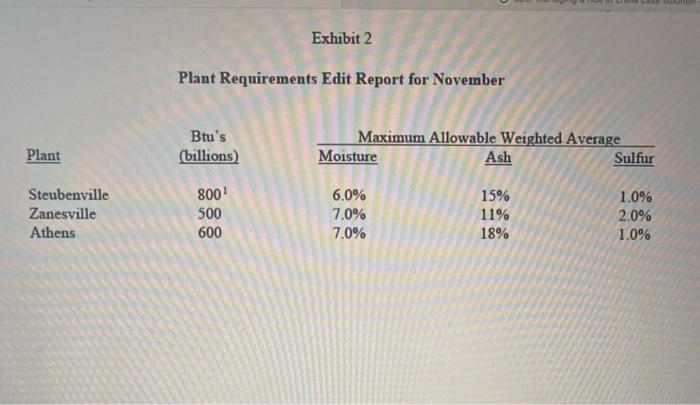

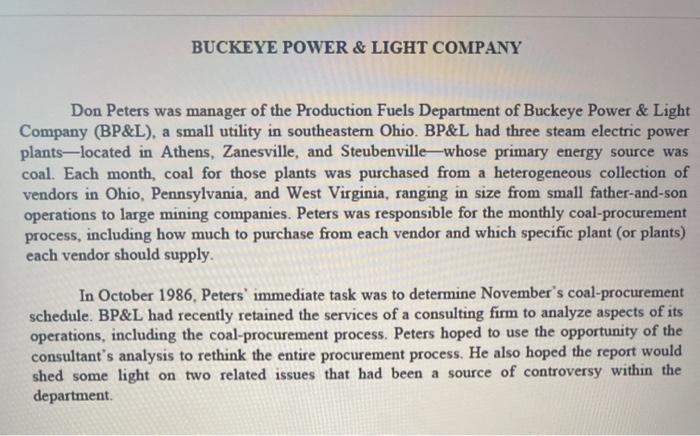

BUCKEYE POWER & LIGHT COMPANY Don Peters was manager of the Production Fuels Department of Buckeye Power & Light Company (BP&L), a small utility in southeastern Ohio. BP&L had three steam electric power plantslocated in Athens, Zanesville, and Steubenvillewhose primary energy source was coal. Each month, coal for those plants was purchased from a heterogeneous collection of vendors in Ohio, Pennsylvania, and West Virginia, ranging in size from small father-and-son operations to large mining companies. Peters was responsible for the monthly coal-procurement process, including how much to purchase from each vendor and which specific plant (or plants) each vendor should supply. In October 1986, Peters' immediate task was to determine November's coal-procurement schedule. BP&L had recently retained the services of a consulting firm to analyze aspects of its operations, including the coal-procurement process. Peters hoped to use the opportunity of the consultant's analysis to rethink the entire procurement process. He also hoped the report would shed some light on two related issues that had been a source of controversy within the department BP&L's Coal-Procurement Process Each month, vendors interested in supplying one or more of BP&L's coal-fired power plants completed an offer sheet specifying the amount of coal they had to sell along with its quality and price. Quality was expressed in terms of Btu/lb and moisture, ash, and sulfur content. Vendors were asked to quote a per ton price, transportation included, for each power plant they were willing and able to supply. The Production Fuels department took all offers, adjusted them for past performance (particularly the amount of coal available for purchase, which was often overstated and had to be adjusted downward), and summarized the results in a document called the offers edit report (Exhibit 1). At the same time, each of the three coal-fired power plants submitted its requirements for the upcoming month. Corporate policy dictated that a plant have sufficient Btu's on hand each month to satisfy 120% of expected demand. Exactly how many Btu's to order for the upcoming month depended on both the estimated ending inventory of coal in the current month (stated in terms of Btu's) and the expected demand during the upcoming month. Each plant also provided minimum acceptable quality standards for moisture, ash, and sulfur content. Each of those was stated in terms of a weighted average of all coal delivered to the plant in the month. For example, 1,000 tons of coal with 2% sulfur content and 500 tons of coal with 1% sulfur content would produce an overall 1.67% sulfur-content level; this number was not allowed to exceed the sulfur standard. The sulfur standards were set by law; moisture and ash standards were left to the discretion of the individual plant managers, who were familiar with the costs associated with handling the increased levels of moisture and ash at their respective plants. The Production Fuels Department was responsible for taking the offers edit report and the plant requirements, summarized in the plant requirements edit report (Exhibit 2). and arriving at an overall coal-procurement plan. Peters, as manager of the department, had the flexibility to negotiate with both vendors and plant managers to strike a better overall deal for the company. For example, he could negotiate price reductions and/or quantity increases with vendors. Similarly, he could make plant managers aware of particularly restrictive quality requirements and negotiate to have them relaxed Ultimately, Peters was responsible for approving the overall coal-procurement plan. Recently, the Production Fuels Department had been struggling with two issues related to the coal-procurement process: long-term contracts and safety-stock levels. Long-Term Contracts Because of a utility's need to have a guaranteed source of fuel, long-term contracts with coal vendors were a long-standing industry practice. A long-term contract with a vendor obligated the utility to buy a minimum amount of coal each month from that vendor at the contract-specified price. The balance of the utility's needs were met by purchasing additional coal on the spot market. Prior to 1973, BP&L had purchased approximately 65% of its coal on long-term contract. The energy crisis of the 1970s and resulting surge in demand for coal and coal prices had precipitated an upward trend in that figure. By 1986, BP&L was purchasing 80% of its coal on long-term contract (vendors in late 1986 with whom BP&L had long-term contracts and the contract amounts are indicated in Exhibit 1). BP&L in the 1970s had driven the company to raise its required safety-stock level from 15% to 20%. Since the safety stock had been increased, however, none of BP&L's plants had ever been forced to purchase outside energy. In fact, over the past three years, actual monthly energy demand had rarely exceeded 110% of expected demand. Some BP&L officials attributed this situation to improved forecasting techniques, while others thought it represented a leveling off of demand Whatever the reason, many at BP&L were now pushing to reduce the safety-stock level back to 15%. Peters recognized that such a reduction would save BP&L carrying costs on the coal needed to supply 5% of overall Btu demand. From October's coal-procurement numbers, Peters estimated that the average cost of a billion Btu's at each plant were as follows: Plant Steubenville Zanesville Athens Average cost of 1 billion Btu's $1,740 $1,610 $1,625 He wondered if those were the appropriate costs to use, and if so, how to balance the cost savings against the increased possibility of running out of coal. Exhibit Offers Edit Report for November Quantity Available (tons) Vendor Btu/Lb Moisture Ash Sulfur Plant $/Ton Willis Bros. MacMillan K. Bames Foster & Hughes 2,500 9,000 3,000 27,000 10,980 11,590 11,550 12,065 6.2% 6.0% 6.4% 6.1% 21% 1.2% 20% 0.9% 18% 1.1% 12% 1.0% Ath Ath Ath Stb Zan Ath Westem 22,500 12,210 6.2% 14% 0.9% Stb $30.80 $36.80 $34.00 $42.00 $41.60 $45.60 $43.92 $42.70 $41.48 $33.15 $32.00 $44.10 $45.36 $35.00 $33.12 $32.40 6,000 3,000 30,000 11,240 11,000 12,640 6.8% 6.3% 5.8% 18% 17% 10% 1.8% 2.2% 0.8% Zan Ath Stb Stb Stb Zan Zan Zan Zan Pellham McIntyre Monongahela Consolidated Pope Lyon Valley Crescent Rock 3,600 2,700 2,300 12,570 11,950 12,080 6.4% 6.8% 6.6% 10% 12% 13% 1.0% 0.9% 1.1% Long-Term Contracts: MacMillan (minimum of 8,000 tons) Foster & Hughes (minimum of 20,000 tons) Westem (minimum of 16,000 tons) Monongahela Consol. (minimum of 18,000 tons) Exhibit 2 Plant Requirements Edit Report for November Btu's (billions) Maximum Allowable Weighted Average Moisture Ash Sulfur Plant Steubenville Zanesville Athens 800 500 600 6.0% 7.0% 7.0% 15% 11% 18% 1.0% 2.0% 1.0%