Question: Write cleanly, please. > Let me learn more about it. Question 1 Suppose you are the General Manager of a medium-size building maintenance contractor. Your

Write cleanly, please. >

Let me learn more about it.

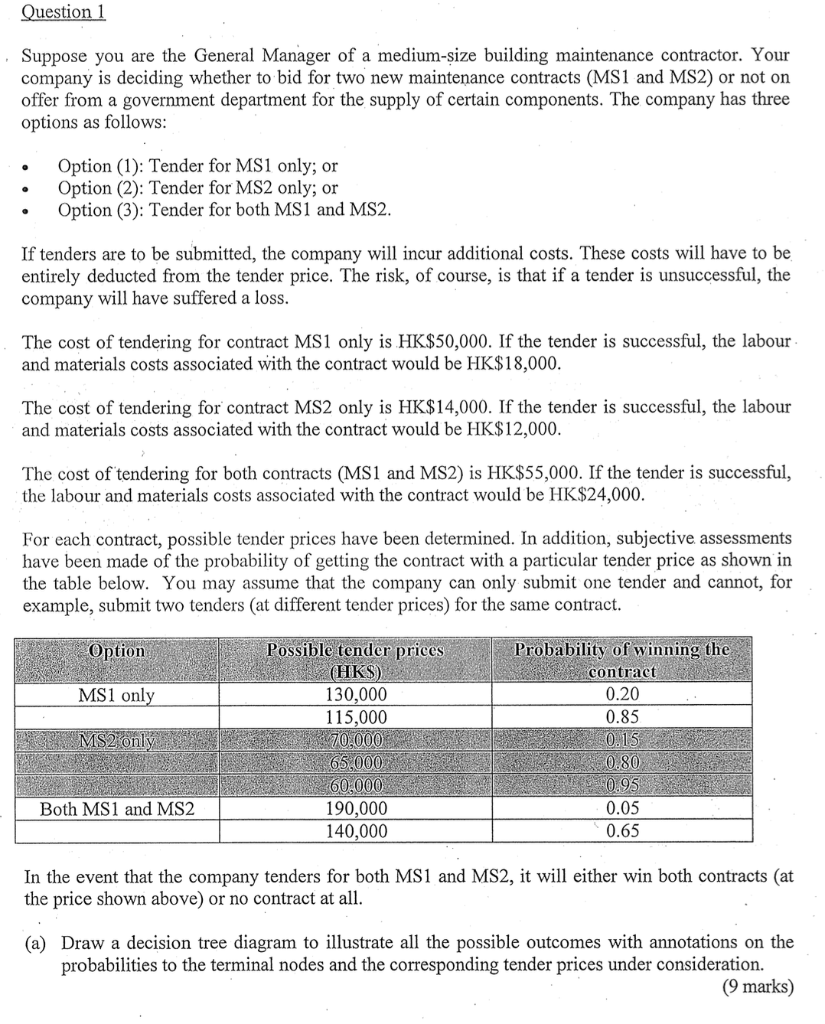

Question 1 Suppose you are the General Manager of a medium-size building maintenance contractor. Your company is deciding whether to bid for two new maintenance contracts (MS1 and MS2) or not on offer from a government department for the supply of certain components. The company has three options as follows: Option (1): Tender for MS1 only; or Option (2): Tender for MS2 only; or Option (3): Tender for both MS1 and MS2. If tenders are to be submitted, the company will incur additional costs. These costs will have to be entirely deducted from the tender price. The risk, of course, is that if a tender is unsuccessful, the company will have suffered a loss. The cost of tendering for contract MS1 only is HK$50,000. If the tender is successful, the labour and materials costs associated with the contract would be HK$18,000. The cost of tendering for contract MS2 only is HK$14,000. If the tender is successful, the labour and materials costs associated with the contract would be HK$12,000. The cost of tendering for both contracts (MS1 and MS2) is HK$55,000. If the tender is successful, the labour and materials costs associated with the contract would be HK$24,000. For each contract, possible tender prices have been determined. In addition, subjective assessments have been made of the probability of getting the contract with a particular tender price as shown in the table below. You may assume that the company can only submit one tender and cannot, for example, submit two tenders (at different tender prices) for the same contract. Option MS1 only MS2 only Possible tender prices (HK$) 130,000 115,000 70,000 65,000 60.000 190,000 140,000 Probability of winning the contract 0.20 0.85 0.15 0.80 0.95 0.05 0.65 Both MS1 and MS2 In the event that the company tenders for both MS1 and MS2, it will either win both contracts (at the price shown above) or no contract at all. (a) Draw a decision tree diagram to illustrate all the possible outcomes with annotations on the probabilities to the terminal nodes and the corresponding tender prices under consideration. (9 marks) (b) Calculate the total profit generated from each branch from the initial node to the terminal node in the decision tree diagram illustrated in (a). (14 marks) (c) Determine the Expected Monetary Value (EMV) of each decision node and advise the company of the best strategy that he should adopt. (8 marks) (d) What are the upside (profit) and the downside (loss) of your recommended strategy in (c)? (2 marks) Question 1 Suppose you are the General Manager of a medium-size building maintenance contractor. Your company is deciding whether to bid for two new maintenance contracts (MS1 and MS2) or not on offer from a government department for the supply of certain components. The company has three options as follows: Option (1): Tender for MS1 only; or Option (2): Tender for MS2 only; or Option (3): Tender for both MS1 and MS2. If tenders are to be submitted, the company will incur additional costs. These costs will have to be entirely deducted from the tender price. The risk, of course, is that if a tender is unsuccessful, the company will have suffered a loss. The cost of tendering for contract MS1 only is HK$50,000. If the tender is successful, the labour and materials costs associated with the contract would be HK$18,000. The cost of tendering for contract MS2 only is HK$14,000. If the tender is successful, the labour and materials costs associated with the contract would be HK$12,000. The cost of tendering for both contracts (MS1 and MS2) is HK$55,000. If the tender is successful, the labour and materials costs associated with the contract would be HK$24,000. For each contract, possible tender prices have been determined. In addition, subjective assessments have been made of the probability of getting the contract with a particular tender price as shown in the table below. You may assume that the company can only submit one tender and cannot, for example, submit two tenders (at different tender prices) for the same contract. Option MS1 only MS2 only Possible tender prices (HK$) 130,000 115,000 70,000 65,000 60.000 190,000 140,000 Probability of winning the contract 0.20 0.85 0.15 0.80 0.95 0.05 0.65 Both MS1 and MS2 In the event that the company tenders for both MS1 and MS2, it will either win both contracts (at the price shown above) or no contract at all. (a) Draw a decision tree diagram to illustrate all the possible outcomes with annotations on the probabilities to the terminal nodes and the corresponding tender prices under consideration. (9 marks) (b) Calculate the total profit generated from each branch from the initial node to the terminal node in the decision tree diagram illustrated in (a). (14 marks) (c) Determine the Expected Monetary Value (EMV) of each decision node and advise the company of the best strategy that he should adopt. (8 marks) (d) What are the upside (profit) and the downside (loss) of your recommended strategy in (c)? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts