Question: Write down steps leading to your answer so you can get partial credits. Only giving a one-number answer is not acceptable. Round your final answer

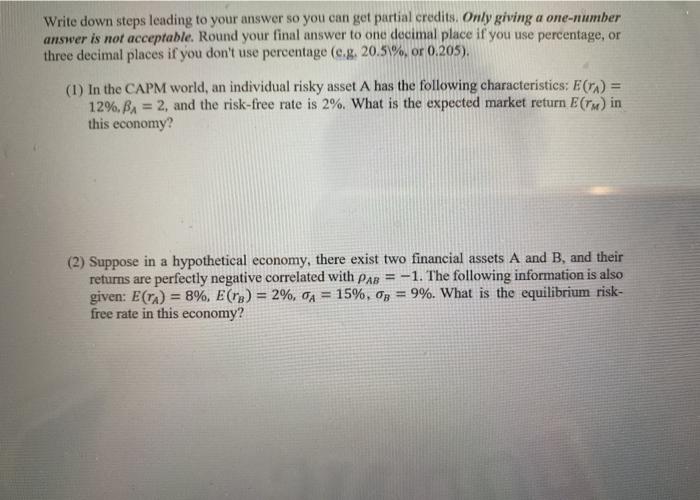

Write down steps leading to your answer so you can get partial credits. Only giving a one-number answer is not acceptable. Round your final answer to one decimal place if you use percentage, or three decimal places if you don't use percentage (0.8. 20.5%, or 0.205). (1) In the CAPM world, an individual risky asset A has the following characteristics: E(X) = 12%. BA = 2, and the risk-free rate is 2%. What is the expected market return E(TM) in this economy? (2) Suppose in a hypothetical economy, there exist two financial assets A and B, and their returns are perfectly negative correlated with PaB = -1. The following information is also given: E(A) = 8%, Ero) = 2%, 0 = 15%, 0g = 9%. What is the equilibrium risk- free rate in this economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts