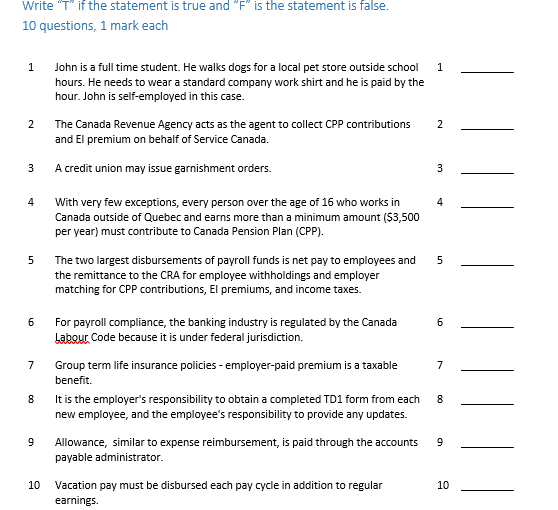

Question: Write T if the statement is true and F is the statement is false. 10 questions, 1 mark each 1 John is a full time

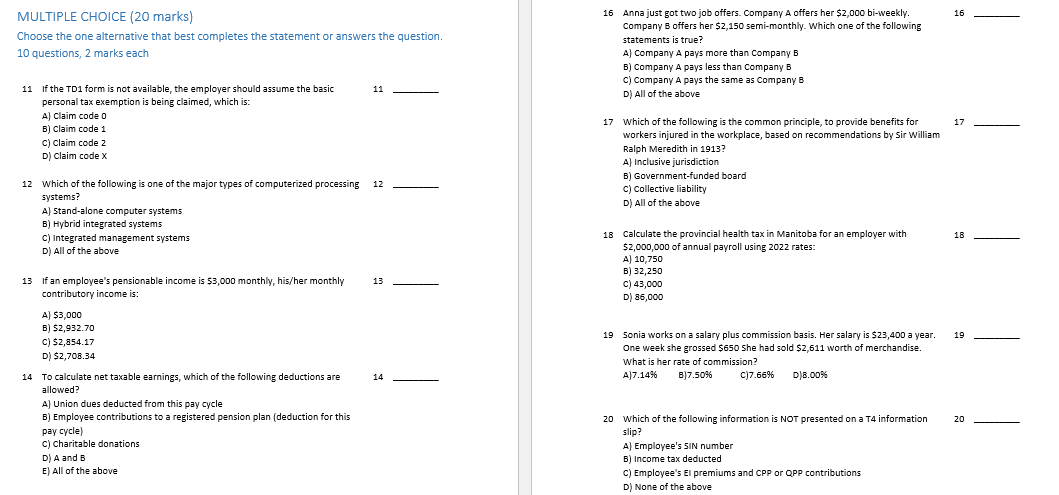

Write "T" if the statement is true and "F" is the statement is false. 10 questions, 1 mark each 1 John is a full time student. He walks dogs for a local pet store outside school 1 hours. He needs to wear a standard company work shirt and he is paid by the hour. John is self-employed in this case. The Canada Revenue Agency acts as the agent to collect CPP contributions 2 and El premium on behalf of Service Canada. 3 A credit union may issue garnishment orders. 4 With very few exceptions, every person over the age of 16 who works in 4 Canada outside of Quebec and earns more than a minimum amount ($3,500 per year) must contribute to Canada Pension Plan (CPP). 5 The two largest disbursements of payroll funds is net pay to employees and 5 the remittance to the CRA for employee withholdings and employer matching for CPP contributions, El premiums, and income taxes. 6 For payroll compliance, the banking industry is regulated by the Canada Labour Code because it is under federal jurisdiction. 7 Group term life insurance policies - employer-paid premium is a taxable benefit. 8 It is the employer's responsibility to obtain a completed TD1 form from each 8 new employee, and the employee's responsibility to provide any updates. 9 Allowance, similar to expense reimbursement, is paid through the accounts 9 payable administrator. 10 Vacation pay must be disbursed each pay cycle in addition to regular 10 earnings.MULTIPLE CHOICE (20 marks) 6 Anna just got two job offers. Company A offers her $2,000 bi-weekly. 16 Company B offers her $2,150 semi-monthly. Which one of the following Choose the one alternative that best completes the statement or answers the question. statements is true? 10 questions, 2 marks each A) Company A pays more than Company B B) Company A pays less than Company B C) Company A pays the same as Company B 11 If the TD1 form is not available, the employer should assume the basic 11 D) All of the above personal tax exemption is being claimed, which is: A} Claim code 0 17 which of the following is the common principle, to provide benefits for 17 B) Claim code 1 workers injured in the workplace, based on recommendations by Sir William c) claim code 2 Ralph Meredith in 1913? D) Claim code X A) Inclusive jurisdiction B) Government-funded board 12 Which of the following is one of the major types of computerized processing 12 c) collective liability systems? D) All of the above A} Stand-alone computer systems B) Hybrid integrated systems C) Integrated management systems 18 Calculate the provincial health tax in Manitoba for an employer with 18 D) All of the above $2,000,000 of annual payroll using 2022 rates: A} 10,750 B) 32,250 13 If an employee's pensionable income is $3,000 monthly, his/her monthly 13 C) 43,000 contributory income is: D) 86,000 4) $3,000 B) $2,932.70 Sonia works on a salary plus commission basis. Her salary is $23,400 a year. 19 C) $2,854.17 One week she grossed $650 She had sold $2,611 worth of merchandise. D) $2,708.34 What is her rate of commission? 14 To calculate net taxable earnings, which of the following deductions are 14 A)7.14%% B)7.50%% C)7.66% DJ8.00% allowed? A) Union dues deducted from this pay cycle B) Employee contributions to a registered pension plan (deduction for this 20 which of the following information is NOT presented on a T4 information 20 pay cycle) slip? c) charitable donations A) Employee's SIN number D) A and B B) Income tax deducted EJ All of the above C) Employee's El premiums and CPP or OPP contributions D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts