Question: company 3. Purchase of materials from a trading company for the production of cigarettes with VAT-exclusive price: VND 500 million. 4. Other information: -

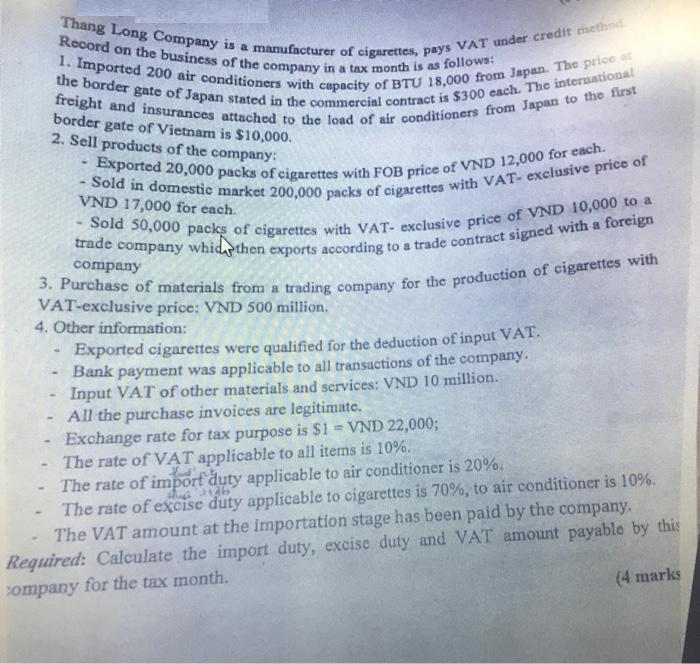

company 3. Purchase of materials from a trading company for the production of cigarettes with VAT-exclusive price: VND 500 million. 4. Other information: - Record on the business of the company in a tax month is as follows: Thang Long Company is a manufacturer of cigarettes, pays VAT under credit method the border gate of Japan stated in the commercial contract is $300 each. The international 1. Imported 200 air conditioners with capacity of BTU 18,000 from Japan. The price at freight and insurances attached to the load of air conditioners from Japan to the first border gate of Vietnam is $10,000. 2. Sell products of the company: - Sold in domestic market 200,000 packs of cigarettes with VAT- exclusive price of Exported 20,000 packs of cigarettes with FOB price of VND 12,000 for each. VND 17,000 for each. Sold 50,000 packs of cigarettes with VAT- exclusive price of VND 10,000 to a trade company whid then exports according to a trade contract signed with a foreign - - Exported cigarettes were qualified for the deduction of input VAT. Bank payment was applicable to all transactions of the company. Input VAT of other materials and services: VND 10 million. All the purchase invoices are legitimate. Exchange rate for tax purpose is $1= VND 22,000; The rate of VAT applicable to all items is 10%. The rate of import duty applicable to air conditioner is 20%. The rate of excise duty applicable to cigarettes is 70%, to air conditioner is 10%. The VAT amount at the importation stage has been paid by the company. Required: Calculate the import duty, excise duty and VAT amount payable by this company for the tax month. (4 marks

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts