Question: Write three complex sentences in which you accurately paraphrase something relevant and significant from your sources, and include an in - text citation Question 2

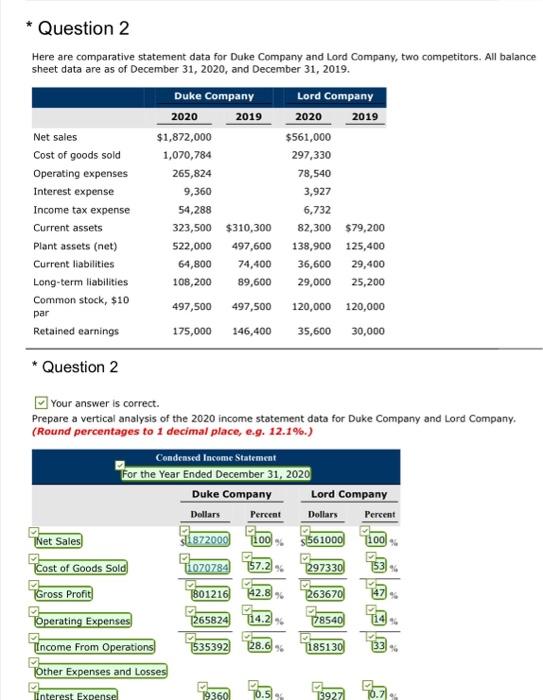

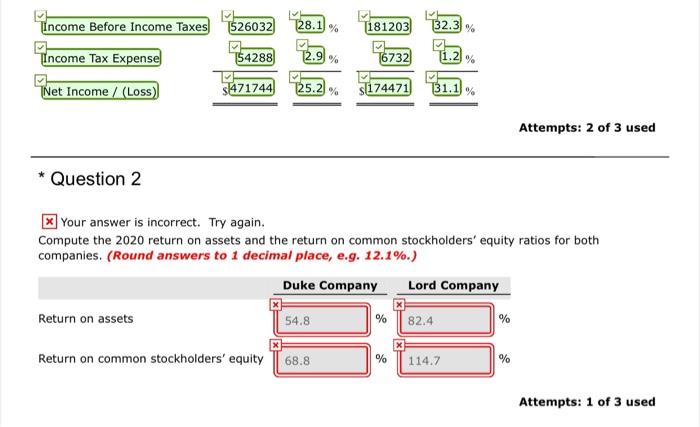

Question 2 Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019. Duke Company Lord Company 2020 2019 2020 2019 Net sales $1,872,000 $561,000 Cost of goods sold 1,070,784 297,330 Operating expenses 265,824 78,540 Interest expense 9,360 3,927 Income tax expense 54,288 6,732 Current assets 323,500 $310,300 82,300 $79,200 Plant assets (net) 522,000 497,600 138,900 125,400 Current liabilities 64,800 74,400 36,600 29,400 Long-term liabilities 108,200 89,600 29,000 25,200 Common stock, $10 497,500 497,500 120,000 120,000 Retained earnings 175,000 146,400 35,600 30,000 par * Question 2 your answer is correct Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company (Round percentages to 1 decimal place, e.g. 12.1%.) Condensed Income Statement For the Year Ended December 31, 2020 Duke Company Lord Company Dollars Percent Net Sales 51872000 561000 Cost of Goods Sold Glo70789 297330 Gross Profit 1801216) 263670 Dollars Percent lool 1100 157.21 42.8% Operating Expenses 1265824 114.2 78540 Income From Operations 535392 128.6 1185130 33 Other Expenses and Losses 9236095 Interest Expensel 193601 po Income Before Income Taxes 526032 128.1 % 181203 32.31% Income Tax Expense 54288 12.9% 16732 1.21 % $1471744 125.2% Net Income / (Loss) ST174471 31.1 % Attempts: 2 of 3 used * * Question 2 >> Your answer is incorrect. Try again. Compute the 2020 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, e.g. 12.1%.) Duke Company Lord Company Return on assets 54.8 % 82.4 % Return on common stockholders' equity 68.8 % 114.7 % Attempts: 1 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts