Question: Writing, using software, and interpreting results is a large part of your learning experience. These assignments are designed to improve your use of technology

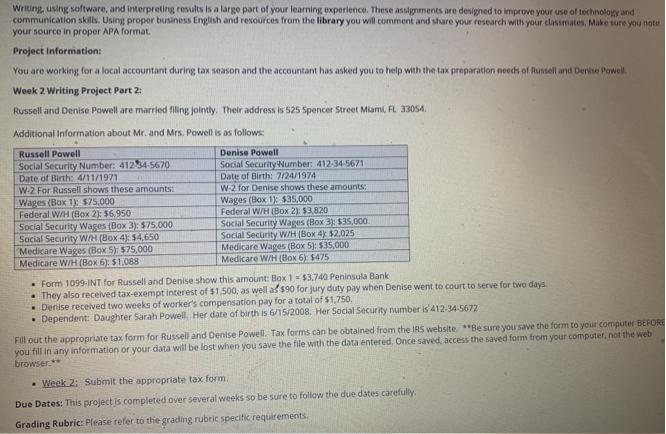

Writing, using software, and interpreting results is a large part of your learning experience. These assignments are designed to improve your use of technology and communication skills. Using proper business English and resources from the library you will comment and share your research with your classmates, Make sure you note your source in proper APA format. Project Information: You are working for a local accountant during tax season and the accountant has asked you to help with the tax preparation needs of Russell and Denise Powell. Week 2 Writing Project Part 2: Russell and Denise Powell are married filling jointly. Their address is 525 Spencer Street Miami, FL 33054. Additional Information about Mr. and Mrs. Powell is as follows: Russell Powell Social Security Number: 41234-5670 Date of Birth: 4/11/1971 W-2 For Russell shows these amounts: Wages (Box 1): $75,000 Federal W/H (Box 2): $6,950 Social Security Wages (Box 3): $75,000 Social Security W/H (Box 4): $4,650 Medicare Wages (Box S): $75,000 Medicare W/H (Box 6): $1,088 Denise Powell Social Security Number: 412-34-5671 Date of Birth: 7/24/1974) W-2 for Denise shows these amounts: Wages (Box 1): $35,000 Federal W/H (Box 2): $3,820 Social Security Wages (Box 3): $35,000 Social Security W/H (Box 4): $2,025 Medicare Wages (Box 5): $35,000 Medicare W/H (Box 6): 1475 Form 1099-INT for Russell and Denise show this amount: Box 1- $3,740 Peninsula Bank They also received tax-exempt interest of $1,500, as well as $90 for jury duty pay when Denise went to court to serve for two days. Denise received two weeks of worker's compensation pay for a total of $1,750. Dependent: Daughter Sarah Powell, Her date of birth is 6/15/2008. Her Social Security number is 412-34-5672 Fill out the appropriate tax form for Russell and Denise Powell. Tax forms can be obtained from the IRS website. Be sure you save the form to your computer BEFORE you fill in any information or your data will be lost when you save the file with the data entered. Once saved, access the saved form from your computer, not the web browser.** Week 2: Submit the appropriate tax form. Due Dates: This project is completed over several weeks so be sure to follow the due dates carefully. Grading Rubric: Please refer to the grading rubric specific requirements.

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Subject Tax Preparation for Russell and Denise Powell Dear Accountants Name I hope this message find... View full answer

Get step-by-step solutions from verified subject matter experts