Question: W&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. Further, only

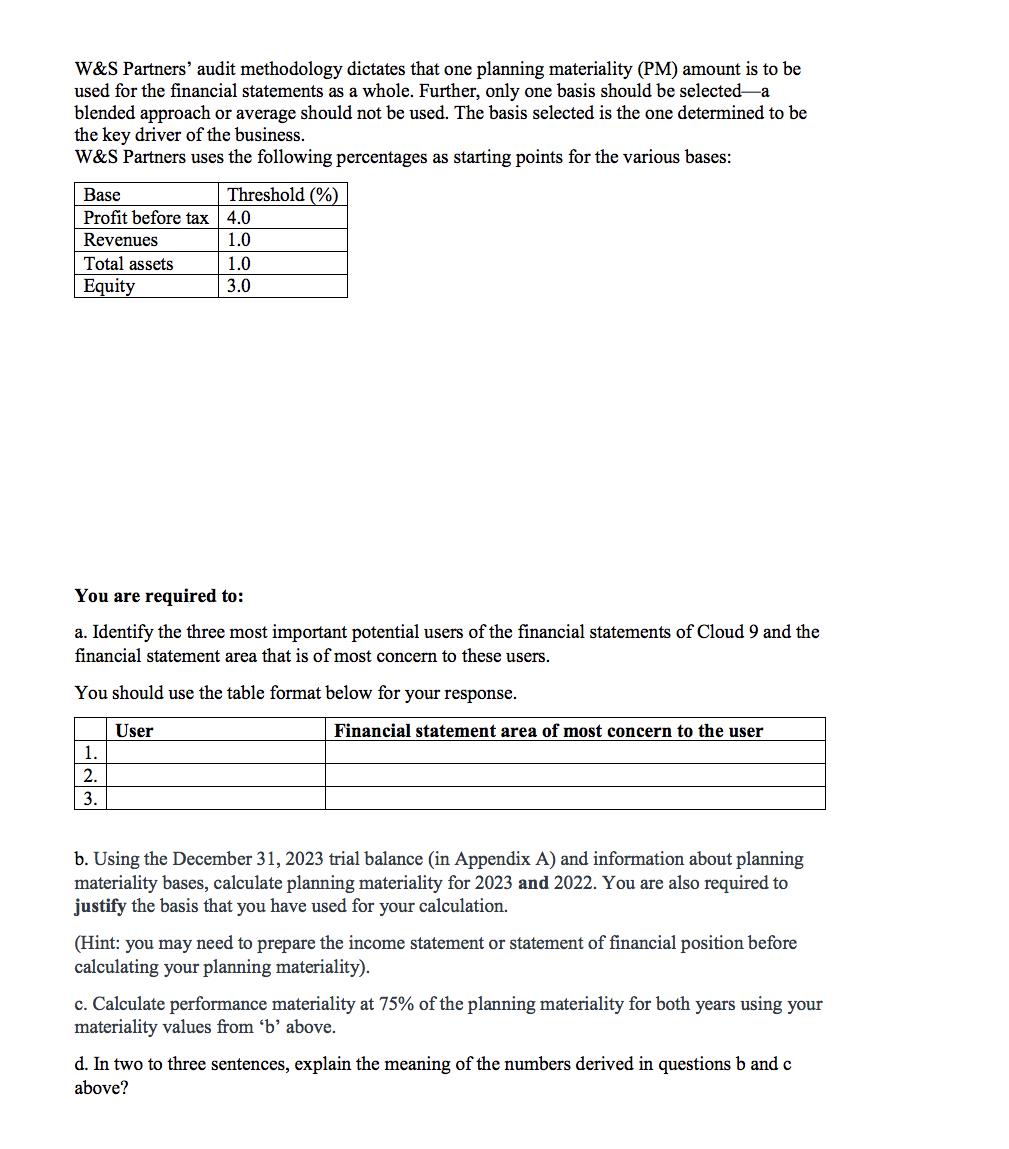

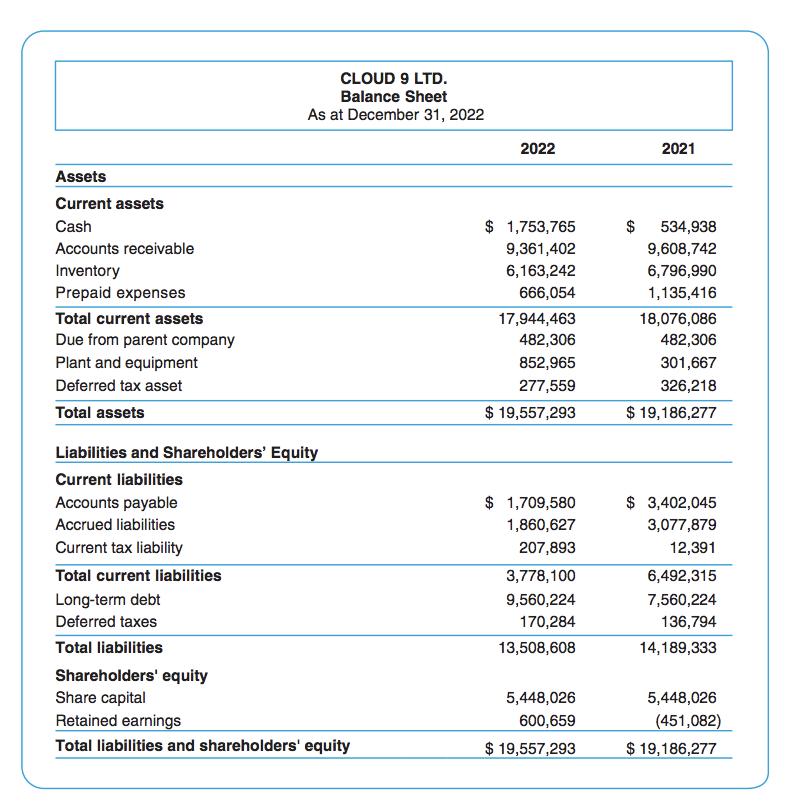

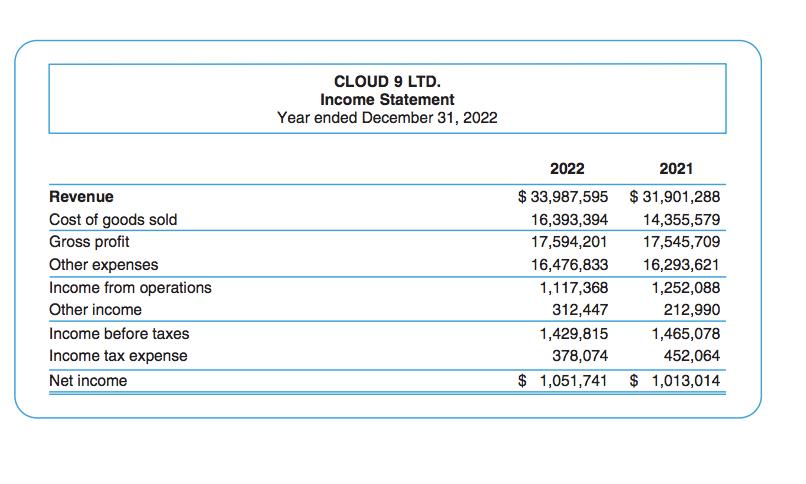

W&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. Further, only one basis should be selected-a blended approach or average should not be used. The basis selected is the one determined to be the key driver of the business. W&S Partners uses the following percentages as starting points for the various bases: Base Profit before tax 4.0 Revenues 1.0 Total assets Equity Threshold (%) 1. 2. 3. 1.0 3.0 You are required to: a. Identify the three most important potential users of the financial statements of Cloud 9 and the financial statement area that is of most concern to these users. You should use the table format below for your response. User Financial statement area of most concern to the user b. Using the December 31, 2023 trial balance (in Appendix A) and information about planning materiality bases, calculate planning materiality for 2023 and 2022. You are also required to justify the basis that you have used for your calculation. (Hint: you may need to prepare the income statement or statement of financial position before calculating your planning materiality). c. Calculate performance materiality at 75% of the planning materiality for both years using your materiality values from 'b' above. d. In two to three sentences, explain the meaning of the numbers derived in questions b and c above? Assets Current assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Due from parent company Plant and equipment Deferred tax asset Total assets CLOUD 9 LTD. Balance Sheet As at December 31, 2022 Liabilities and Shareholders' Equity Current liabilities Accounts payable Accrued liabilities Current tax liability Total current liabilities Long-term debt Deferred taxes Total liabilities Shareholders' equity Share capital Retained earnings Total liabilities and shareholders' equity 2022 $ 1,753,765 9,361,402 6,163,242 666,054 17,944,463 482,306 852,965 277,559 $ 19,557,293 $ 1,709,580 1,860,627 207,893 3,778,100 9,560,224 170,284 13,508,608 5,448,026 600,659 $19,557,293 2021 $ 534,938 9,608,742 6,796,990 1,135,416 18,076,086 482,306 301,667 326,218 $ 19,186,277 $3,402,045 3,077,879 12,391 6,492,315 7,560,224 136,794 14,189,333 5,448,026 (451,082) $ 19,186,277 Revenue Cost of goods sold Gross profit Other expenses Income from operations Other income Income before taxes Income tax expense Net income CLOUD 9 LTD. Income Statement Year ended December 31, 2022 2022 2021 $33,987,595 $ 31,901,288 16,393,394 14,355,579 17,594,201 17,545,709 16,476,833 16,293,621 1,117,368 1,252,088 312,447 212,990 1,465,078 452,064 $ 1,013,014 1,429,815 378,074 $ 1,051,741

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

1 Cloud 9s primary stakeholders are its shareholders The financial statement area of most concern to them would be the companys profitability as measured by its net income 2 Cloud 9s creditors are als... View full answer

Get step-by-step solutions from verified subject matter experts