Question: Www Pacifica Papers Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 15% common share dividend on

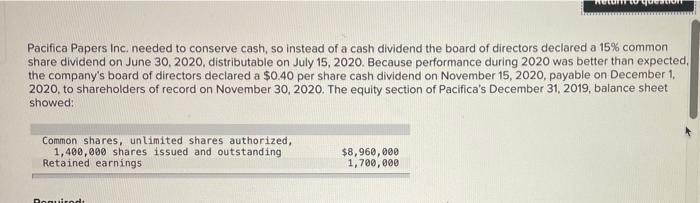

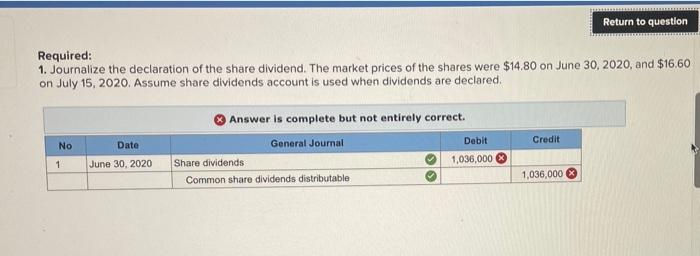

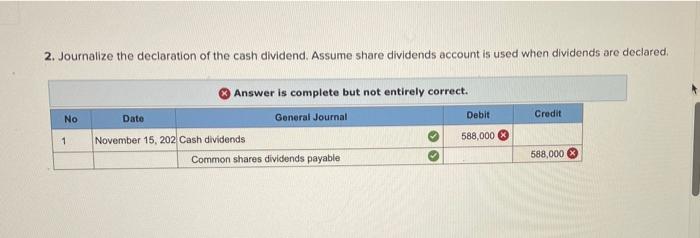

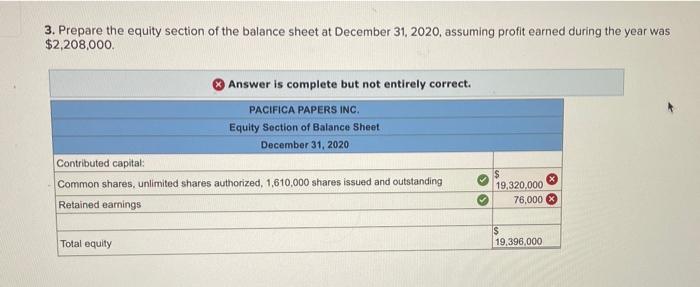

Www Pacifica Papers Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 15% common share dividend on June 30, 2020, distributable on July 15, 2020. Because performance during 2020 was better than expected, the company's board of directors declared a $0.40 per share cash dividend on November 15, 2020, payable on December 1. 2020. to shareholders of record on November 30, 2020. The equity section of Pacifica's December 31, 2019, balance sheet showed: Common shares, unlimited shares authorized, 1,400,000 shares issued and outstanding Retained earnings $8,960,000 1,700,000 Dod Return to question Required: 1. Journalize the declaration of the share dividend. The market prices of the shares were $14,80 on June 30, 2020, and $16.60 on July 15, 2020. Assume share dividends account is used when dividends are declared. Credit No Date June 30, 2020 Answer is complete but not entirely correct. General Journal Debit Share dividends 1,036,000 Common share dividends distributable 1 1,036,000 2. Journalize the declaration of the cash dividend. Assume share dividends account is used when dividends are declared. No Credit Answer is complete but not entirely correct. Date General Journal Debit November 15, 202 Cash dividends 588,000 Common shares dividends payable 1 588,000 3. Prepare the equity section of the balance sheet at December 31, 2020, assuming profit earned during the year was $2,208,000 Answer is complete but not entirely correct. PACIFICA PAPERS INC Equity Section of Balance Sheet December 31, 2020 Contributed capital Common shares, unlimited shares authorized, 1,610,000 shares issued and outstanding Retained earnings $ 19,320,000 76,000 s 19.396,000 Total equity

Step by Step Solution

There are 3 Steps involved in it

To address the required tasks correctly lets go step by step 1 Journalize the Declaration of the Sha... View full answer

Get step-by-step solutions from verified subject matter experts