Question: WX)Eice Se in Share Comment insert Formas View Page Layout Home 29 Wrap Tet Genel X I - Ard 10 - A A a-A- Delete

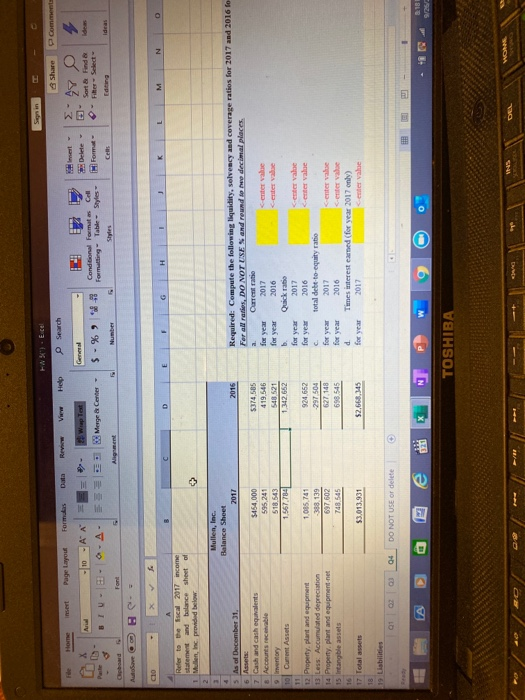

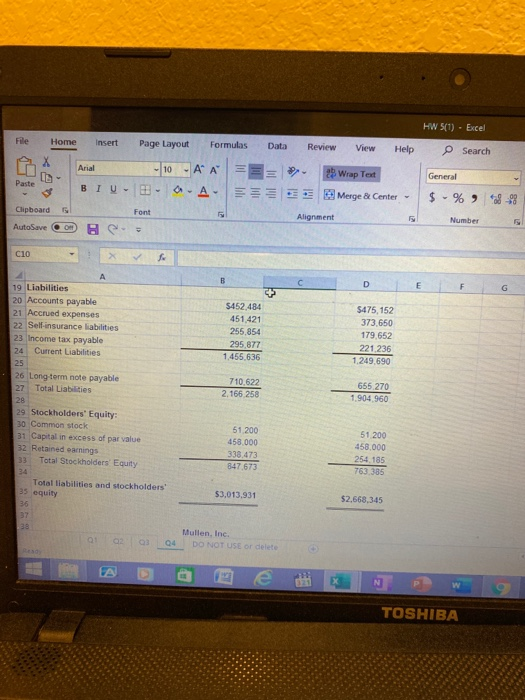

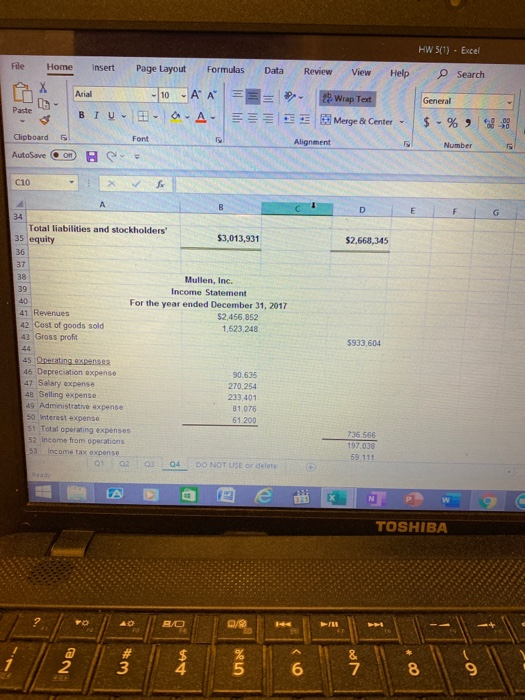

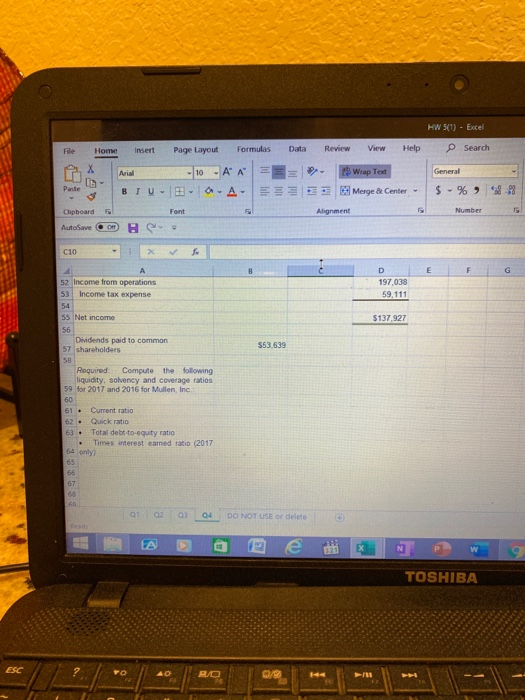

WX)Eice Se in Share Comment insert Formas View Page Layout Home 29 Wrap Tet Genel X I - Ard 10 - A A a-A- Delete - Format F Merge Center - Conditional Formatas Formatting Table Styles $ - % -13 Filter Select Number Chipboard Font Alignment Autore C10 L H M G N A Refer to the fiscal 2017 income statement and balance sheet of Mullen, Inc. provided below. Mullen, Inc. Balance Sheet 2017 2015 5 As of December 31 Assets 7 Cash and cash equivalents & Accounts receivable ventory 10 Current Assets $454,000 595 241 518,543 1.567.741 $374,585 419,546 548 521 1.342652 for year for year Required: Compute the following liquidity, solvency and coverage ratios for 2017 and 2016 fo For all rates, DO NOT USE S and round to be decimal places. a. Current ratio for year 2017 Center value 2016 Center vale b. Quick ratio 2017 Center value for year 2016 Center value C total debt-to-equity ratio 2017 Center vale 2016 Center value d. Times interest earned (for year 2017 only) 2017 enter value 12 Property, plant and equipment 13 Less: Accumulated depreciation 14 Property, plant and equipment net 15 Intangible assets 1085741 388.139 697 602 748.545 924.652 297 504 627 148 698.545 for year $3.013,931 $2,668,345 17 Total assets 18 19 Liabilities 01 04 DO NOT USE or delete A EW e TOSHIBA & #9 HW 5(1) - Excel File Home Insert Page Layout Formulas Data Review View Help O Search Arial 25 Wrap Text 10 - A A 33 - O-A- General Paste BIU Merge & Center $ - % 8-98 Clipboard Font Alignment Number AutoSave OH C10 B D E G $452,484 451,421 255 854 295 877 1,455,636 $475,152 373,650 179,652 221.236 1.249.690 A 19 Liabilities 20 Accounts payable 21 Accrued expenses 22 Self-insurance liabilities 23 Income tax payable 24 Current Liabilities 25 26 Long term note payable 27 Total Liabilities 28 29 Stockholders' Equity: 30 Common stock 31 Capital in excess of par value 32 Retained earnings 33 Total Stockholders' Equity 34 Total liabilities and stockholders 710.622 2,166 258 655 270 1.904.960 61,200 458.000 338.473 847 673 51 200 458.000 254 185 763 385 35 equity $3.013.931 $2,668,345 36 Mullen, Inc. DO NOT USE or delete A e TOSHIBA HW 5(1) - Excel File Home Insert Page Layout Formulas Data Review View Help O Search X Arial 10 - A A 2 Wrap Text General Paste BIU a A- Merge & Center - $ - % -58 Clipboard Font Alignment Number AutoSave Om C10 x 4 D F G $2,668,345 A B 34 Total liabilities and stockholders 35 equity $3,013,931 36 37 38 Mullen, Inc. 39 Income Statement 40 For the year ended December 31, 2017 41 Revenues $2,456,852 42 Cost of goods sold 1,523.248 43 Gross profit 44 45 Operating expenses 45 Depreciation expense 90.635 47 Salary expense 270,254 48 Selling expense 233401 49 Administrative expense 81,076 50 Interest expense 61 200 51 Total operating expenses 52 Income from operations 53 Income tax expense 01 02 04 DO NOT USE or delete $933 604 735 566 197038 59 111 A a 13 e X TOSHIBA FO 40 B/O - a 2 w* $ Unde 6 oon 8 9 HW 5(1) - Excel File Home Insert Page Layout Formulas Data Review View Help Search Arial 10-A A 2 General 23 Wrap Text Merge & Center - Paste BIU A- $ - % *888 Font Alignment Number Clipboard AutoSave On C10 fo E F G D 197 038 59,111 $137 927 553.639 A 52 Income from operations 53 Income tax expense 54 55 Net income 56 Dividends paid to common 57 shareholders 58 Required Compute the following liquidity, solvency and coverage ratios 59 for 2017 and 2016 for Mullen, Inc 60 61 - Current ratio 62 Quick ratio 63 . Total debt-to-equity ratio Times interest eamed ratio (2017 65 66 67 o 02 03 04 DO NOT USE or delete Resu A a TOSHIBA ESC 40 RO C/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts