Question: X Bad Autosum - AY Goud EX 7 - Vik Agrawal M Fill- Sort & Find & Clear Filter Select Editing Calculation Check Cell 5.

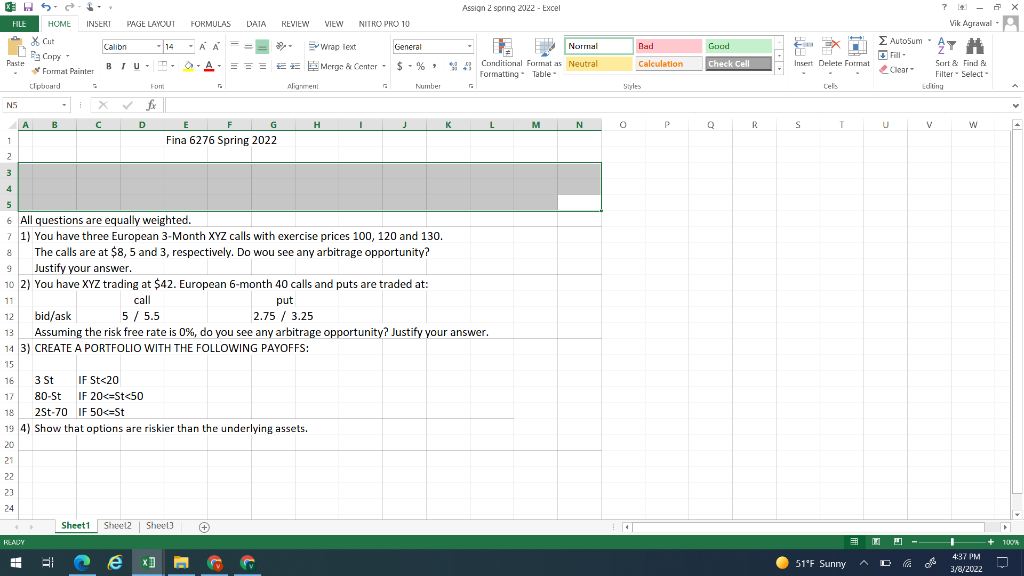

X Bad Autosum - AY Goud EX 7 - Vik Agrawal M Fill- Sort & Find & Clear Filter Select Editing Calculation Check Cell 5. Assign 2 spring 2022 - Excel FILE HOME INSERI PAGE LAYOUT FORMULAS DATA REVIEW VIEW NITRO PRO 10 * Cut Calibn - 14 - -AA 9- Wrap Text General Normal Fa Copy Paste BTU O-A- Format Painter === EE Merge & Center - $ % & Conditional Format as Neutral - Formatting Table clipboard Font Alignment Number NS i fx B D E F G H 1 K L M N 1 Fina 6276 Spring 2022 2 Insert Delete Format - Styles Cels A 0 P Q R S T U V w All questions are equally weighted. 1) You have three European 3-Month XYZ calls with exercise prices 100, 120 and 130. 8 The calls are at $8,5 and 3, respectively. Do wou see any arbitrage opportunity? 9 Justify your answer. 2) You have XYZ trading at $42. European 6-month 40 calls and puts are traded at: 11 call put bid/ask 5 / 5.5 2.75 / 3.25 13 Assuming the risk free rate is 0%, do you see any arbitrage opportunity? Justify your answer. 14 3) CREATE A PORTFOLIO WITH THE FOLLOWING PAYOFFS: : 12 15 16 17 18 3 St IF St

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts