Question: x Comments AutoSave Off H U B : Chapter 10 Homework A johnsonedddie@gmail.com File Home Insert Draw Design Layout References Mailings Review View Help Search

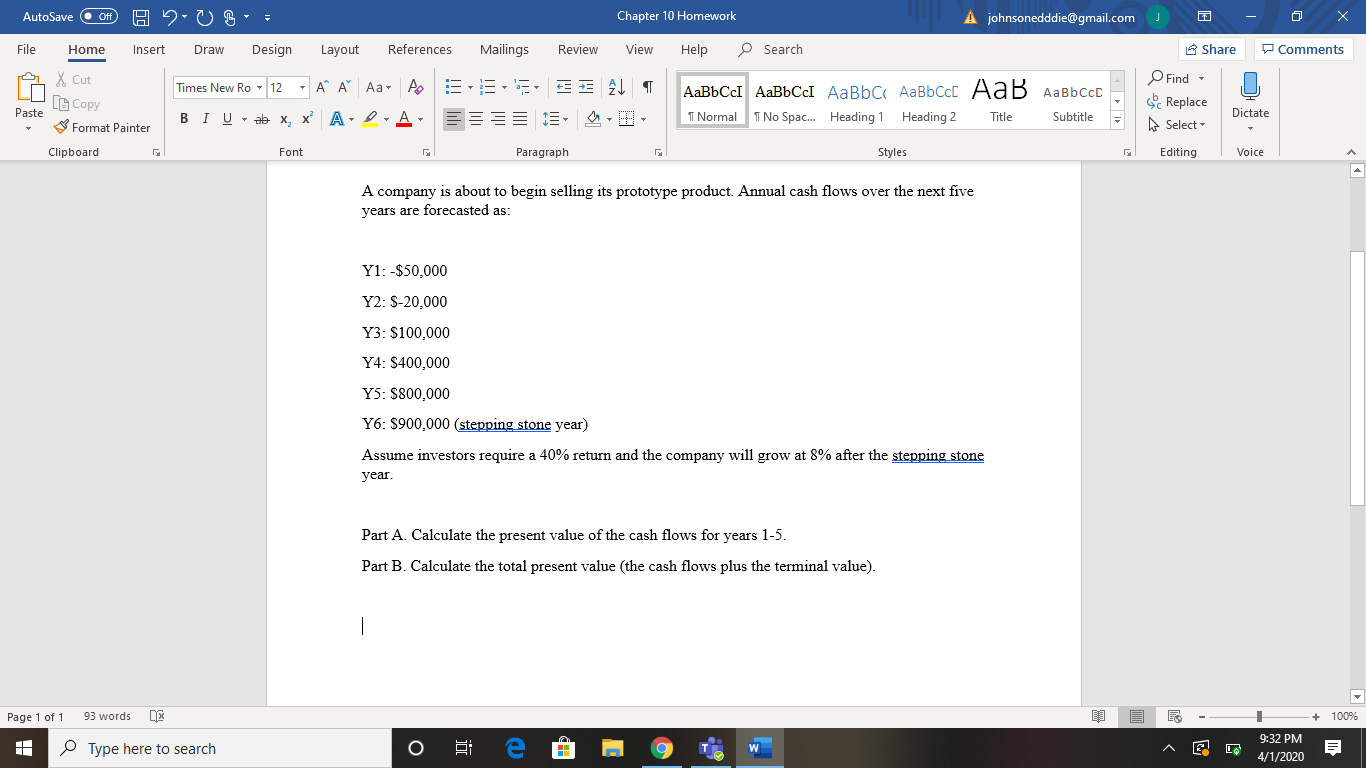

x Comments AutoSave Off H U B : Chapter 10 Homework A johnsonedddie@gmail.com File Home Insert Draw Design Layout References Mailings Review View Help Search X Cut Times New Ro - 12 - A A Aa A 5,5, E AL LE Copy Paste | B I J ae x, x 4 - 0 A = = = = = Format Painter 1 Normal 2 , . . 1 No Spac... Heading 1 Heading 2 Title Subtitle Clipboard Font Paragraph Styles - Share Find - Sc Replace Dictate h Select Editing Voice A company is about to begin selling its prototype product. Annual cash flows over the next five years are forecasted as: Y1:-$50.000 Y2: S-20,000 Y3: $100,000 Y4: $400,000 Y5: $800,000 Y6: $900,000 (stepping stone year) Assume investors require a 40% return and the company will grow at 8% after the stepping stone year. Part A. Calculate the present value of the cash flows for years 1-5. Part B. Calculate the total present value (the cash flows plus the terminal value). Page 1 of 1 93 words DX 9:32 PM 1 Type here to search o Bi e 9 E 4/1/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts