Question: x Comparison of Capital Budgeting Methods - Excel ? + - 1 FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri -

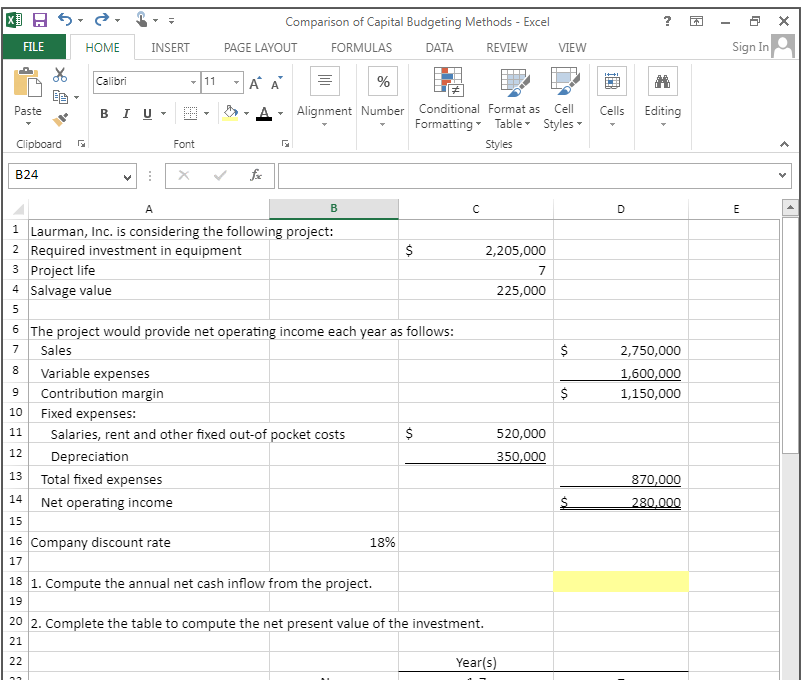

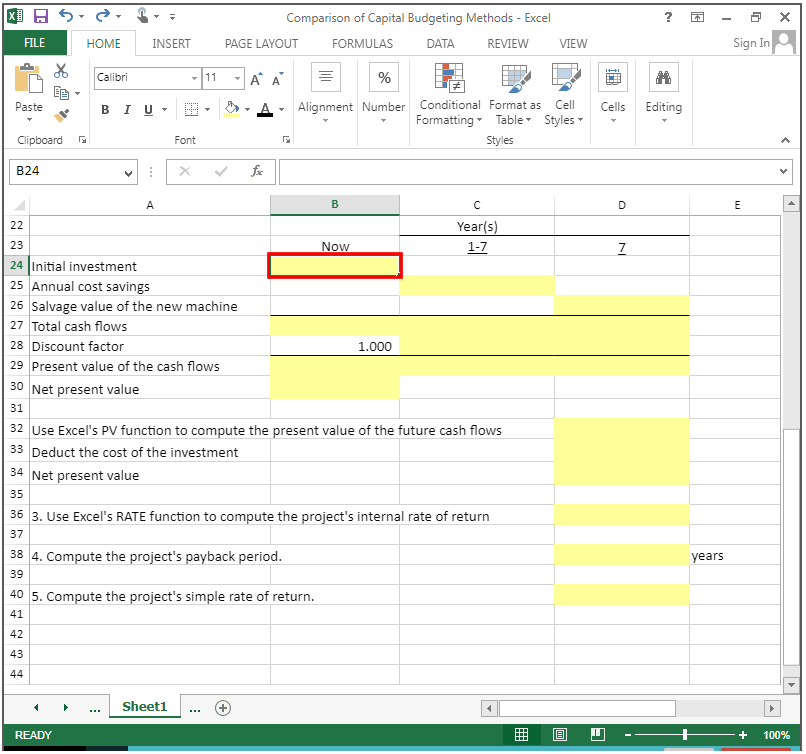

x Comparison of Capital Budgeting Methods - Excel ? + - 1 FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri - 11 DEL Paste BIU T T % Alignment Number Conditional Format as Cell Formatting Table Styles Styles Cells Editing Clipboard 2 Font B24 fo B D E $ $ 1 Laurman, Inc. is considering the following project: 2 Required investment in equipment 3 Project life 4 Salvage value 2,205,000 7 225,000 5 $ $ 8 2,750,000 1,600,000 1,150,000 $ 10 6 The project would provide net operating income each year as follows: 7 Sales Variable expenses 9 Contribution margin Fixed expenses: Salaries, rent and other fixed out-of pocket costs Depreciation 13 Total fixed expenses Net operating income 11 $ 520,000 350,000 12 870,000 280.000 14 15 16 Company discount rate 18% 17 18 1. Compute the annual net cash inflow from the project. 19 20 2. Complete the table to compute the net present value of the investment. 21 22 Year(s) XU H5 le - o x 1 Comparison of Capital Budgeting Methods - Excel PAGE LAYOUT FORMULAS DATA REVIEW FILE HOME INSERT VIEW Sign In Calibri 11 P Paste % Alignment Number Conditional Format as Cell Formatting Table Styles Styles Cells Editing Clipboard 2 Font

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts