Question: X D21 McGraw Hill Connect X Question 2 - Week Six Quiz - Cor X G In 2018, Jerry acquired an interes x * Homework

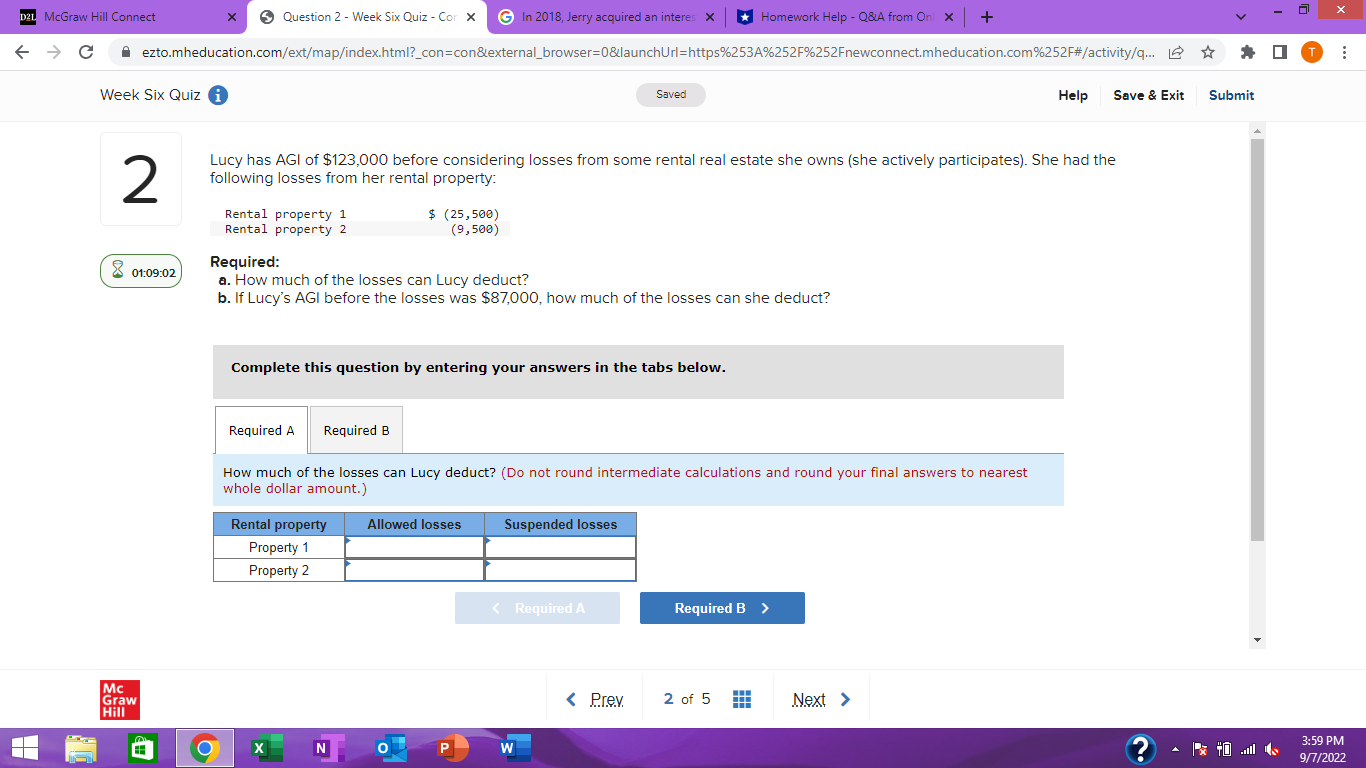

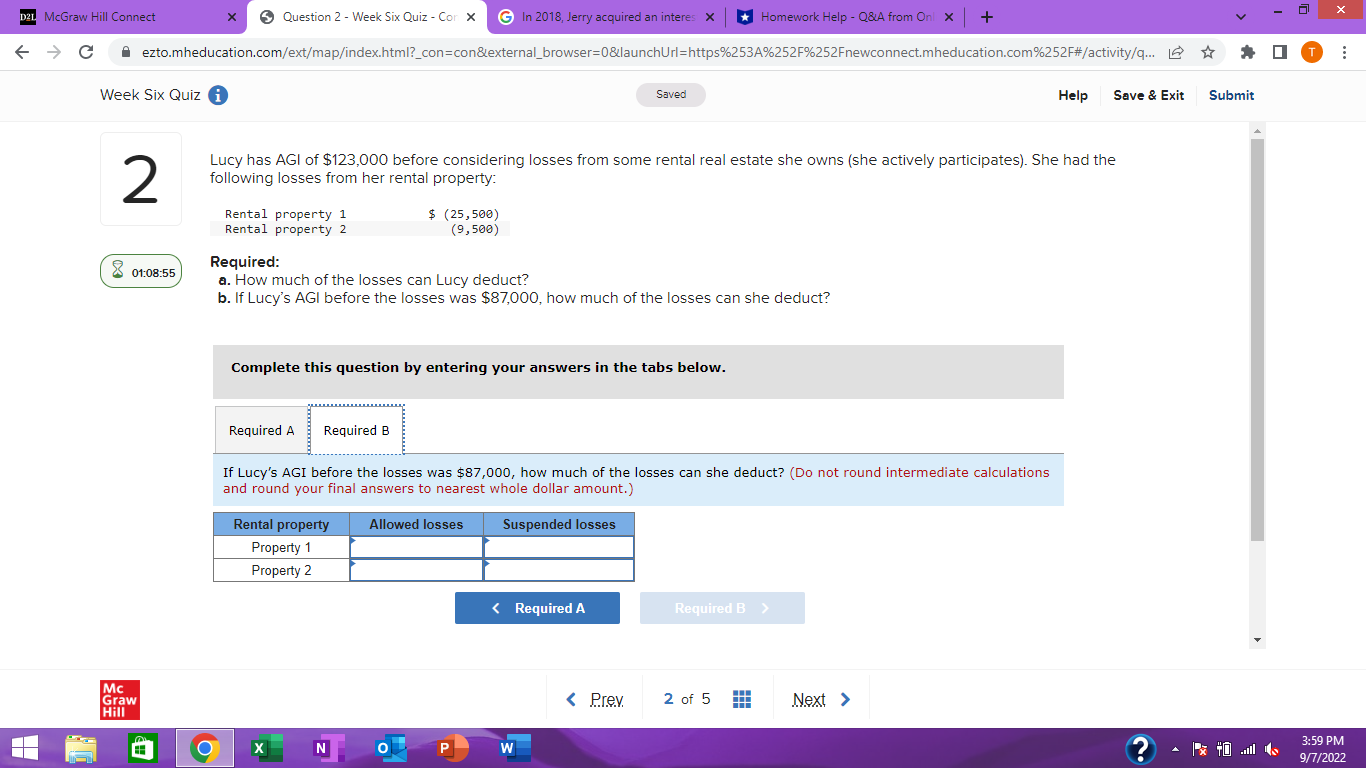

X D21 McGraw Hill Connect X Question 2 - Week Six Quiz - Cor X G In 2018, Jerry acquired an interes x * Homework Help - Q&A from Onl x + C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... _ * # T Week Six Quiz i Saved Help Save & Exit Submit 2 Lucy has AGI of $123,000 before considering losses from some rental real estate she owns (she actively participates). She had the following losses from her rental property: Rental property 1 $ (25, 500) Rental property 2 (9,500) Required: X 01:09:02 a. How much of the losses can Lucy deduct? b. If Lucy's AGI before the losses was $87,000, how much of the losses can she deduct? Complete this question by entering your answers in the tabs below. Required A Required B How much of the losses can Lucy deduct? (Do not round intermediate calculations and round your final answers to nearest whole dollar amount.) Rental property Allowed losses Suspended losses Property 1 Property 2 Mc Graw Hill 3:59 PM X N P W 9/7/2022D21 McGraw Hill Connect X G In 2018, Jerry acquired an interes x * Homework Help - Q&A from Onl x + X Question 2 - Week Six Quiz - Cor X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... _ * # T Week Six Quiz i Saved Help Save & Exit Submit 2 Lucy has AGI of $123,000 before considering losses from some rental real estate she owns (she actively participates). She had the following losses from her rental property: Rental property 1 $ (25, 500) Rental property 2 (9,500) X 01:08:55 Required: a. How much of the losses can Lucy deduct? b. If Lucy's AGI before the losses was $87,000, how much of the losses can she deduct? Complete this question by entering your answers in the tabs below. Required A Required B If Lucy's AGI before the losses was $87,000, how much of the losses can she deduct? (Do not round intermediate calculations and round your final answers to nearest whole dollar amount.) Rental property Allowed losses Suspended losses Property 1 Property 2 Mc Graw Hill 3:59 PM X N P W 9/7/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts