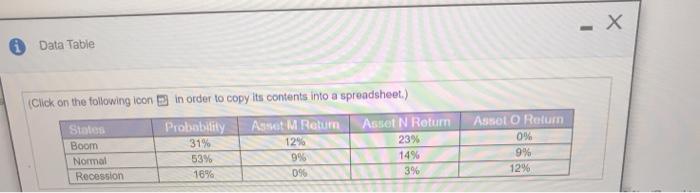

Question: - X Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) States Boom Normal Recession Probability 31% 53%

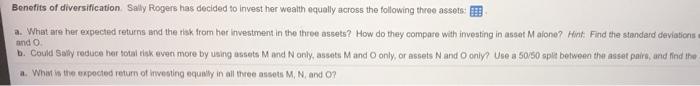

- X Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) States Boom Normal Recession Probability 31% 53% 16% Asset M Return 12% 9% 096 Ass N Return 23% 14% 3% ASSOIO Return 0% 9% 12% Benefits of diversification Sally Rogers has decided to invest her wealth equally across the following three assets: a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset Malono? Hint Find the standard deviations and o b. Could Sally reduce her totalisk even more by using assets and Nonly, assets M and only, or assets and only? Use a 50/50 split between the asset pairs, and find the a. What is the expected return of investing equally in all three M, N and O? e following three assets: w do they compare with investing in asset Malone? Hint: Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, only, or uses and only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts