Question: X Ltd . ( X ) purchased 4 0 % of Y Ltd . ( Y ) on January 1 , 2 0 2 2

X LtdX purchased of Y LtdY on January for $ Y paid dividends of

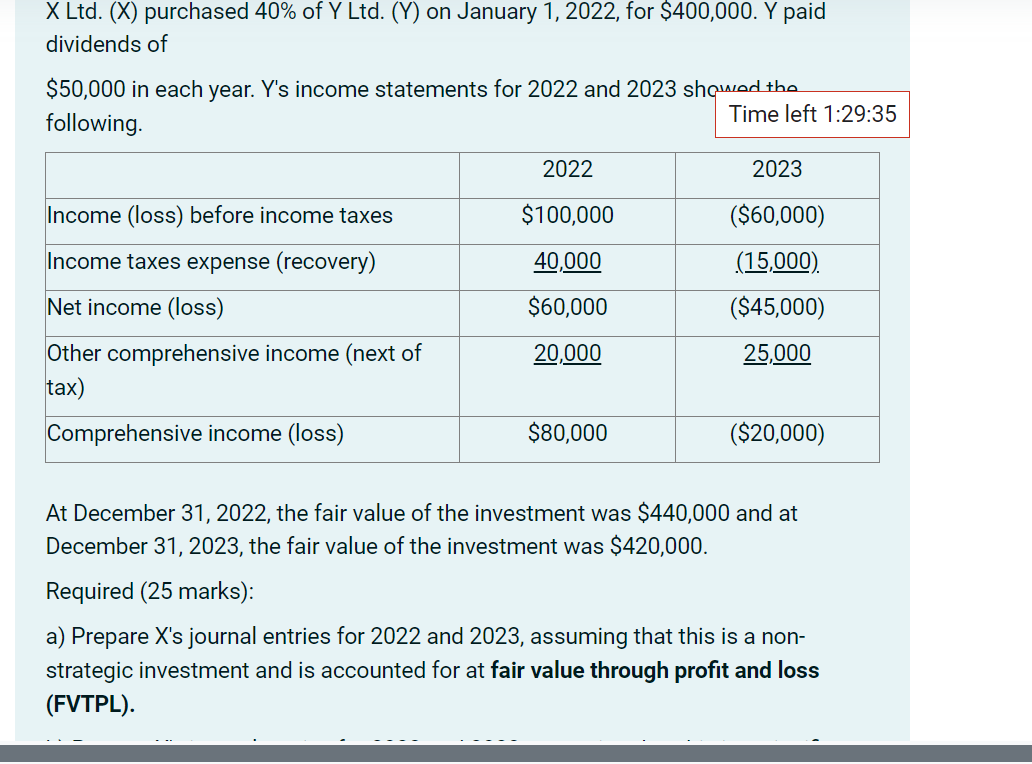

$ in each year. Ys income statements for and showed the following.

Ltd purchased of LtdY on January for $ Y paid

dividends of

$ in each year. Ys income statements for and shquad the

following.

Time left ::

At December the fair value of the investment was $ and at

December the fair value of the investment was $

Required marks:

a Prepare Xs journal entries for and assuming that this is a non

strategic investment and is accounted for at fair value through profit and loss

FVTPL

Income loss before income taxes

$

$

Income taxes expense recovery

Net income loss

$

$

Other comprehensive income next of tax

Comprehensive income loss

$

$

At December the fair value of the investment was $ and at December the fair value of the investment was $

Required marks:

a Prepare Xs journal entries for and assuming that this is a nonstrategic investment and is accounted for at fair value through profit and loss FVTPL

b Prepare Xs journal entries for and assuming that this is a significant influence investment and will be reported using the equity method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock