Question: X * [ Quiz: Exam 3 (Remotely Proc @ x + & Home - ott edu + + C utchattanoogainstructure.com/courses/25523/quizes/secured#lockdown Question 6 6 pts Question

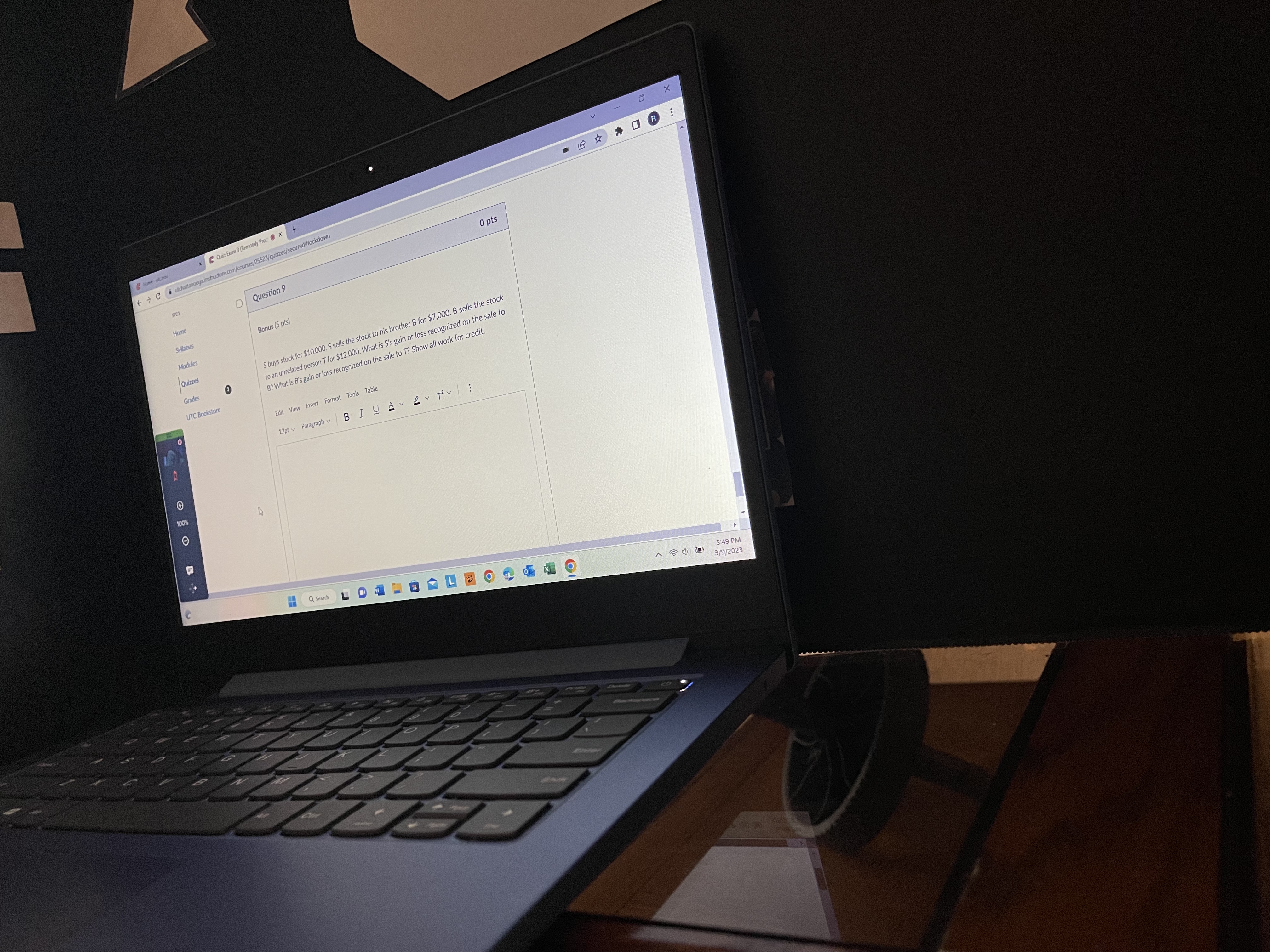

X * [ Quiz: Exam 3 (Remotely Proc @ x + & Home - ott edu + + C utchattanoogainstructure.com/courses/25523/quizes/secured#lockdown Question 6 6 pts Question 7 SP23 Question 1 Question 8 Home Syllabus This year D's hunting cabin worth $50,000 (basis $52,000) was completely destroyed by Time Running: Hide Time fire. The area was designated a federal disaster area. The cabin was uninsured. If D's Attempt due: Mar 9 at 11:59pm Modules A.G.I. is $40,000 this year, how much of the loss may be claimed? What type of 1 Hour, 25 Minutes, 24 Seconds Quizzes deduction is the casualty (FOR AGI, ITEMIZED, MISC. ITEMIZED)? SHOW ALL WORK Grades Edit View Insert Format Tools Table UTC Bookstore 12 pt v Paragraph B IYA 100% Q Search 1 1 8 6 1 2 0 2 9 4 0 5:48 PM 3/9/2023 Enterv X x C Quiz bum ] (Remotely Proc x + Home cutcents + + C i utchattanooga.instructure.com/courses/25523/quizzes/secured#lockdown 8 pts SP23 D Question 2 Home a) This year D's warehouse (used in his business) worth $120,000 (basis $125,000) was Syllabus completely destroyed by fire. D received insurance proceeds of $50,000. If D's A.G.I. is Modules $30,000 this year, how much of the loss may be claimed? What type of deduction is the casualty (FOR AGI, ITEMIZED, MISC. ITEMIZED)? SHOW ALL WORK Quizzes Grades UTC Bookstore b) Same facts, except the warehouse had a FMV of $ $50,000 following the fire. How much of the loss may be claimed? What type of deduction is the casualty (FOR AGI, ITEMIZED, MISC. ITEMIZED)? SHOW ALL WORK Edit View Insert Format Tools Table 12pty Paragraph BI U Av LV TV 100% C Q Search L 1 8 1 2 0 2 9 4 0 5:48 PM 3/9/2023X C Quiz Exam 3 (Remotely Proc x + + + e i utchattanoogainstructure.com/courses/25523/quizzes/secured#lockdown 10 pts SP23 Question Home Syllabus T rented a house this year with the following results: Modules Quizzes Rent Income $4,000 Grades Utilities $2.500 UTC Bookstore Maintenance $3,000 Interest Expense $2,000 Repairs $42,000 Assuming T's AGI is $130,000, compute T's rental loss deduction, amount to be carried forward and what type of deduction (e.g. for AGI, itemized AGI, Misc. Itemized, not deductible)? SHOW ALL WORK Edit View Insert Format Tools Table 12 pt v Paragraph BI U A LV TV Styles Q search 4 8 2 1 2 0 1 9 4 0 5:48 PM 3/9/2023X x C Quiz Exam 3 (Remotely Proc @ x + hattanooga.instructure.com/courses/25523/quizzes/secured#lockdown 25 pts D Question 4 Mr. G made the following charitable contributions during the year. $40,000 fizzes Cash to his Church rades 3 UTC Bookstore LTCG Stock to United Way FMV 150,000 COST 70,000 Land to a private non- operating foundation FMV 30,000 COST 20,000 Assuming MR. G has AGI of $400,000 calculate his total charitable contribution deduction and carryover. SHOW ALL WORK Edit View Insert Format Tools Table 12pty Paragraph ~ BI U A v Q V T V Q Search 4 8 1 2 0 1 5 4 0 5:48 PM 3/9/2023ki Kiguap! X such as skin V Group people * [ Quiz Eam ] ( Remotely Proc 8 x + + + c . utchuttanong zinstructure.com/courses/25523/quizes/secured #lockdown 8 pts Question 6 Home S and M (under 65, good vision, MFJ) have wages of $125,000. In addition, M started a Syllabus sole-proprietor and had business income of $65,000. His business expenses were R Modules $225,000. They also have dividend income of $3,500. Calculate their taxable income Quizzes (Loss) and their NOL Grades Edit View Insert Format Tools Table UTC Bookstore 12pt v Paragraph BIU Av LV T' v 3 conce 100% Q Search L 4 8 - L 2 0 1 9 4 0 5:49 PM 3/9/2023X * G Quiz Exam ] Remotely Proc 8 x + Jack Swift is self-employed. During the year he incurred the following expenses + + C utchattanoogainstructure.com/courses/25523/quizes/secured#lockdown associated with driving around on business: Home $2,000 Gas 430 Maintenance Modules Insurance Quizze 500 Interest on Car Loan Grades 2,000 Depreciation UTC Bookstore 345 License 120 Parking Business Miles 9,000 Total Miles 10,000 100 Calculate Jack's actual transportation expenses. Calculate Jack's expenses using the standard mileage rate (Assume the rate is $0.56 per mile). SHOW ALL WORK Expenses using actual_ Q Search LD 4 8 1 2 0 2 9 4 0 5:49 PM 1 7 42 3/9/2023X x C Que From ] (Remotely Proc 8 x + * + C d dchatanoogainstructure com/courses/25523/quizzes/secured #lockdown P Home 8 pts Syllabus D Question 8 Modules Quizzes Sharon has a home office. The square footage of the home is 5,000 sq ft and the home office is 600 sq ft. She had net income (after direct expenses) of $70,000. Calculate her Codes home office expense using the actual expense method and the simplified method given UTC Bookstore the following actual expenses: Insurance $3,000 Property Tax $5.500 Utilities $1,000 100% Security Sy $1,500 Edit View Insert Format Tools Table 12 pt ~ Paragraph B I U 5:49 PM 3/9/2023X V * & Quit Exam 3 (Remotely Proc 8 x + + + C . ulchattanoogainstructure.com/courses/25523/quizes/secured #lockdown 0 pts D Question 9 Home Syllabus Bonus (5 pts) Modules Quizzes S buys stock for $10,000. S sells the stock to his brother B for $7,000. B sells the stock Grades to an unrelated person T for $12,000. What is S's gain or loss recognized on the sale to B? What is B's gain or loss recognized on the sale to T? Show all work for credit. UTC Bookstore Edit View Insert Format Tools Table 12 pty Paragraph v BI U Av LV TV A Q Search L 1 8 L 2 0 2 9 4 0 5:49 PM 1 7 4 0 3/9/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts