Question: X Times New Roman 12 v ' ' = Paste B I U v a. Av AB7 x fx A B D E E F

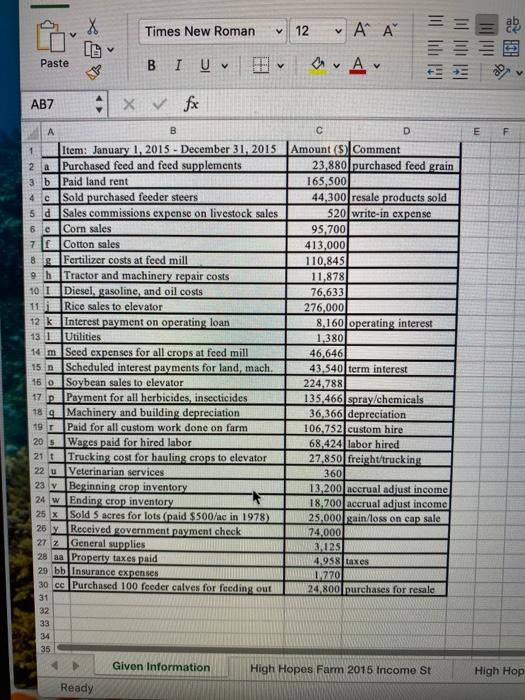

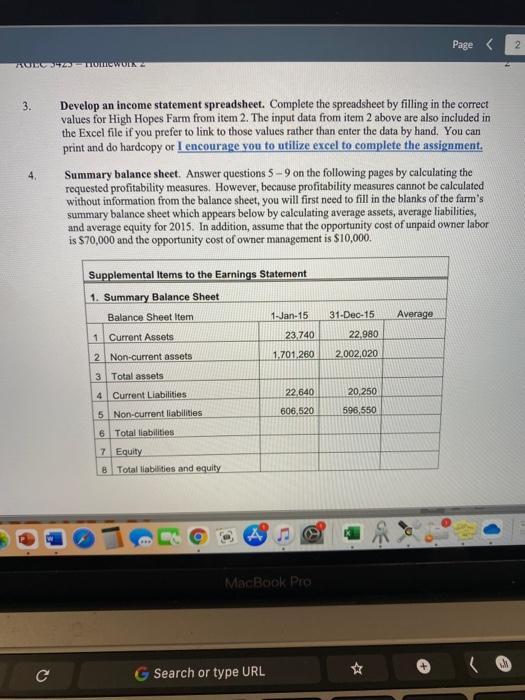

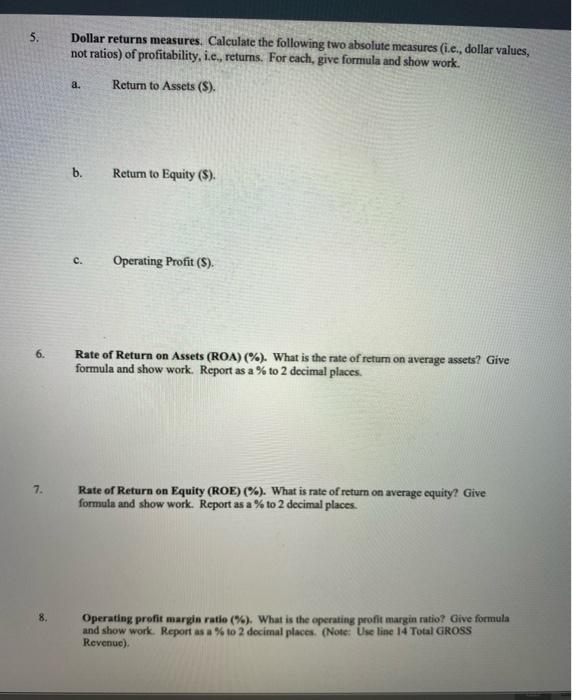

X Times New Roman 12 v ' ' = Paste B I U v a. Av AB7 x fx A B D E E F 15 Item: January 1, 2015 - December 31, 2015 Amount (S) Comment 2 a Purchased feed and feed supplements 23,880 purchased feed grain 3 b Paid land rent 165,500 Sold purchased feeder steers 44,300 resale products sold 5 d Sales commissions expense on livestock sales 520 write-in expense 6 e Corn sales 95,700 7 - Cotton sales 413,000 8 g Fertilizer costs at feed mill 110,845 9 h Tractor and machinery repair costs 11,878 10 I Diesel, gasoline, and oil costs 76,633 110 Rice sales to elevator 276,000 12 k Interest payment on operating loan 8,160 operating interest 131 Utilities 1,380 14 m Seed expenses for all crops at feed mill 46.646 Scheduled interest payments for land, mach, 43,540 term interest 160 Soybean sales to elevator 224,788 17 p Payment for all herbicides, insecticides 135,466 spray/chemicals 18 9 Machinery and building depreciation 36 366 depreciation 19 T Paid for all custom work done on farm 106,752 custom hire 20 s Wages paid for hired labor 68,424 labor hired 21 Trucking cost for hauling crops to elevator 27.850 freight trucking 22 u Veterinarian services 360 23 v Beginning crop inventory 13,200 accrual adjust income 24 w Ending crop inventory 18.700 accrual adjust income 25 x Sold 5 acres for lots (paid $500/ac in 1978) 25.000 gain/loss on cap sale 26 y Received government payment check 74.000 27 2 General supplies 3,125 28 a Property taxes paid 4,958 taxes 29 bb Insurance expenses 1770 30 cc Purchased 100 feeder calves for feeding out 24,800 purchases for resale 31 32 33 34 35 Given Information High Hopes Farm 2015 Income St Ready High Hop Page 2 BIUC Title VIN 3. 4 Develop an income statement spreadsheet. Complete the spreadsheet by filling in the correct values for High Hopes Farm from item 2. The input data from item 2 above are also included in the Excel file if you prefer to link to those values rather than enter the data by hand. You can print and do hardcopy or I encourage you to utilize excel to complete the assignment. Summary balance sheet. Answer questions 5 - 9 on the following pages by calculating the requested profitability measures. However, because profitability measures cannot be calculated without information from the balance sheet, you will first need to fill in the blanks of the farm's summary balance sheet which appears below by calculating average assets, average liabilities, and average equity for 2015. In addition, assume that the opportunity cost of unpaid owner labor is $70,000 and the opportunity cost of owner management is $10,000. Supplemental Items to the Earnings Statement 1. Summary Balance Sheet Balance Sheet Item 1-Jan-15 1 Current Assets 23,740 2 Non-current assets 1.701 260 31-Dec-15 Average 22 980 2002020 3 Total assets 22,640 20.250 4 Current Liabilities 5 Non-current liabilities 606,520 596,550 6 Total liabilities 7 Equity B Total liabilities and equity MacBook Pro G Search or type URL 5. Dollar returns measures. Calculate the following two absolute measures (i.e., dollar values, not ratios) of profitability, i.e., returns. For each, give formula and show work. a. Return to Assets ($) b. Return to Equity (). c. Operating Profit (S). 6. Rate of Return on Assets (ROA) (%). What is the rate of return on average assets? Give formula and show work. Report as a % to 2 decimal places. 7. Rate of Return on Equity (ROE) (%). What is rate of return on average equity? Give formula and show work. Report as a % to 2 decimal places. 8. Operating profit margin ratio (%). What is the operating profit margin ratio? Give formula and show work. Report as a % to 2 decimal places. (Note: Use line 14 Total GROSS Revenue). 5. Dollar returns measures. Calculate the following two absolute measures (i.e., dollar values, not ratios) of profitability, i.e., returns. For each, give formula and show work. a. Return to Assets () b. Return to Equity (S) c. Operating Profit (S). 6. Rate of Return on Assets (ROA) (%). What is the rate of return on average assets? Give formula and show work. Report as a % to 2 decimal places. 7. Rate of Return on Equity (ROE) (%). What is rate of return on average equity? Give formula and show work. Report as a % to 2 decimal places. 8. Operating profit margin ratio (%). What is the operating profit margin ratio? Give formula and show work. Report as a % to 2 decimal places. (Note: Use line 14 Total GROSS Revenue) X Times New Roman 12 v ' ' = Paste B I U v a. Av AB7 x fx A B D E E F 15 Item: January 1, 2015 - December 31, 2015 Amount (S) Comment 2 a Purchased feed and feed supplements 23,880 purchased feed grain 3 b Paid land rent 165,500 Sold purchased feeder steers 44,300 resale products sold 5 d Sales commissions expense on livestock sales 520 write-in expense 6 e Corn sales 95,700 7 - Cotton sales 413,000 8 g Fertilizer costs at feed mill 110,845 9 h Tractor and machinery repair costs 11,878 10 I Diesel, gasoline, and oil costs 76,633 110 Rice sales to elevator 276,000 12 k Interest payment on operating loan 8,160 operating interest 131 Utilities 1,380 14 m Seed expenses for all crops at feed mill 46.646 Scheduled interest payments for land, mach, 43,540 term interest 160 Soybean sales to elevator 224,788 17 p Payment for all herbicides, insecticides 135,466 spray/chemicals 18 9 Machinery and building depreciation 36 366 depreciation 19 T Paid for all custom work done on farm 106,752 custom hire 20 s Wages paid for hired labor 68,424 labor hired 21 Trucking cost for hauling crops to elevator 27.850 freight trucking 22 u Veterinarian services 360 23 v Beginning crop inventory 13,200 accrual adjust income 24 w Ending crop inventory 18.700 accrual adjust income 25 x Sold 5 acres for lots (paid $500/ac in 1978) 25.000 gain/loss on cap sale 26 y Received government payment check 74.000 27 2 General supplies 3,125 28 a Property taxes paid 4,958 taxes 29 bb Insurance expenses 1770 30 cc Purchased 100 feeder calves for feeding out 24,800 purchases for resale 31 32 33 34 35 Given Information High Hopes Farm 2015 Income St Ready High Hop Page 2 BIUC Title VIN 3. 4 Develop an income statement spreadsheet. Complete the spreadsheet by filling in the correct values for High Hopes Farm from item 2. The input data from item 2 above are also included in the Excel file if you prefer to link to those values rather than enter the data by hand. You can print and do hardcopy or I encourage you to utilize excel to complete the assignment. Summary balance sheet. Answer questions 5 - 9 on the following pages by calculating the requested profitability measures. However, because profitability measures cannot be calculated without information from the balance sheet, you will first need to fill in the blanks of the farm's summary balance sheet which appears below by calculating average assets, average liabilities, and average equity for 2015. In addition, assume that the opportunity cost of unpaid owner labor is $70,000 and the opportunity cost of owner management is $10,000. Supplemental Items to the Earnings Statement 1. Summary Balance Sheet Balance Sheet Item 1-Jan-15 1 Current Assets 23,740 2 Non-current assets 1.701 260 31-Dec-15 Average 22 980 2002020 3 Total assets 22,640 20.250 4 Current Liabilities 5 Non-current liabilities 606,520 596,550 6 Total liabilities 7 Equity B Total liabilities and equity MacBook Pro G Search or type URL 5. Dollar returns measures. Calculate the following two absolute measures (i.e., dollar values, not ratios) of profitability, i.e., returns. For each, give formula and show work. a. Return to Assets ($) b. Return to Equity (). c. Operating Profit (S). 6. Rate of Return on Assets (ROA) (%). What is the rate of return on average assets? Give formula and show work. Report as a % to 2 decimal places. 7. Rate of Return on Equity (ROE) (%). What is rate of return on average equity? Give formula and show work. Report as a % to 2 decimal places. 8. Operating profit margin ratio (%). What is the operating profit margin ratio? Give formula and show work. Report as a % to 2 decimal places. (Note: Use line 14 Total GROSS Revenue). 5. Dollar returns measures. Calculate the following two absolute measures (i.e., dollar values, not ratios) of profitability, i.e., returns. For each, give formula and show work. a. Return to Assets () b. Return to Equity (S) c. Operating Profit (S). 6. Rate of Return on Assets (ROA) (%). What is the rate of return on average assets? Give formula and show work. Report as a % to 2 decimal places. 7. Rate of Return on Equity (ROE) (%). What is rate of return on average equity? Give formula and show work. Report as a % to 2 decimal places. 8. Operating profit margin ratio (%). What is the operating profit margin ratio? Give formula and show work. Report as a % to 2 decimal places. (Note: Use line 14 Total GROSS Revenue)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts