Question: X ts ad de e CHAPTER 1 The financial management function focuses primarily on decision-making with regard to investment (capita budgeting, investing in annuity, perpetuity

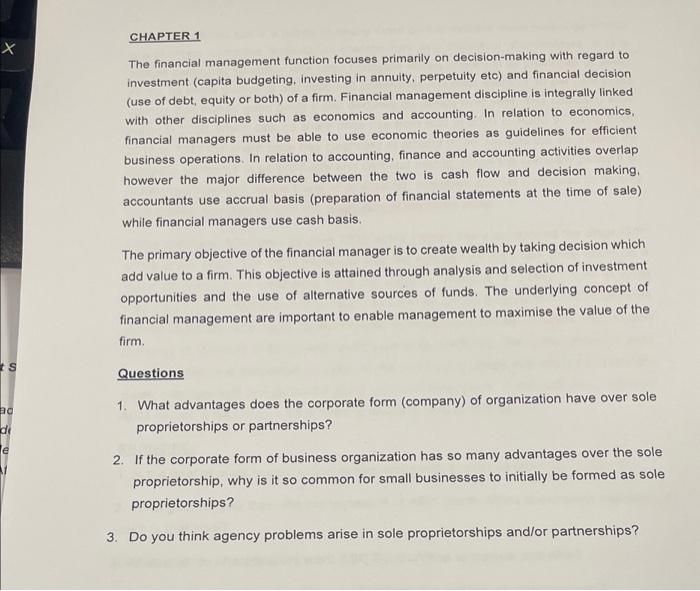

The financial management function focuses primarily on decision-making with regard to investment (capita budgeting, investing in annuity, perpetuity etc) and financial decision (use of debt, equity or both) of a firm. Financial management discipline is integrally linked with other disciplines such as economics and accounting. In relation to economics, financial managers must be able to use economic theories as guidelines for efficient business operations. In relation to accounting, finance and accounting activities overlap however the major difference between the two is cash flow and decision making. accountants use accrual basis (preparation of financial statements at the time of sale) while financial managers use cash basis. The primary objective of the financial manager is to create wealth by taking decision which add value to a firm. This objective is attained through analysis and selection of investment opportunities and the use of alternative sources of funds. The underlying concept of financial management are important to enable management to maximise the value of the firm. Questions 1. What advantages does the corporate form (company) of organization have over sole proprietorships or partnerships? 2. If the corporate form of business organization has so many advantages over the sole proprietorship, why is it so common for small businesses to initially be formed as sole proprietorships? 3. Do you think agency problems arise in sole proprietorships and/or partnerships

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts