Question: X Using return distributions - Excel FORMULAS DATA REVIEW - Sign In FILE HOME INSERT PAGE LAYOUT VIEW Paste B I - - A -

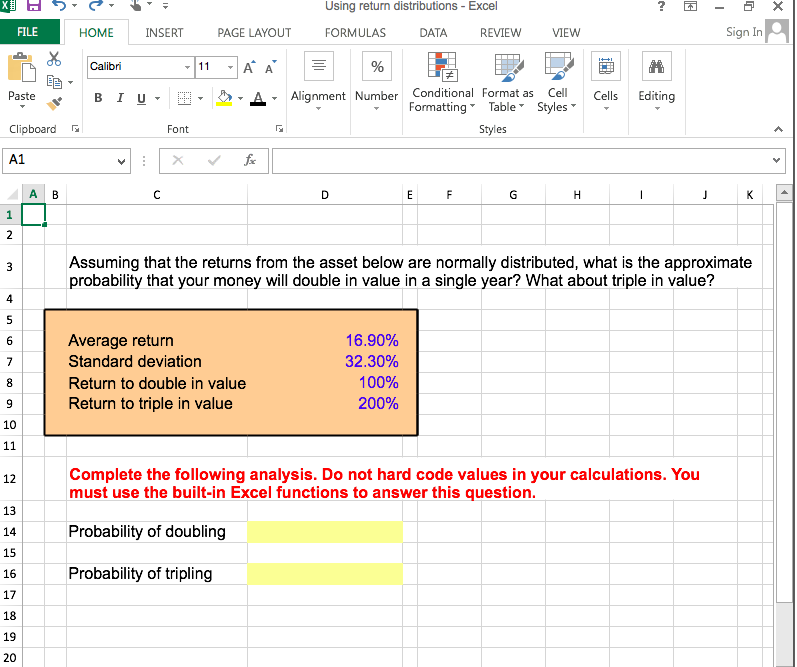

X Using return distributions - Excel FORMULAS DATA REVIEW - Sign In FILE HOME INSERT PAGE LAYOUT VIEW Paste B I - - A - Alignment Number Cells Editing U - Font Conditional Format as Cell Formatting Table Styles Styles Clipboard A1 Assuming that the returns from the asset below are normally distributed, what is the approximate probability that your money will double in value in a single year? What about triple in value? Average return Standard deviation Return to double in value Return to triple in value 16.90% 32.30% 100% 200% Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question. Probability of doubling Probability of tripling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts