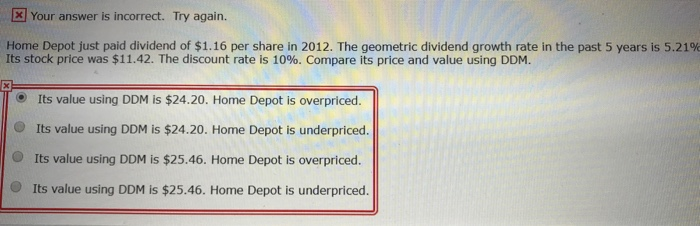

Question: x Your answer is incorrect. Try again. Home Depot just paid dividend of $1.16 per share in 2012. The geometric dividend growth rate in the

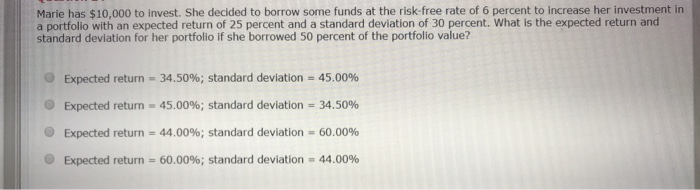

x Your answer is incorrect. Try again. Home Depot just paid dividend of $1.16 per share in 2012. The geometric dividend growth rate in the past 5 years is 5.21% Its stock price was $11.42. The discount rate is 10%. Compare its price and value using DDM. Its value using DDM is $24.20. Home Depot is overpriced. Its value using DDM is $24.20. Home Depot is underpriced. Its value using DDM is $25.46. Home Depot is overpriced. Its value using DDM is $25.46. Home Depot is underpriced. Marie has $10,000 to invest. She decided to borrow some funds at the risk-free rate of 6 percent to increase her investment in a portfolio with an expected return of 25 percent and a standard deviation of 30 percent. What is the expected return and standard deviation for her portfolio if she borrowed 50 percent of the portfolio value? Expected return = 34.50%; standard deviation = 45.00% Expected return = 45.00%; standard deviation = 34.50% Expected return = 44.00%; standard deviation = 60.00% Expected return = 60.00%; standard deviation = 44.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts