Question: x YZ Electronics is considering two plans for raising $ 2 , 0 0 0 , 0 0 0 to expand operations. Plan A is

x YZ Electronics is considering two plans for raising $ to expand operations. Plan A is to issue bonds payable, and plan is to issue shares of common stock. Betore any new financing. XYZ Electronics has net income of $ and shares of common stock outstanding. Management believes the company can use the new funds to earn addaional income of $ before interest and tases. The income tax rase is Anabze the XYZ Flectronics stuation to determine which plan with result in higher earmings per share. Complete at inpul feids. Enter an for any zero balances. Round earnings per share amounts to the nearest cent.

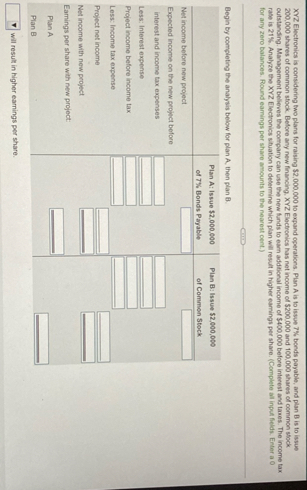

Begin by completing the analysis below for plan A then plan B

tablePlan A: Issue $ of Bonds Payable,Pian B: Issue $ of Common StockNet income before new project,Expected income on the new projuct before interest and income tax expenses,,Less: Interest expense,,Project income before income tax,Less: Income tax expense,Project net income,Net income with new project,Earnings per share with new project:,,tablePlan APlan B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock