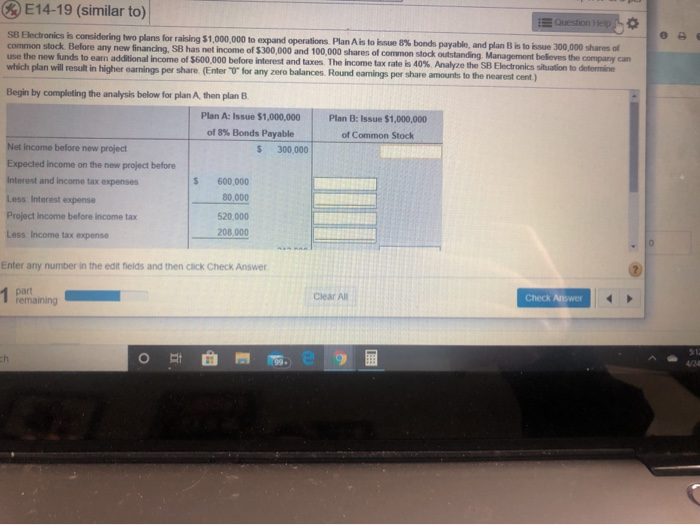

Question: E14-19 (similar to) E Questione SB Electronics is considering two plans for raising 51,000,000 to expand operations. Plan A is to issue 8% bonds payable,

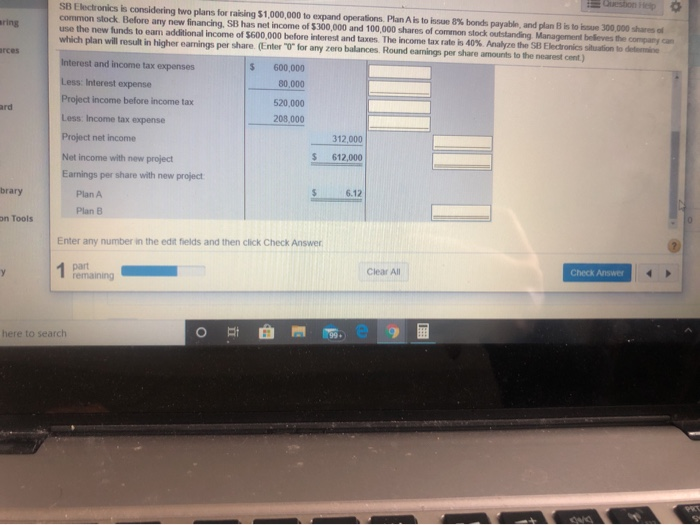

E14-19 (similar to) E Questione SB Electronics is considering two plans for raising 51,000,000 to expand operations. Plan A is to issue 8% bonds payable, and plan B is to issue 300,000 shares of common stock. Before any new financing. SB has net income of $300,000 and 100,000 shares of common stock outstanding Management believes the company can une the new funds to earn additional income of $600 000 before interest and takes the income tax rates 40% Analyze the SB Electronics in to determine which plan will result in higher earnings per share. (Enter for any zero balances. Round earnings per share amounts to the nearest cent.) Plan B: Issue $1,000,000 of Common Stock Begin by completing the analysis below for plan Athen plan B Plan A: Issue $1,000,000 of 8% Bonds Payable Net income before new project $ 300,000 Expected income on the new project before Interest and income tax expenses 600.000 Less Interest expense 80,000 Project Income before income tax 520.000 208.000 Less Income tax expense Enter any number in the edit fields and then click Check Answer Check Answer par I remaining SB Electronics is considering two plans for raising $1,000,000 to expand operations. Plan A is to issue 8% bonds payable, and plan B is to b e 300.000 shares of common stock. Before any new financing. SB has net income of $300,000 and 100,000 shares of common stock outstanding Management believes the company.com use the new funds to eam adesional income of $600 000 before interest and taxes. The income tax rates 40% Analyze the SB Electronics sution to dete which plan will result in higher earnings per share. (Enter for any zero balances. Round earnings per share amounts to the nearest cent) Interest and income tax expenses 600,000 80.000 Less: Interest expense Project Income before income tax 520,000 208.000 Less Income tax expense 312 000 Project net income 612,000 Net Income with new project Earnings per share with new project orary Plan A Plan B on Tools Enter any number in the edit fields and then click Check Answer Check Answer Clea 1 part 1 remaining O tme 9 here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts