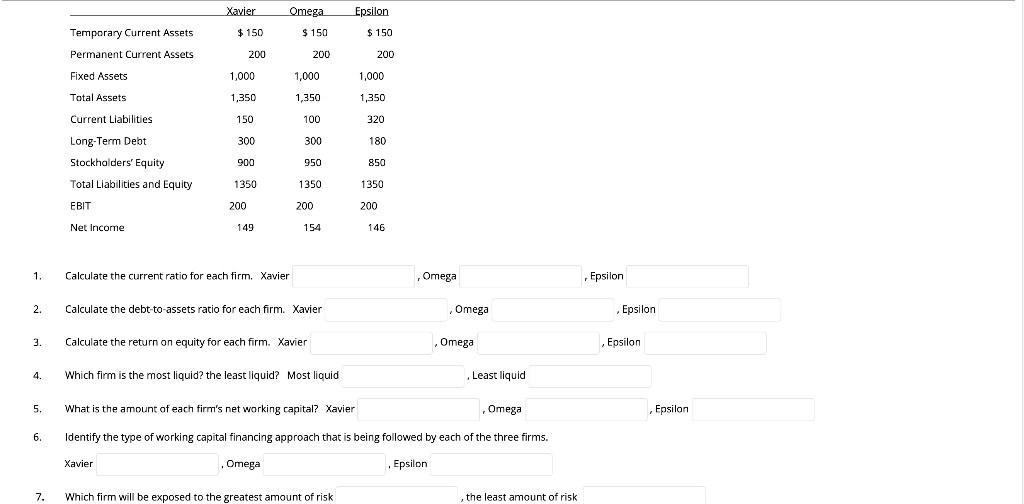

Question: Xavier Omega Epsilon $ 150 $ 150 $ 150 Temporary Current Assets Permanent Current Assets 200 200 200 Fixed Assets 1,000 1,000 1,000 Total Assets

Xavier Omega Epsilon $ 150 $ 150 $ 150 Temporary Current Assets Permanent Current Assets 200 200 200 Fixed Assets 1,000 1,000 1,000 Total Assets 1,350 1,350 1,350 Current Liabilities 150 100 320 Long-Term Debt 300 300 180 Stockhalders' Equity 900 950 850 Total Liabilities and Equity 1350 1350 1350 EBIT 200 200 200 Net Income 149 154 146 1. Calculate the current ratio for each firm. Xavier Omega Epsilon 2. Calculate the debt-to-assets ratio for each firm. Xavier --. Omega Epsilon 3. Calculate the return on equity for each firm. Xavier Omega Epsilon Which firm is the most liquid? the least liquid? Most liquid Least liquid 5. What is the amount of each firm's net working capital? Xavier Omega Epsilon 6. Identify the type of working capital financing approach that is being followed by each of the three firms. Xavier Omega . Epsilon 7. Which firm will be exposed to the greatest amount of risk , the least amount of risk Xavier Omega Epsilon $ 150 $ 150 $ 150 Temporary Current Assets Permanent Current Assets 200 200 200 Fixed Assets 1,000 1,000 1,000 Total Assets 1,350 1,350 1,350 Current Liabilities 150 100 320 Long-Term Debt 300 300 180 Stockhalders' Equity 900 950 850 Total Liabilities and Equity 1350 1350 1350 EBIT 200 200 200 Net Income 149 154 146 1. Calculate the current ratio for each firm. Xavier Omega Epsilon 2. Calculate the debt-to-assets ratio for each firm. Xavier --. Omega Epsilon 3. Calculate the return on equity for each firm. Xavier Omega Epsilon Which firm is the most liquid? the least liquid? Most liquid Least liquid 5. What is the amount of each firm's net working capital? Xavier Omega Epsilon 6. Identify the type of working capital financing approach that is being followed by each of the three firms. Xavier Omega . Epsilon 7. Which firm will be exposed to the greatest amount of risk , the least amount of risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts