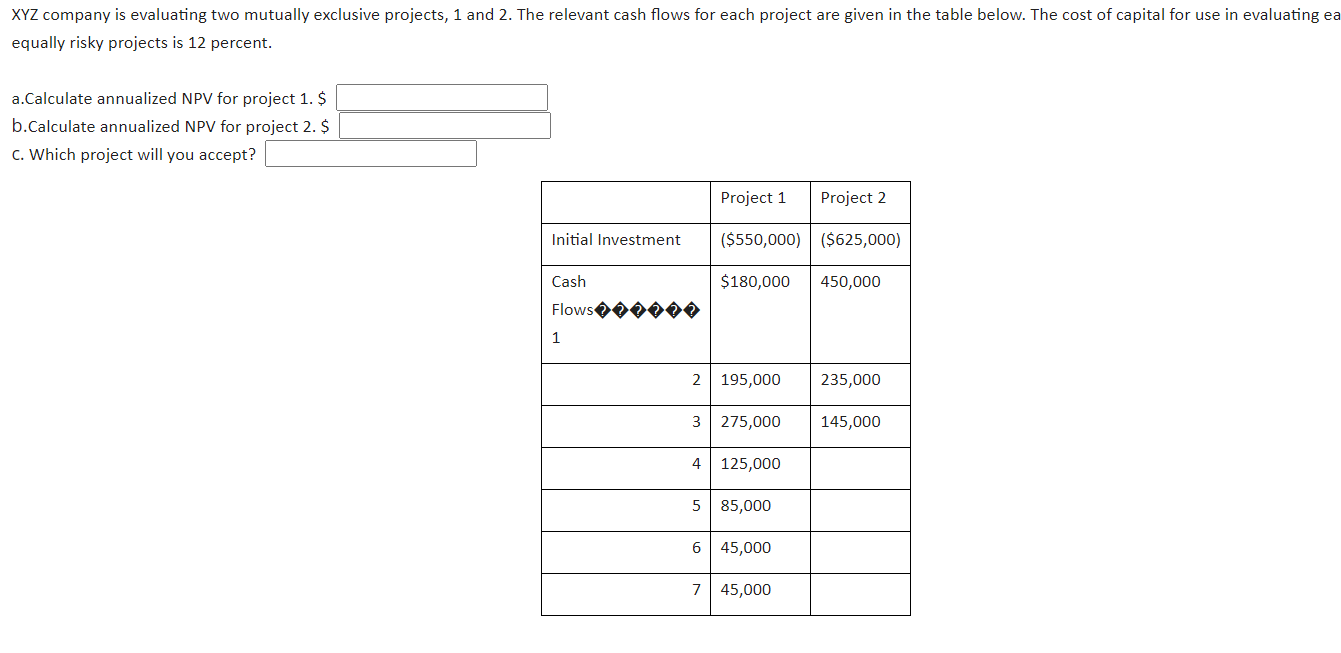

Question: XYZ company is evaluating two mutually exclusive projects, 1 and 2. The relevant cash flows for each project are given in the table below.

XYZ company is evaluating two mutually exclusive projects, 1 and 2. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating ea equally risky projects is 12 percent. a.Calculate annualized NPV for project 1. $ b.Calculate annualized NPV for project 2. $ c. Which project will you accept? Project 1 Project 2 Initial Investment ($550,000) ($625,000) Cash $180,000 450,000 Flows 1 2 195,000 235,000 3 275,000 145,000 4 125,000 5 85,000 6 45,000 7 45,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts