Question: xyz company online solution please write a business analysis using the solution and following the criteria. Using the excel write a business analysis for xyz

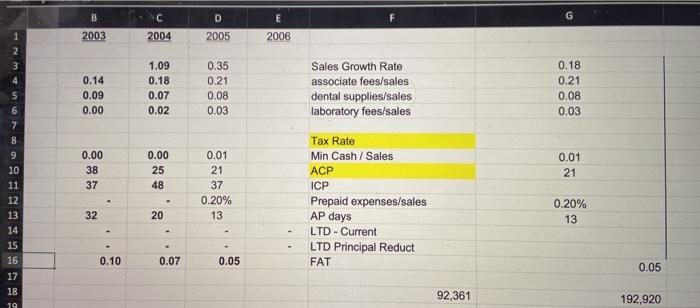

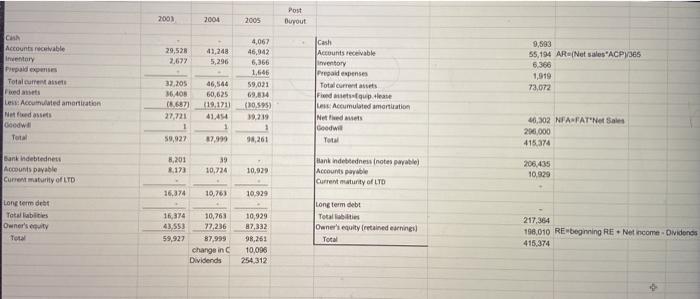

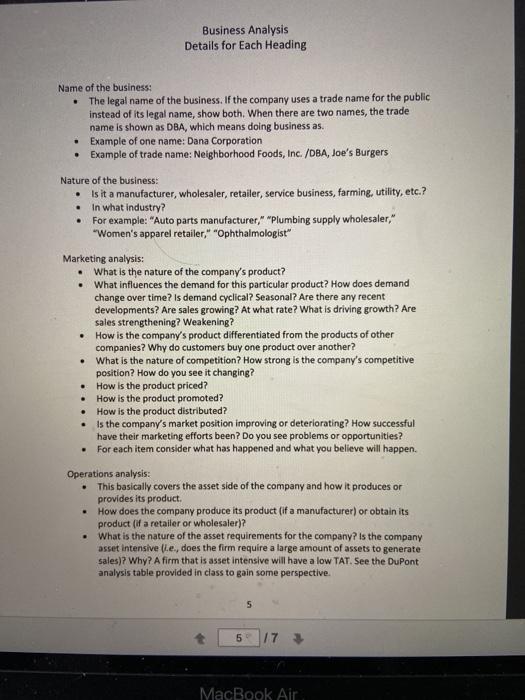

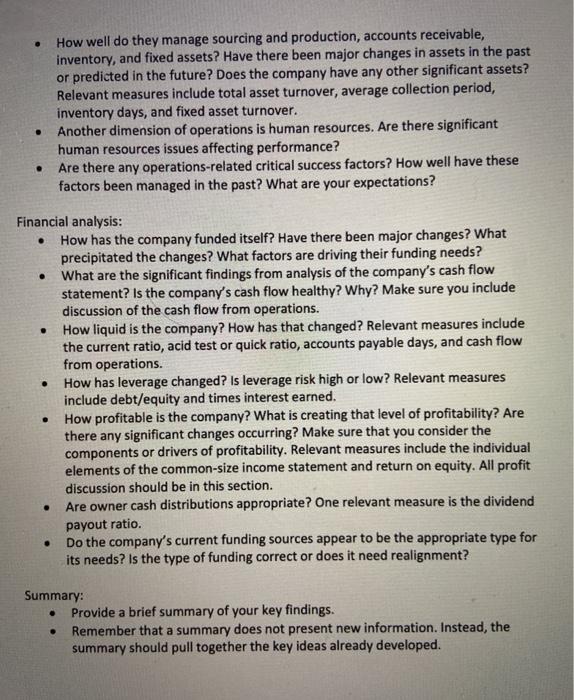

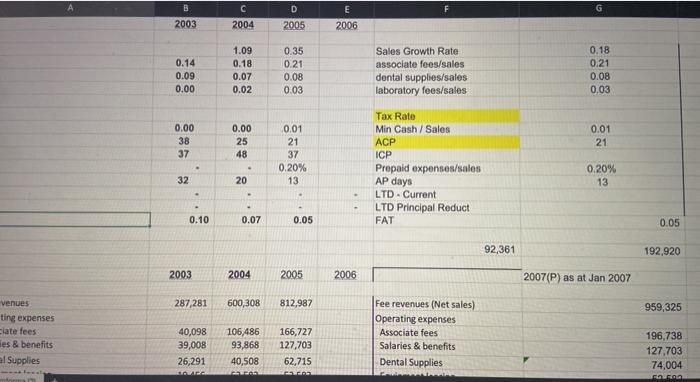

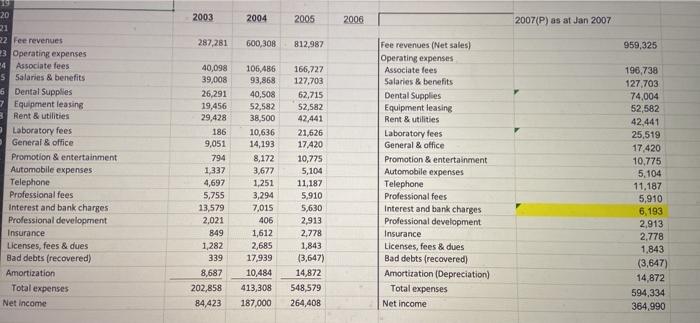

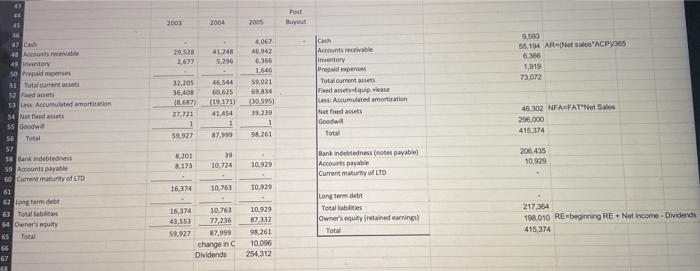

B D E 2006 2003 2004 2005 0.14 0.09 0.00 1.09 0.18 0.07 0.02 0.35 0.21 0.08 0.03 Sales Growth Rate associate fees/sales dental supplies/sales laboratory fees/sales 0.18 0.21 0.08 0.03 0.01 0.00 38 37 0.00 25 48 21 8 9 10 11 12 13 14 15 16 17 18 0.01 21 37 0.20% 13 Tax Rate Min Cash/ Sales ACP ICP Prepaid expenses/sales AP days LTD - Current LTD Principal Reduct FAT 32 20 0.20% 13 0.10 0.07 0.05 0.05 92,361 192,920 19 2003 2004 2005 2006 2007(P) as at Jan 2007 287,281 600,308 812,987 959,325 Fee revenues Operating expenses Associate fees Salaries & benefits Dental Supplies Equipment leasing Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization Total expenses Net Income 40,098 39,008 26,291 19,456 29,428 186 9,051 794 1,337 4,697 5,755 13,579 2,021 849 1.282 339 8,687 202,858 84,423 106,486 93,868 40,508 52,582 38,500 10,636 14,193 8,172 3,677 1.251 3,294 7,015 406 1,612 2,685 17.939 10,484 413,308 187,000 166,727 127,703 62,715 52,582 42,441 21,626 17,420 10,775 5,104 11.187 5,910 5,630 2,913 2,778 1,843 (3.647) 14,872 548,579 264,408 Fee revenues (Net sales) Operating expenses Associate fees Salaries & benefits Dental Supplies Equipment leasing Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization (Depreciation) Total expenses Net income 196,738 127,703 74,004 52,582 42,441 25,519 17,420 10,775 5.104 11.187 5,910 6,193 2.913 2,778 1,843 (3,647) 14.872 594,334 364.990 2003 2004 2005 Post Duyout Cash Accounts receivable Inventory 29,528 2.677 41,248 5,296 4,067 46,942 6,366 1,666 59,021 69.614 (10.595) 9,893 55,194 AR-Net sales ACP/365 6.366 1,919 73,072 32.205 16408 Totalcumentaiset Feeds Les Accumulated amortization Netfase Goodw Total Cash Accounts receivable inventory Pred expenses Total currents Find uplate Accumulated amortation Netvedes Goodwill 46,544 60,625 119,1711 41.454 27,721 46,302 NFA FAT'Ne sa 200,000 415.374 59,927 98.261 Bank indebtednes Accounts payable Current maturity of LTD 8,201 8173 39 10,724 10,929 tank indebtedness notes pale Accounts payable Current maturity of LTD 205.435 10.920 26,374 10,763 10.929 Long term det Total Babies Owner's equity Towa 16,374 43.55) 10,763 77,236 87,999 change in Dividends Long term debt Totalbes Owner's equity retained earnings Total 10,929 87,332 98,261 10.096 254 312 59.927 217,364 158,010 RE beginning RENet income Ovidends 415,374 Business Analysis Details for Each Heading Name of the business: The legal name of the business. If the company uses a trade name for the public instead of its legal name, show both. When there are two names, the trade name is shown as DBA, which means doing business as. Example of one name: Dana Corporation Example of trade name:Neighborhood Foods, Inc. /DBA, Joe's Burgers Nature of the business: Is it a manufacturer, wholesaler, retailer, service business, farming, utility, etc.? In what industry? For example: "Auto parts manufacturer," Plumbing supply wholesaler," "Women's apparel retailer "Ophthalmologist Marketing analysis: What is the nature of the company's product? What influences the demand for this particular product? How does demand change over time? Is demand cyclical? Seasonal? Are there any recent developments? Are sales growing? At what rate? What is driving growth? Are sales strengthening? Weakening? How is the company's product differentiated from the products of other companies? Why do customers buy one product over another? What is the nature of competition? How strong is the company's competitive position? How do you see it changing? How is the product priced? How is the product promoted? How is the product distributed? Is the company's market position improving or deteriorating? How successful have their marketing efforts been? Do you see problems or opportunities? For each item consider what has happened and what you believe will happen. Operations analysis: . This basically covers the asset side of the company and how it produces or provides its product How does the company produce its product (if a manufacturer) or obtain its product (if a retailer or wholesaler)? What is the nature of the asset requirements for the company? Is the company asset intensive lie, does the firm require a large amount of assets to generate sales)? Why? A firm that is asset intensive will have a low TAT. See the DuPont analysis table provided in class to gain some perspective. . 5 17 MacBook Air . How well do they manage sourcing and production, accounts receivable, inventory, and fixed assets? Have there been major changes in assets in the past or predicted in the future? Does the company have any other significant assets? Relevant measures include total asset turnover, average collection period, inventory days, and fixed asset turnover. Another dimension of operations is human resources. Are there significant human resources issues affecting performance? Are there any operations-related critical success factors? How well have these factors been managed in the past? What are your expectations? . . . . . Financial analysis: How has the company funded itself? Have there been major changes? What precipitated the changes? What factors are driving their funding needs? What are the significant findings from analysis of the company's cash flow statement? Is the company's cash flow healthy? Why? Make sure you include discussion of the cash flow from operations. How liquid is the company? How has that changed? Relevant measures include the current ratio, acid test or quick ratio, accounts payable days, and cash flow from operations. How has leverage changed? Is leverage risk high or low? Relevant measures include debt/equity and times interest earned. How profitable is the company? What is creating that level of profitability? Are there any significant changes occurring? Make sure that you consider the components or drivers of profitability. Relevant measures include the individual elements of the common-size income statement and return on equity. All profit discussion should be in this section. Are owner cash distributions appropriate? One relevant measure is the dividend payout ratio. Do the company's current funding sources appear to be the appropriate type for its needs? Is the type of funding correct or does it need realignment? . . Summary: Provide a brief summary of your key findings. Remember that a summary does not present new information. Instead, the summary should pull together the key ideas already developed. Business Analysis Details for Each Heading Name of the business: The legal name of the business. If the company uses a trade name for the public instead of its legal name, show both. When there are two names, the trade name is shown as DBA, which means doing business as. Example of one name: Dana Corporation Example of trade name: Neighborhood Foods, Inc. /DBA, Joe's Burgers Nature of the business: Is it a manufacturer, wholesaler, retailer, service business, farming, utility, etc.? In what industry? For example: "Auto parts manufacturer," "Plumbing supply wholesaler," "Women's apparel retailer," "Ophthalmologist" Marketing analysis: What is the nature of the company's product? What influences the demand for this particular product? How does demand change over time? Is demand cyclical? Seasonal? Are there any recent developments? Are sales growing? At what rate? What is driving growth? Are sales strengthening? Weakening? How is the company's product differentiated from the products of pther companies? Why do customers buy one product over another? What is the nature of competition? How strong is the company's competitive position? How do you see it changing? How is the product priced? How is the product promoted? How is the nroduct distributed ? . . . Marketing analysis: What is the nature of the company's product? What influences the demand for this particular product? How does demand change over time? Is demand cyclical? Seasonal? Are there any recent developments? Are sales growing? At what rate? What is driving growth? Are sales strengthening? Weakening? How is the company's product differentiated from the products of other companies? Why do customers buy one product over another? What is the nature of competition? How strong is the company's competitive position? How do you see it changing? How is the product priced? How is the product promoted? How is the product distributed? Is the company's market position improving or deteriorating? How successful have their marketing efforts been? Do you see problems or opportunities? For each item consider what has happened and what you believe will happen. . . . Operations analysis: This basically covers the asset side of the company and how it produces or provides its product. How does the company produce its product (if a manufacturer) or obtain its product (if a retailer or wholesaler)? What is the nature of the asset requirements for the company? Is the company asset intensive (i.e., does the firm require a large amount of assets to generate sales)? Why? A firm that is asset intensive will have a low TAT. See the DuPont analysis table provided in class to gain some perspective. . How well do they manage sourcing and production, accounts receivable, inventory, and fixed assets? Have there been major changes in assets in the past or predicted in the future? Does the company have any other significant assets? Relevant measures include total asset turnover, average collection period, inventory days, and fixed asset turnover. Another dimension of operations is human resources. Are there significant human resources issues affecting performance? Are there any operations-related critical success factors? How well have these factors been managed in the past? What are your expectations? . . Financial analysis: How has the company funded itself? Have there been major changes? What precipitated the changes? What factors are driving their funding needs? What are the significant findings from analysis of the company's cash flow statement? Is the company's cash flow healthy? Why? Make sure you include discussion of the cash flow from operations. How liquid is the company? How has that changed? Relevant measures include the current ratio, acid test or quick ratio, accounts payable days, and cash flow from operations. How has leverage changed? Is leverage risk high or low? Relevant measures include debt/equity and times interest earned. How profitable is the company? What is creating that level of profitability? Are there any significant changes occurring? Make sure that you consider the components or drivers of profitability. Relevant measures include the individual elements of the common-size income statement and return on equity. All profit discussion should be in this section. Are owner cash distributions appropriate? One relevant measure is the dividend payout ratio. Do the company's current funding sources appear to be the appropriate type for its needs? Is the type of funding correct or does it need realignment? mer the current ratio, acid test or quick ratio, accounts payable days, and cash flow from operations. How has leverage changed? Is leverage risk high or low? Relevant measures include debt/equity and times interest earned. How profitable is the company? What is creating that level of profitability? Are there any significant changes occurring? Make sure that you consider the components or drivers of profitability. Relevant measures include the individual elements of the common-size income statement and return on equity. All profit discussion should be in this section. Are owner cash distributions appropriate? One relevant measure is the dividend payout ratio. Do the company's current funding sources appear to be the appropriate type for its needs? Is the type of funding correct or does it need realignment? . Summary: Provide a brief summary of your key findings. Remember that a summary does not present new information. Instead, the summary should pull together the key ideas already developed. . D C 2004 E 2006 2003 2005 0.14 0.09 0.00 1.09 0.18 0.07 0.02 0.35 0.21 0.08 0.03 Sales Growth Rate associate fees/sales dental supplies/sales laboratory fees/sales 0.18 0.21 0.08 0.03 0.00 0.00 25 48 0.01 21 38 37 0.01 21 37 0.20% 13 Tax Rate Min Cash/ Sales ACP ICP Prepaid expenses/sales AP days LTD - Current LTD Principal Reduct FAT 32 0.20% 13 20 - 0.10 0.07 0.05 0.05 92,361 192,920 2003 2004 2005 2006 2007(P) as at Jan 2007 287,281 600,308 812,987 959,325 venues ting expenses Ciate fees les & benefits al Supplies 40,098 39,008 26,291 106,486 93,868 40,508 166,727 127,703 62,715 Fee revenues (Net sales) Operating expenses Associate fees Salaries & benefits Dental Supplies 196,738 127.703 74,004 RA 2003 2004 2005 2006 2007(P) as at Jan 2007 287,281 600,308 812,987 959,325 20 21 22 Fee revenues 23 Operating expenses 4 Associate fees 5 salaries & benefits 16 Dental Supplies 7 Equipment leasing B Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization Total expenses Net Income 40,098 39,008 26,291 19,456 29,428 186 9,051 794 1337 4,697 5,755 13,579 2,021 849 1,282 339 8,687 202,858 84,423 106,486 93,868 40,508 52,582 38,500 10,636 14,193 8,172 3,677 1,251 3,294 7,015 166,727 127,703 62,715 52,582 42,441 21,626 17.420 10,775 5,104 11,187 5,910 5,630 2,913 2,778 1,843 (3,647) 14,872 548,579 264,408 Fee revenues (Net sales) Operating expenses Associate fees Salaries & benefits Dental Supplies Equipment leasing Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization (Depreciation) Total expenses Net income 196,738 127,703 74,004 52,582 42,441 25,519 17,420 10,775 5,104 11,187 5,910 6,193 2,913 2,778 1,843 (3,647) 14,872 594,334 364,990 406 1,612 2,685 17,939 10,484 413,308 187,000 45 2003 2004 Post Iluyor 2005 4,067 46,942 29.528 2.677 21.248 5.296 9.500 56,194 ARNet ACP 6.366 1,919 73.072 365 12.30 36 403 1.646 59,021 59 AM 46,546 60,625 (19.171) 41.454 1 27.9 Acounts receivable nentory Prepaid expenses Total current ed assequip.lease Accumulated amortization Noted as Goodwill Total 19.239 1 27.121 1 53.927 46,302 NFAFAT Net Sales 206,000 415.374 98,261 47 Case 48 Arena 49 Inventory 50 Prepaid SI Total current area 52 sets 53 In Acumulated artin 54 Net 55 Goodwill 56 Total 57 38 Bank indebted 59 Accounts payable 50 Current maturity of LTD 61 62 Long term deb 63 Total lace 54 Owner's equity 65 Total 66 67 3.201 173 39 10,724 200435 10,929 Bank indebtedness notes payabu Accounts payable Current matury of LTD 10,929 16,374 10,763 10.929 Long term debit Total abities Owner's equity retained earnings Total 10.929 87332 98.261 10.096 254.312 15,374 10,763 43,553 77,236 59.927 17,999 change in Dividends 217,364 198,010 RE beginning RE .Net income. Dividends 415,374 B D E 2006 2003 2004 2005 0.14 0.09 0.00 1.09 0.18 0.07 0.02 0.35 0.21 0.08 0.03 Sales Growth Rate associate fees/sales dental supplies/sales laboratory fees/sales 0.18 0.21 0.08 0.03 0.01 0.00 38 37 0.00 25 48 21 8 9 10 11 12 13 14 15 16 17 18 0.01 21 37 0.20% 13 Tax Rate Min Cash/ Sales ACP ICP Prepaid expenses/sales AP days LTD - Current LTD Principal Reduct FAT 32 20 0.20% 13 0.10 0.07 0.05 0.05 92,361 192,920 19 2003 2004 2005 2006 2007(P) as at Jan 2007 287,281 600,308 812,987 959,325 Fee revenues Operating expenses Associate fees Salaries & benefits Dental Supplies Equipment leasing Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization Total expenses Net Income 40,098 39,008 26,291 19,456 29,428 186 9,051 794 1,337 4,697 5,755 13,579 2,021 849 1.282 339 8,687 202,858 84,423 106,486 93,868 40,508 52,582 38,500 10,636 14,193 8,172 3,677 1.251 3,294 7,015 406 1,612 2,685 17.939 10,484 413,308 187,000 166,727 127,703 62,715 52,582 42,441 21,626 17,420 10,775 5,104 11.187 5,910 5,630 2,913 2,778 1,843 (3.647) 14,872 548,579 264,408 Fee revenues (Net sales) Operating expenses Associate fees Salaries & benefits Dental Supplies Equipment leasing Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization (Depreciation) Total expenses Net income 196,738 127,703 74,004 52,582 42,441 25,519 17,420 10,775 5.104 11.187 5,910 6,193 2.913 2,778 1,843 (3,647) 14.872 594,334 364.990 2003 2004 2005 Post Duyout Cash Accounts receivable Inventory 29,528 2.677 41,248 5,296 4,067 46,942 6,366 1,666 59,021 69.614 (10.595) 9,893 55,194 AR-Net sales ACP/365 6.366 1,919 73,072 32.205 16408 Totalcumentaiset Feeds Les Accumulated amortization Netfase Goodw Total Cash Accounts receivable inventory Pred expenses Total currents Find uplate Accumulated amortation Netvedes Goodwill 46,544 60,625 119,1711 41.454 27,721 46,302 NFA FAT'Ne sa 200,000 415.374 59,927 98.261 Bank indebtednes Accounts payable Current maturity of LTD 8,201 8173 39 10,724 10,929 tank indebtedness notes pale Accounts payable Current maturity of LTD 205.435 10.920 26,374 10,763 10.929 Long term det Total Babies Owner's equity Towa 16,374 43.55) 10,763 77,236 87,999 change in Dividends Long term debt Totalbes Owner's equity retained earnings Total 10,929 87,332 98,261 10.096 254 312 59.927 217,364 158,010 RE beginning RENet income Ovidends 415,374 Business Analysis Details for Each Heading Name of the business: The legal name of the business. If the company uses a trade name for the public instead of its legal name, show both. When there are two names, the trade name is shown as DBA, which means doing business as. Example of one name: Dana Corporation Example of trade name:Neighborhood Foods, Inc. /DBA, Joe's Burgers Nature of the business: Is it a manufacturer, wholesaler, retailer, service business, farming, utility, etc.? In what industry? For example: "Auto parts manufacturer," Plumbing supply wholesaler," "Women's apparel retailer "Ophthalmologist Marketing analysis: What is the nature of the company's product? What influences the demand for this particular product? How does demand change over time? Is demand cyclical? Seasonal? Are there any recent developments? Are sales growing? At what rate? What is driving growth? Are sales strengthening? Weakening? How is the company's product differentiated from the products of other companies? Why do customers buy one product over another? What is the nature of competition? How strong is the company's competitive position? How do you see it changing? How is the product priced? How is the product promoted? How is the product distributed? Is the company's market position improving or deteriorating? How successful have their marketing efforts been? Do you see problems or opportunities? For each item consider what has happened and what you believe will happen. Operations analysis: . This basically covers the asset side of the company and how it produces or provides its product How does the company produce its product (if a manufacturer) or obtain its product (if a retailer or wholesaler)? What is the nature of the asset requirements for the company? Is the company asset intensive lie, does the firm require a large amount of assets to generate sales)? Why? A firm that is asset intensive will have a low TAT. See the DuPont analysis table provided in class to gain some perspective. . 5 17 MacBook Air . How well do they manage sourcing and production, accounts receivable, inventory, and fixed assets? Have there been major changes in assets in the past or predicted in the future? Does the company have any other significant assets? Relevant measures include total asset turnover, average collection period, inventory days, and fixed asset turnover. Another dimension of operations is human resources. Are there significant human resources issues affecting performance? Are there any operations-related critical success factors? How well have these factors been managed in the past? What are your expectations? . . . . . Financial analysis: How has the company funded itself? Have there been major changes? What precipitated the changes? What factors are driving their funding needs? What are the significant findings from analysis of the company's cash flow statement? Is the company's cash flow healthy? Why? Make sure you include discussion of the cash flow from operations. How liquid is the company? How has that changed? Relevant measures include the current ratio, acid test or quick ratio, accounts payable days, and cash flow from operations. How has leverage changed? Is leverage risk high or low? Relevant measures include debt/equity and times interest earned. How profitable is the company? What is creating that level of profitability? Are there any significant changes occurring? Make sure that you consider the components or drivers of profitability. Relevant measures include the individual elements of the common-size income statement and return on equity. All profit discussion should be in this section. Are owner cash distributions appropriate? One relevant measure is the dividend payout ratio. Do the company's current funding sources appear to be the appropriate type for its needs? Is the type of funding correct or does it need realignment? . . Summary: Provide a brief summary of your key findings. Remember that a summary does not present new information. Instead, the summary should pull together the key ideas already developed. Business Analysis Details for Each Heading Name of the business: The legal name of the business. If the company uses a trade name for the public instead of its legal name, show both. When there are two names, the trade name is shown as DBA, which means doing business as. Example of one name: Dana Corporation Example of trade name: Neighborhood Foods, Inc. /DBA, Joe's Burgers Nature of the business: Is it a manufacturer, wholesaler, retailer, service business, farming, utility, etc.? In what industry? For example: "Auto parts manufacturer," "Plumbing supply wholesaler," "Women's apparel retailer," "Ophthalmologist" Marketing analysis: What is the nature of the company's product? What influences the demand for this particular product? How does demand change over time? Is demand cyclical? Seasonal? Are there any recent developments? Are sales growing? At what rate? What is driving growth? Are sales strengthening? Weakening? How is the company's product differentiated from the products of pther companies? Why do customers buy one product over another? What is the nature of competition? How strong is the company's competitive position? How do you see it changing? How is the product priced? How is the product promoted? How is the nroduct distributed ? . . . Marketing analysis: What is the nature of the company's product? What influences the demand for this particular product? How does demand change over time? Is demand cyclical? Seasonal? Are there any recent developments? Are sales growing? At what rate? What is driving growth? Are sales strengthening? Weakening? How is the company's product differentiated from the products of other companies? Why do customers buy one product over another? What is the nature of competition? How strong is the company's competitive position? How do you see it changing? How is the product priced? How is the product promoted? How is the product distributed? Is the company's market position improving or deteriorating? How successful have their marketing efforts been? Do you see problems or opportunities? For each item consider what has happened and what you believe will happen. . . . Operations analysis: This basically covers the asset side of the company and how it produces or provides its product. How does the company produce its product (if a manufacturer) or obtain its product (if a retailer or wholesaler)? What is the nature of the asset requirements for the company? Is the company asset intensive (i.e., does the firm require a large amount of assets to generate sales)? Why? A firm that is asset intensive will have a low TAT. See the DuPont analysis table provided in class to gain some perspective. . How well do they manage sourcing and production, accounts receivable, inventory, and fixed assets? Have there been major changes in assets in the past or predicted in the future? Does the company have any other significant assets? Relevant measures include total asset turnover, average collection period, inventory days, and fixed asset turnover. Another dimension of operations is human resources. Are there significant human resources issues affecting performance? Are there any operations-related critical success factors? How well have these factors been managed in the past? What are your expectations? . . Financial analysis: How has the company funded itself? Have there been major changes? What precipitated the changes? What factors are driving their funding needs? What are the significant findings from analysis of the company's cash flow statement? Is the company's cash flow healthy? Why? Make sure you include discussion of the cash flow from operations. How liquid is the company? How has that changed? Relevant measures include the current ratio, acid test or quick ratio, accounts payable days, and cash flow from operations. How has leverage changed? Is leverage risk high or low? Relevant measures include debt/equity and times interest earned. How profitable is the company? What is creating that level of profitability? Are there any significant changes occurring? Make sure that you consider the components or drivers of profitability. Relevant measures include the individual elements of the common-size income statement and return on equity. All profit discussion should be in this section. Are owner cash distributions appropriate? One relevant measure is the dividend payout ratio. Do the company's current funding sources appear to be the appropriate type for its needs? Is the type of funding correct or does it need realignment? mer the current ratio, acid test or quick ratio, accounts payable days, and cash flow from operations. How has leverage changed? Is leverage risk high or low? Relevant measures include debt/equity and times interest earned. How profitable is the company? What is creating that level of profitability? Are there any significant changes occurring? Make sure that you consider the components or drivers of profitability. Relevant measures include the individual elements of the common-size income statement and return on equity. All profit discussion should be in this section. Are owner cash distributions appropriate? One relevant measure is the dividend payout ratio. Do the company's current funding sources appear to be the appropriate type for its needs? Is the type of funding correct or does it need realignment? . Summary: Provide a brief summary of your key findings. Remember that a summary does not present new information. Instead, the summary should pull together the key ideas already developed. . D C 2004 E 2006 2003 2005 0.14 0.09 0.00 1.09 0.18 0.07 0.02 0.35 0.21 0.08 0.03 Sales Growth Rate associate fees/sales dental supplies/sales laboratory fees/sales 0.18 0.21 0.08 0.03 0.00 0.00 25 48 0.01 21 38 37 0.01 21 37 0.20% 13 Tax Rate Min Cash/ Sales ACP ICP Prepaid expenses/sales AP days LTD - Current LTD Principal Reduct FAT 32 0.20% 13 20 - 0.10 0.07 0.05 0.05 92,361 192,920 2003 2004 2005 2006 2007(P) as at Jan 2007 287,281 600,308 812,987 959,325 venues ting expenses Ciate fees les & benefits al Supplies 40,098 39,008 26,291 106,486 93,868 40,508 166,727 127,703 62,715 Fee revenues (Net sales) Operating expenses Associate fees Salaries & benefits Dental Supplies 196,738 127.703 74,004 RA 2003 2004 2005 2006 2007(P) as at Jan 2007 287,281 600,308 812,987 959,325 20 21 22 Fee revenues 23 Operating expenses 4 Associate fees 5 salaries & benefits 16 Dental Supplies 7 Equipment leasing B Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization Total expenses Net Income 40,098 39,008 26,291 19,456 29,428 186 9,051 794 1337 4,697 5,755 13,579 2,021 849 1,282 339 8,687 202,858 84,423 106,486 93,868 40,508 52,582 38,500 10,636 14,193 8,172 3,677 1,251 3,294 7,015 166,727 127,703 62,715 52,582 42,441 21,626 17.420 10,775 5,104 11,187 5,910 5,630 2,913 2,778 1,843 (3,647) 14,872 548,579 264,408 Fee revenues (Net sales) Operating expenses Associate fees Salaries & benefits Dental Supplies Equipment leasing Rent & utilities Laboratory fees General & office Promotion & entertainment Automobile expenses Telephone Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization (Depreciation) Total expenses Net income 196,738 127,703 74,004 52,582 42,441 25,519 17,420 10,775 5,104 11,187 5,910 6,193 2,913 2,778 1,843 (3,647) 14,872 594,334 364,990 406 1,612 2,685 17,939 10,484 413,308 187,000 45 2003 2004 Post Iluyor 2005 4,067 46,942 29.528 2.677 21.248 5.296 9.500 56,194 ARNet ACP 6.366 1,919 73.072 365 12.30 36 403 1.646 59,021 59 AM 46,546 60,625 (19.171) 41.454 1 27.9 Acounts receivable nentory Prepaid expenses Total current ed assequip.lease Accumulated amortization Noted as Goodwill Total 19.239 1 27.121 1 53.927 46,302 NFAFAT Net Sales 206,000 415.374 98,261 47 Case 48 Arena 49 Inventory 50 Prepaid SI Total current area 52 sets 53 In Acumulated artin 54 Net 55 Goodwill 56 Total 57 38 Bank indebted 59 Accounts payable 50 Current maturity of LTD 61 62 Long term deb 63 Total lace 54 Owner's equity 65 Total 66 67 3.201 173 39 10,724 200435 10,929 Bank indebtedness notes payabu Accounts payable Current matury of LTD 10,929 16,374 10,763 10.929 Long term debit Total abities Owner's equity retained earnings Total 10.929 87332 98.261 10.096 254.312 15,374 10,763 43,553 77,236 59.927 17,999 change in Dividends 217,364 198,010 RE beginning RE .Net income. Dividends 415,374

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts