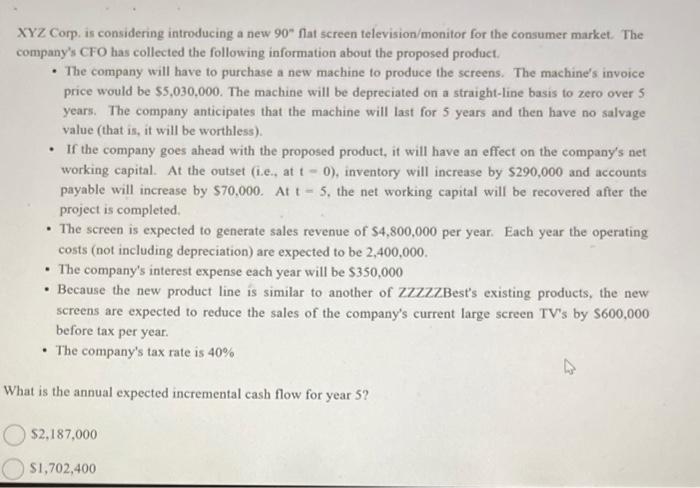

Question: XYZ Corp. is considering introducing a new 90flat screen television/monitor for the consumer market. The company's CFO has collected the following information about the proposed

XYZ Corp. is considering introducing a new 90flat screen television/monitor for the consumer market. The company's CFO has collected the following information about the proposed product. - The company will have to purchase a new machine to produce the screens. The machine's invoice price would be $5,030,000. The machine will be depreciated on a straight-line basis to zero over 5 years. The company anticipates that the machine will last for 5 years and then have no salvage value (that is, it will be worthless). - If the company goes ahead with the proposed product, it will have an effect on the company's net working capital. At the outset (i.e., at t=0 ), inventory will increase by $290,000 and accounts payable will increase by $70,000. At t=5, the net working capital will be recovered after the project is completed. - The screen is expected to generate sales revenue of $4,800,000 per year. Each year the operating costs (not including depreciation) are expected to be 2,400,000. - The company's interest expense each year will be $350,000 - Because the new product line is similar to another of Z7ZZZBest's existing products, the new screens are expected to reduce the sales of the company's current large screen TV's by $600,000 before tax per year. - The company's tax rate is 40% What is the annual expected incremental cash flow for year 5 ? $2,187,000 $1,702,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts