Question: XYZ Corp, is evaluating a new project that would make use of a warehouse building it purchased last year for $225,000 and currently leases for

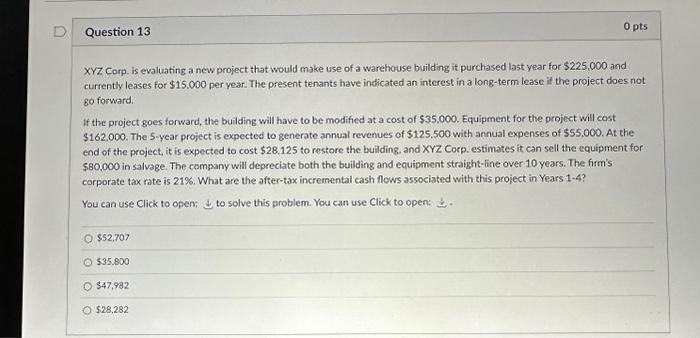

XYZ Corp, is evaluating a new project that would make use of a warehouse building it purchased last year for $225,000 and currently leases for $15,000 per year. The present tenants have indicated an interest in a long-term lease if the project does not 80 forward. If the project goes forward, the building will have to be modified at a cost of $35.000. Equipment for the project will cost $162,000. The 5 -year project is expected to generate annual revenues of $125,500 with annual expenses of $55,000, At the end of the project, it is expected to cost $28,125 to restore the building, and XYZ Corp. estimates it can sell the equipment for $80,000 in salvage. The company will depreciate both the building and equipment straight-line over 10 years. The firm's corporate tax rate is 21%. What are the after-tax incremental cash flows associated with this project in Years 1-4? You can use Click to open: \pm to solve this problem. You can use Click to open: t. $2,707 $35,900 $47,982 $28,282

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts