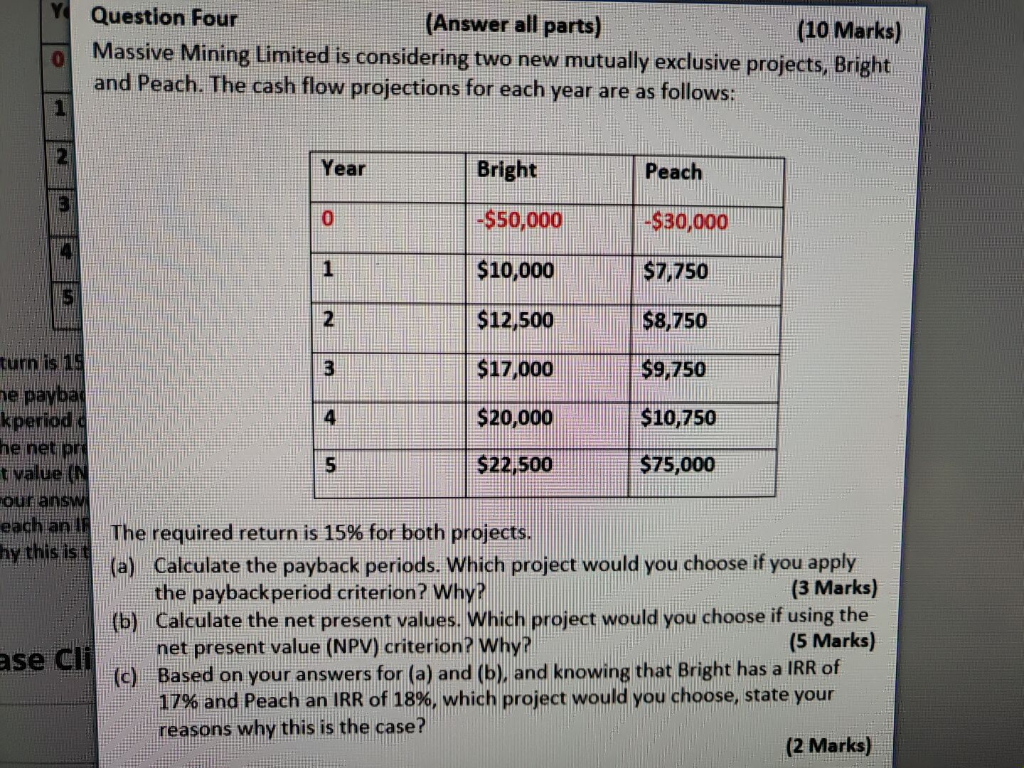

Question: Y Question Four (Answer all parts) (10 Marks) Massive Mining Limited is considering two new mutually exclusive projects, Bright and Peach. The cash flow projections

Y Question Four (Answer all parts) (10 Marks) Massive Mining Limited is considering two new mutually exclusive projects, Bright and Peach. The cash flow projections for each year are as follows: 0 Year Bright Peach 0 -$50,000 -$30,000 1 $10,000 $7,750 2 $12,500 $8,750 turn is 19 3 $17,000 $9,750 4 $20,000 $10,750 5 ne paybad kperioda ne net pri t value IN our answ each an I hy this is $22,500 $75,000 The required return is 15% for both projects. (a) Calculate the payback periods. Which project would you choose if you apply the payback period criterion? Why? (3 Marks) (b) Calculate the net present values. Which project would you choose if using the net present value (NPV) criterion? Why? (5 Marks) (c) Based on your answers for (a) and (b), and knowing that Bright has a IRR of 17% and Peach an IRR of 18%, which project would you choose, state your reasons why this is the case? (2 Marks) ase cli

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts